2019 Survey Of Consumer Finances

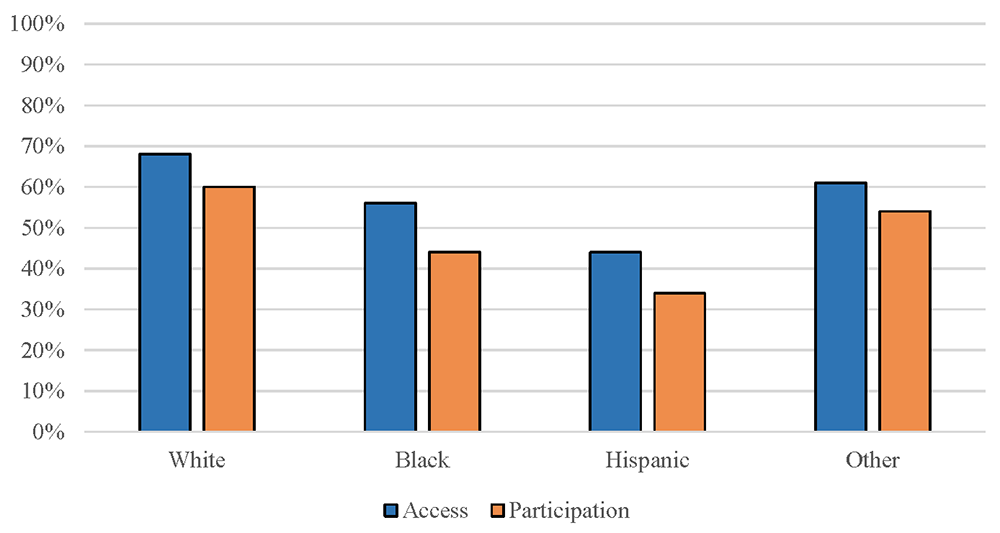

Weekend Reading What The 2019 Survey Of Consumer Finances Reveals Board of governors of the federal reserve board. name. 2022 survey of consumer finances. description. the survey of consumer finances (scf) is normally a triennial cross sectional survey of u.s. families. the survey data include information on families' balance sheets, pensions, income, and demographic characteristics. publisher. Source: federal reserve board, 2019 survey of consumer finances. notes: figures displays the percent of families with access to employer sponsored retirement plans (dc or db plans, blue bars) and the percent of families that participate in an employer sponsored retirement plan (orange bars) among families under 55 years old, by race or ethnicity.

