Affordable Care Act Aca How Employers Are Addressing Its Requireme

Affordable Care Act Aca How Employers Are Addressing Its Requiremeвђ Final regulations (t.d. 9655, rin 1545 bl33) have been published addressing the affordable care act’s (aca) “employer shared responsibility” provisions in §4980h. 1these rules are also sometimes referred to as the aca “employer mandate.”. The affordable care act (aca) employer mandate modifies the landscape of employer provided health insurance which also has broader implications for both the insurance markets and the workforce. in this section, we delve into the various effects of the aca employer mandate, highlighting its impact on insurance exchanges, employer.

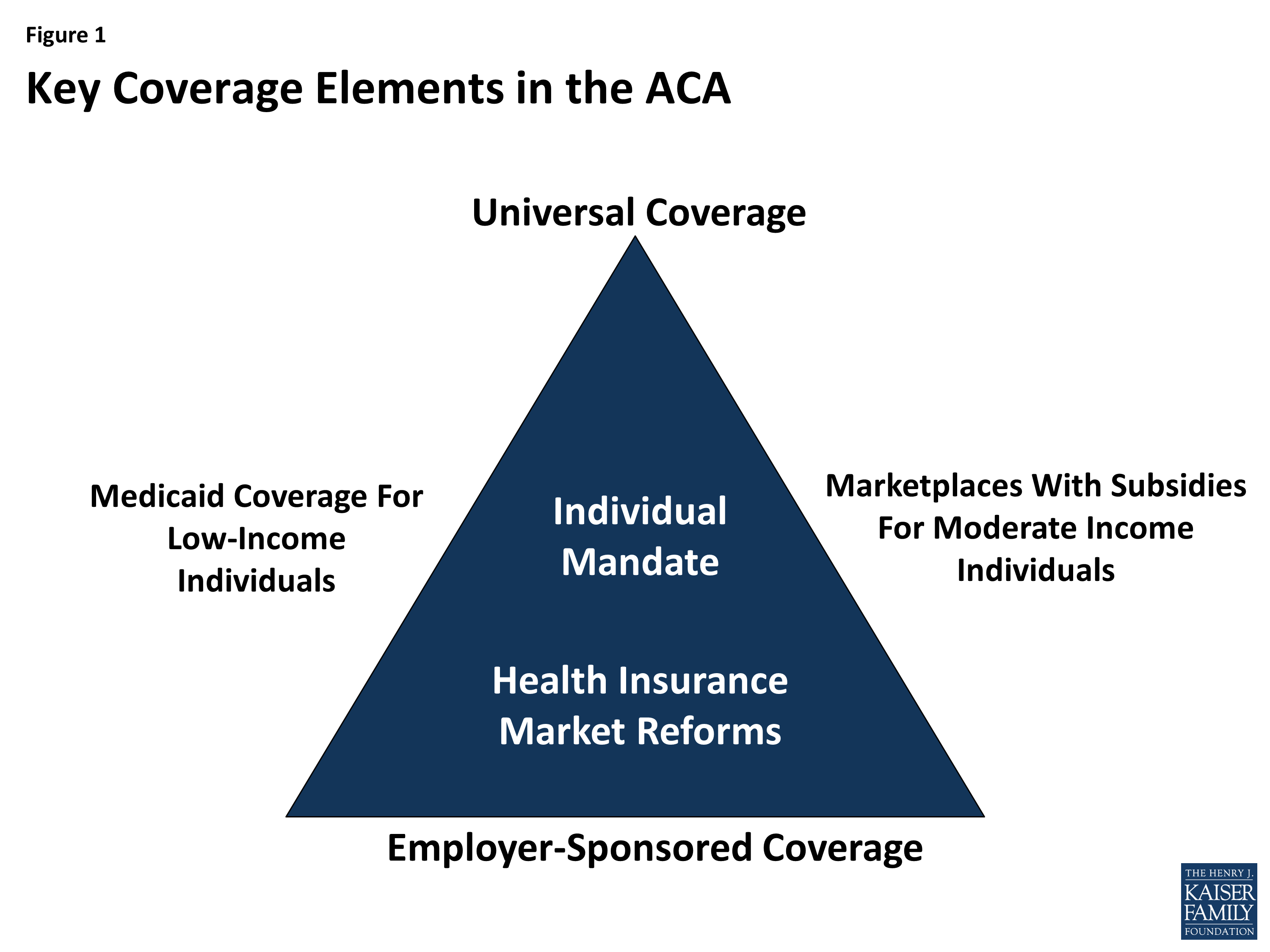

Affordable Care Act Diagrams For Employers This toolkit summarizes the patient protection and affordable care act (ppaca), commonly called the affordable care act (aca). it explores hr's responsibilities pertaining to the employer. Part xvii – this set of faqs addresses the implementation of the paul wellstone and pete domenici mental health parity and addiction equity act of 2008 (mhpaea), as amended by the affordable care act. part xviii – this set of faqs addresses coverage of preventive services, limitations on cost sharing, expatriate health plans, wellness. Affordable care act tax provisions for employers. Employer shared responsibility provisions.

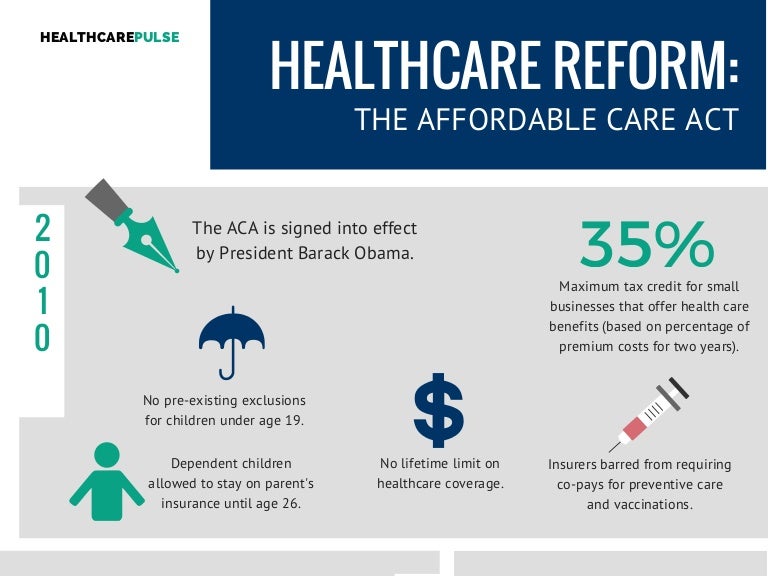

Affordable Care Act Aca Timeline Infographic Affordable care act tax provisions for employers. Employer shared responsibility provisions. The employer shared responsibility provisions were added under section 4980h of the internal revenue code by the affordable care act. under these provisions, certain employers (called applicable large employers or ales) must either offer health coverage that is “affordable” and that provides “minimum value” to their full time employees (and offer coverage to the full time employees. The affordable care act employer mandate generally applies to employers with 50 or more full time employees, according to the irs. this means that in most cases, these businesses must offer health insurance to their employees, or make an employer shared responsibility payment to the irs. although the affordable care act employer requirements.

Comments are closed.