A Focus On Loan Growth In The Banking Space Details Here

A Focus On Loan Growth In The Banking Space вђ Details Here Cnbc Tv18 In this edition, we take a close look at the u.s. banking industry’s third quarter loan growth, which came to a year over year rate of 3.1%, excluding loans under the paycheck protection program. credit card loans rose 1.2% from a year ago, following five consecutive quarters of declines as consumer spending continued to accelerate. Of the 20 banks with the largest increases in loan to deposit ratios, 19 recorded loan growth and only 5 booked deposit growth year over year. bankers' bank led the list with a 58.2 percentage point increase in its ratio to 116.2%. tradition capital bank ranked second as its ratio rose 43.5 percentage points to 118.1%.

A Focus On Loan Growth In The Banking Space вђ Details Here Using four building blocks—strategy, process, analytics, and operating model—these banks create unique models for profitable growth in this new landscape. the use of these levers to reimagine sme lending can have a significant impact on the bottom line. higher conversion rates and increased margins can boost revenues by 10 to 15 percent. The bridge tay primarily sees the role of fintechs in the lending and financial space as that of a bridge: reconciling the gap between legacy systems and modern financial needs. for that, partnerships are in order. “we believe the need for greater collaboration between banks and fintechs and the imperative to continuously adapt to changing. 10. foster a strong employee culture. your bank or credit union is only as good as its weakest link. build a strong employee culture that empowers everyone no matter their position to play key roles in the growth of your fi. establish a robust team culture by: prioritizing remote worker considerations and implications. Prior research shows that loan growth harms bank stability and exacerbates the banking crisis (demirgüç kunt & detragiache, citation 2002). a bidirectional relationship between loan growth and bank stability, on the other hand, may exist. due to their large capital and liquidity, healthy banks have a high ability to control risks.

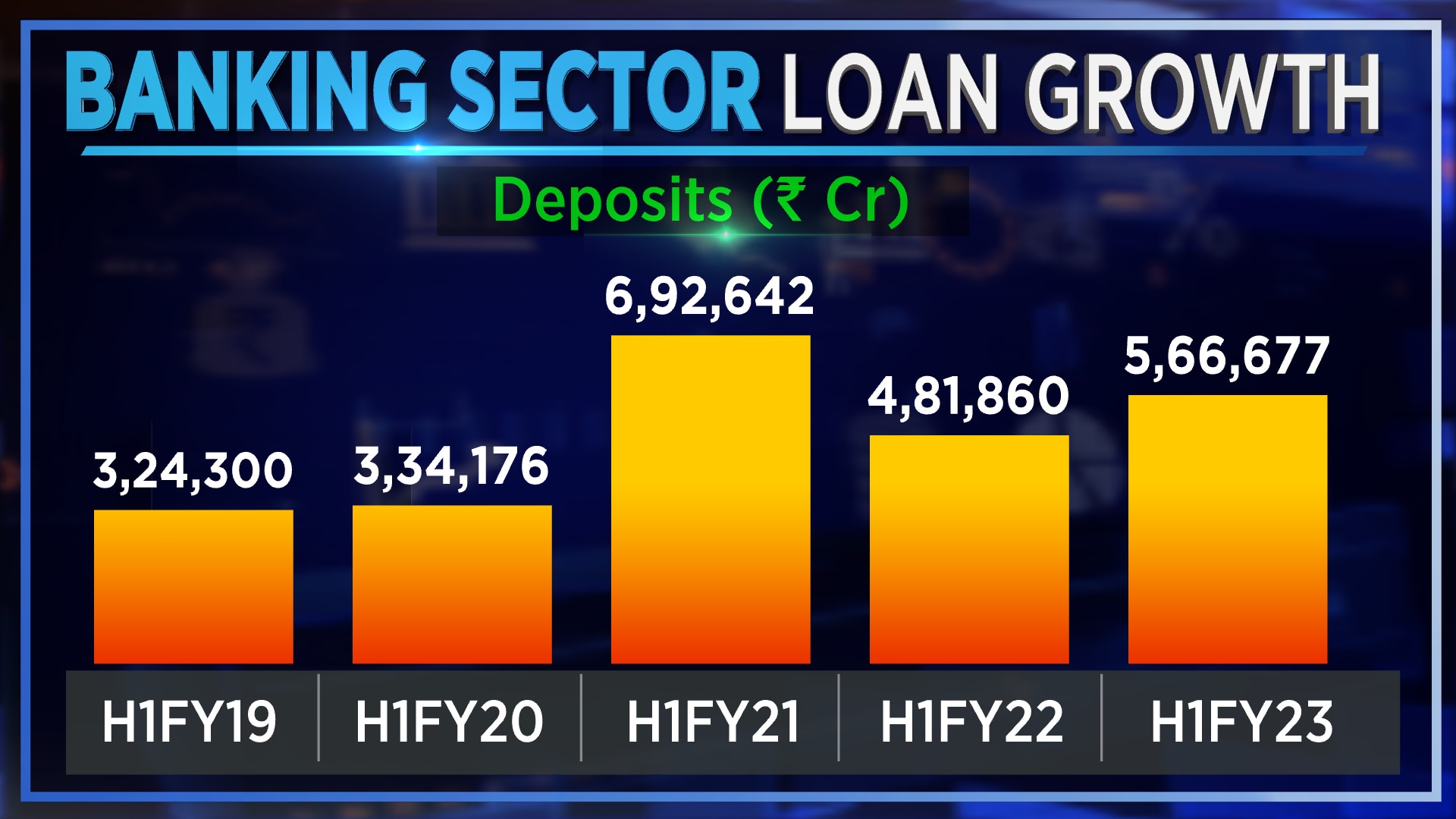

Banking Sector Focus Loan Growth At 15 With Private Banks Outpacing 10. foster a strong employee culture. your bank or credit union is only as good as its weakest link. build a strong employee culture that empowers everyone no matter their position to play key roles in the growth of your fi. establish a robust team culture by: prioritizing remote worker considerations and implications. Prior research shows that loan growth harms bank stability and exacerbates the banking crisis (demirgüç kunt & detragiache, citation 2002). a bidirectional relationship between loan growth and bank stability, on the other hand, may exist. due to their large capital and liquidity, healthy banks have a high ability to control risks. Bryan tay (photo courtesy of lendela). lendela on why banks need fintechs to buoy loan growth. loan demand has doubled in singapore, and fintechs can help onboard quality clients. with interest rates declining and competition amongst lenders intensifying, lendela envisions the role of fintechs — and especially lending platforms like itself. U.s. banks' loan to deposit ratio rose in the second quarter as loan growth continued to accelerate and deposit growth slowed. the aggregate loan to deposit ratio for the industry was 60.2%, up from 57.0% in the first quarter and 58.0% in the year ago period, according to s&p global market intelligence data. that increase marked the first time.

Comments are closed.