8 Best Bearish Candlestick Patterns For Day Trading Tradingsim

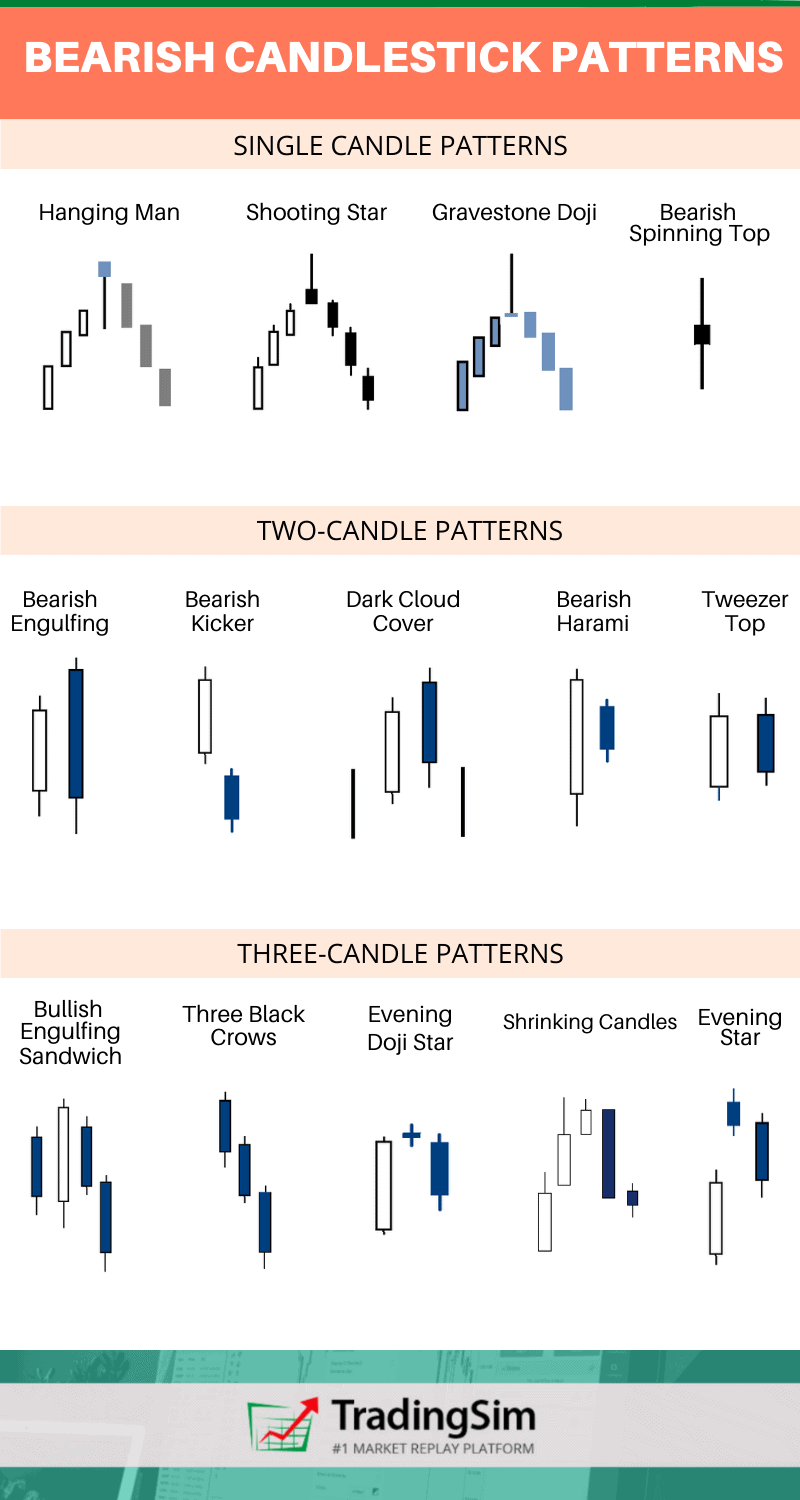

8 Best Bearish Candlestick Patterns For Day Trading Tradingsim Without further ado, let’s dive into the 8 bearish candlestick patterns you need to know for day trading! 1. the shooting star. in case you were wondering, the names of candlestick patterns usually describe a visual representation to something in real life. the japanese were fond of naming them that way. Without further ado, let’s dive into the 8 bearish candlestick patterns you need to know for day trading! 1. the shooting star. in case you were wondering, the names of candlestick patterns usually describe a visual representation to something in real life. the japanese were fond of naming them that way.

8 Best Bearish Candlestick Patterns For Day Trading Tradingsim The morning consolidation is by far my favorite day trading pattern. below is the makeup of the day trading pattern: a minimum of 4 bars moving strongly in one direction. after a high or low is reached from #1, the stock will consolidate for 1 to 4 bars. the high or low is then exceeded prior to 10:10 am. In the example above, the proper entry would be below the body of the shooting star, with a stop at the high. 5. indecision candles. the doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. indecision candlestick patterns. The bodies of the two candles at the time of tasuki gap should be approximately the same size. the falling three methods is a bearish five candlestick continuation pattern that indicates a break but no reversal in the ongoing downtrend. the “falling three methods” is a bearish, five candle continuation pattern that signals an interruption, but not…. Especially using bullish candlestick patterns. while we’ve discussed some of the history of candlesticks in other recent posts, and outlined the 8 most popular bearish candlestick patterns, today we’re going to talk about the following: the hammer; bullish engulfing crack; bearish engulfing sandwich; morning star; tweezer bottom; piercing line.

8 Best Bearish Candlestick Patterns For Day Trading Tradingsim The bodies of the two candles at the time of tasuki gap should be approximately the same size. the falling three methods is a bearish five candlestick continuation pattern that indicates a break but no reversal in the ongoing downtrend. the “falling three methods” is a bearish, five candle continuation pattern that signals an interruption, but not…. Especially using bullish candlestick patterns. while we’ve discussed some of the history of candlesticks in other recent posts, and outlined the 8 most popular bearish candlestick patterns, today we’re going to talk about the following: the hammer; bullish engulfing crack; bearish engulfing sandwich; morning star; tweezer bottom; piercing line. These create a series of candles which produce a bearish “event,” per se. they could be parabolic reversals, tweezer tops, abandoned babies, evening stars, or other unique patterns. evening star bearish candlestick pattern. just like this example above, we discuss 8 of the most reliable bearish candlestick patterns in this tutorial. Be patient: trading bearish candlestick patterns requires patience. wait for the pattern to fully form and be confirmed before entering a trade. trying to predict a pattern before it has been completed can lead to unnecessary losses. manage your risk: always use proper risk management techniques when trading bearish candlestick patterns. set.

Comments are closed.