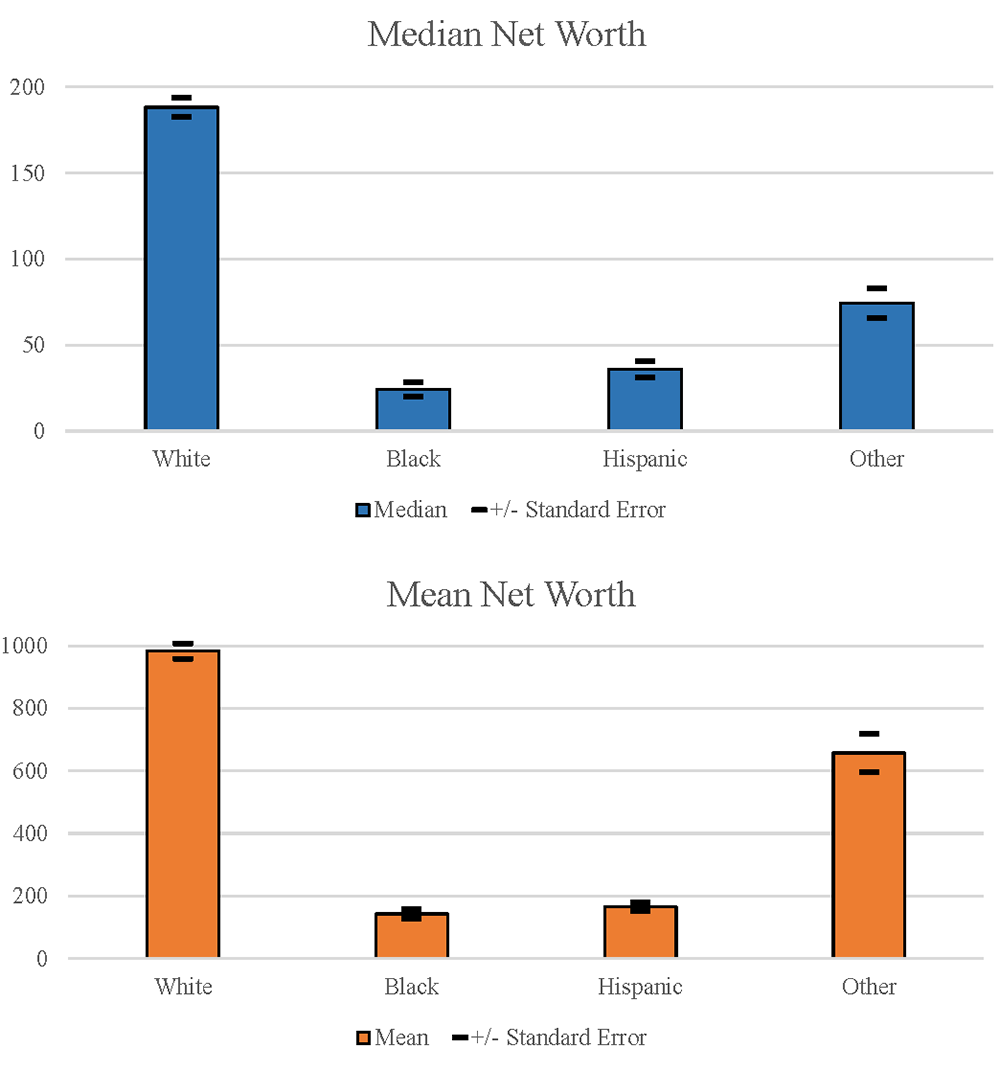

The Fed Disparities In Wealth By Race And Ethnicity In The 2019 Survey of consumer finances, 1989 2022. chart. table. select household financial component. distribute by. units. median ($) mean ($) percent holding (%) download. before tax family income by all families. The regular survey of consumer finances (scf) cross sectional surveys are conducted every three years to provide detailed information on the finances of u.s. families. no other study for the country collects comparable information. data from the scf are widely used, from analysis at the federal reserve and other branches of government to. Survey of consumer finances. the survey of consumer finances ( scf) is a triennial statistical survey of the balance sheet, pension, income and other demographic characteristics of families in the united states; the survey also gathers information on the use of financial institutions. [1]. Adaptive responsive survey designs are strategies that inform adjustments in data collection procedures applied to sample units in the field based upon objective quantifiable metrics rather than ad hoc criteria. improve representation of key subgroups. improve response rates in a meaningful manner. reduce design effects due to weighting.

The Fed Disparities In Wealth By Race And Ethnicity In The 2019 Survey of consumer finances. the survey of consumer finances ( scf) is a triennial statistical survey of the balance sheet, pension, income and other demographic characteristics of families in the united states; the survey also gathers information on the use of financial institutions. [1]. Adaptive responsive survey designs are strategies that inform adjustments in data collection procedures applied to sample units in the field based upon objective quantifiable metrics rather than ad hoc criteria. improve representation of key subgroups. improve response rates in a meaningful manner. reduce design effects due to weighting. Abstract: the federal reserve board’s survey of consumer finances for 2019 provides insights into the evolution of family income and net worth since the previous time the survey was conducted in 2016. the survey shows that over the 2016–19 period, the median value of real (inflation adjusted) family income before taxes rose 5 percent, and. Since 1992, norc has conducted the survey of consumer finances (scf) with sponsorship from the federal reserve board. the scf is unique. this triennial survey is the only fully representative source of information on the broad financial circumstances of u.s. households. every three years, beginning the day after tax day, norc queries roughly.

Comments are closed.