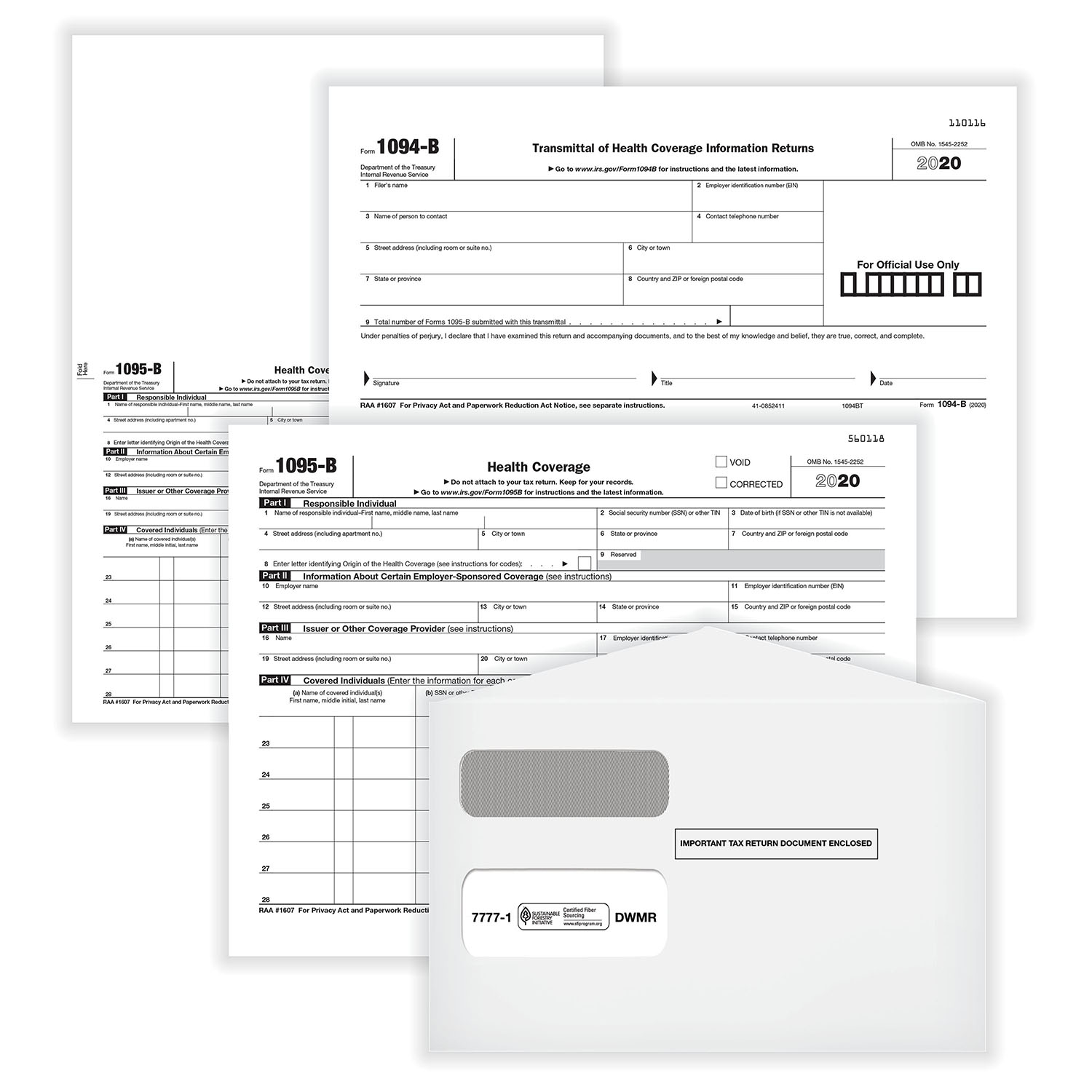

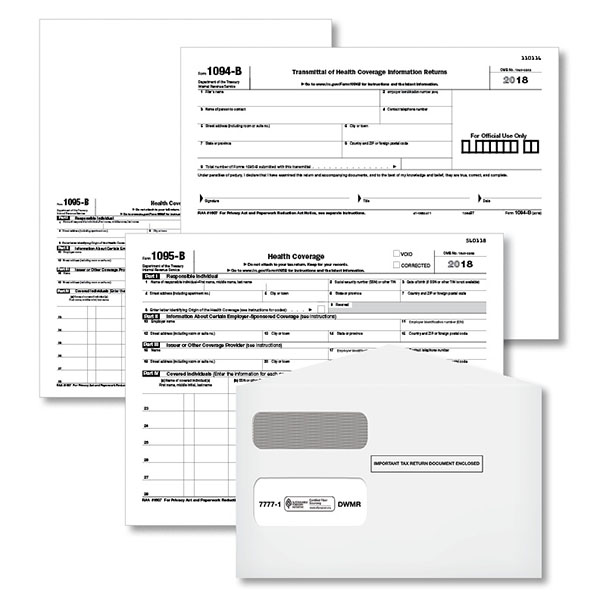

Aca Compliance Reporting Forms Kit 1095 B 1094 B

Aca Compliance Reporting Forms Kit 1095 B 1094 B For forms filed in 2024 reporting coverage provided in calendar year 2023, forms 1094 b and 1095 b are required to be filed by february 28, 2024, or april 1, 2024, if filing electronically. see statements furnished to individuals , later, for information on when form 1095 b must be furnished. File with irs. onesource experts will submit your 1095 bs electronically, and in the correct irs format, by the due date. whether you’re a health insurer or a self insured plan sponsor, the new compliance features of the affordable care act (aca) can seem daunting. this white paper outlines the impact of the aca and summarizes what you need.

Aca Compliance Reporting Forms Kit 1095 B 1094 B Affordable care act information returns (air). Here is how our software works: obtains your data. performs data validations. generates 1095 forms with aca codes. enables form reviewal and approval. transmits the completed forms with the irs and state. distributes employee copies. in case you need to make changes to the information reported on the forms, you can file aca corrections with our. Information reporting by applicable large employers. Irs 1094 & 1095 b c form: distribution to employees: march 01, 2024. state filing: april 01, 2024: rhode island: state specific return or aca 1094 & 1095 b c form: distribution to employees: march 01, 2024. state filing: april 01, 2024: vermont: yet to be released: distribution to employees: yet to be released. state filing: yet to be released.

Aca Compliance Reporting Forms Kit 1095 B 1094 B Information reporting by applicable large employers. Irs 1094 & 1095 b c form: distribution to employees: march 01, 2024. state filing: april 01, 2024: rhode island: state specific return or aca 1094 & 1095 b c form: distribution to employees: march 01, 2024. state filing: april 01, 2024: vermont: yet to be released: distribution to employees: yet to be released. state filing: yet to be released. Aca reporting requirements under section 6055. the irs section 6055 states that anyone who provides minimum essential coverage (mec) to any individual must report details regarding the coverage to the irs by filing form 1095 b along with the transmittal form 1094 b. the information reported on form 1095 b is used by the irs to administer the. Forms 1094 b and 1095 b. *sent to the irs only ale forms 1094 c and 1095 c (part iii will not be completed). forms 1094 c and 1095 c for employees. either b series or c series forms for non employees. insurance provider forms 1094 b and 1095 b. not applicable.

Comments are closed.