A Comprehensive Guide To Roth Ira All The Information You Need

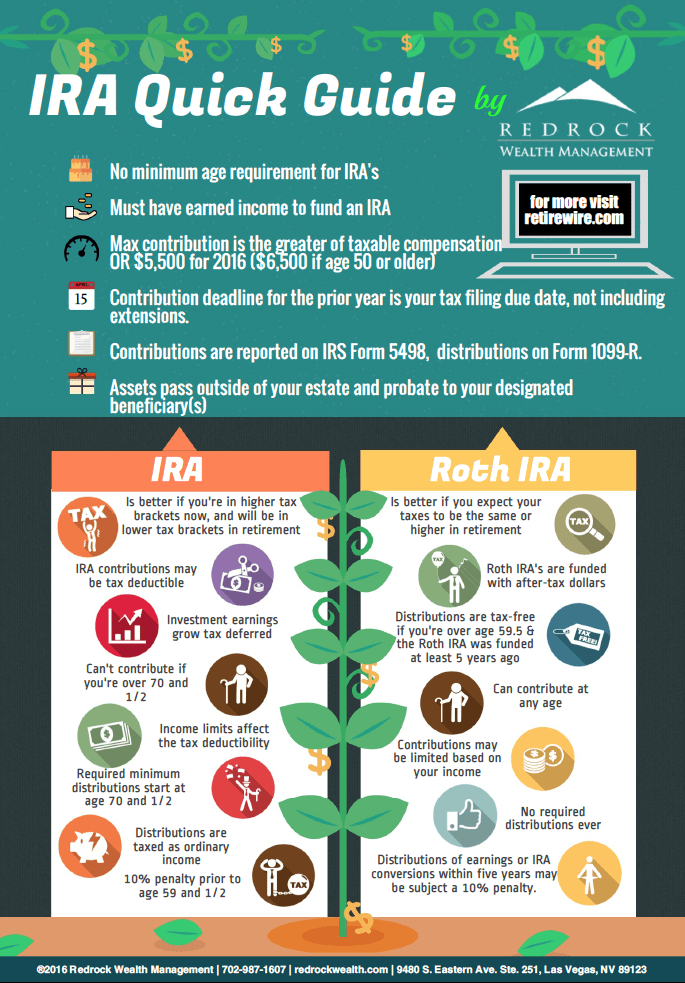

The Ultimate Ira Roth Ira Quick Guide Retirewire Online Financial They include untaxed combat pay, military differential pay, and taxed alimony. the contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023. you're allowed to invest. A roth ira is an individual retirement plan that bears many similarities to the traditional ira, but contributions aren't tax deductible, and qualified distributions are tax free. your guide to.

Roth Ira For Dummies Inflation Protection The roth ira is an individual retirement account that comes with perks that traditional iras don’t offer. the biggest benefit of the roth ira is how tax friendly it is. although you can’t take a tax deduction on roth ira contributions, the money you sock away in a roth ira grows tax free and also comes out tax free, provided you follow the. The headline advantage of having your money in a roth ira is that you’re able to enjoy tax free compounding on your money. the biggest drawback of roth iras is that you will not earn that tax. The biggest benefit of the roth ira is how tax friendly it is. although you can’t take a tax deduction on roth ira contributions, the money you sock away grows tax free and also comes out tax free, provided you follow the withdrawal rules. a roth ira will give you a tax free income stream in retirement. Roth ira: named for delaware senator william roth and established by the taxpayer relief act of 1997 , a roth ira is an individual retirement plan (a type of qualified retirement plan ) that bears.

Roth Vs Traditional Iras A Complete Reference Guide Gone On Fire The biggest benefit of the roth ira is how tax friendly it is. although you can’t take a tax deduction on roth ira contributions, the money you sock away grows tax free and also comes out tax free, provided you follow the withdrawal rules. a roth ira will give you a tax free income stream in retirement. Roth ira: named for delaware senator william roth and established by the taxpayer relief act of 1997 , a roth ira is an individual retirement plan (a type of qualified retirement plan ) that bears. A roth ira works by putting the money you contribute into investments. the money you contribute to a roth ira could come from a job, but it could also be a rollover from a roth 401 (k) plan, a. When you withdraw money from a traditional ira, you’ll be taxed on every penny no matter when you take it out. you'll also face a 10% penalty for early withdrawals before age 59 ½. in this way, roths make it easier to access your money if you face a hardship like job loss or need the cash for an emergency. what's more, traditional iras and.

The Ultimate Guide To A Roth Ira Pbtc Blog A roth ira works by putting the money you contribute into investments. the money you contribute to a roth ira could come from a job, but it could also be a rollover from a roth 401 (k) plan, a. When you withdraw money from a traditional ira, you’ll be taxed on every penny no matter when you take it out. you'll also face a 10% penalty for early withdrawals before age 59 ½. in this way, roths make it easier to access your money if you face a hardship like job loss or need the cash for an emergency. what's more, traditional iras and.

Roth Ira 2021 A Beginner S Guide For Investors Investing Simple

Comments are closed.