Affordable Care Act Reporting Requirements For Applicable Large

Affordable Care Act Reporting Requirements For Applicable Large Information reporting by applicable large employers. Two provisions of the affordable care act apply only to applicable large employers (ales): the employer shared responsibility provision and the employer information reporting provision for offers of minimum essential coverage. in addition, self insured ales – that is, employers who sponsor self insured group health plans – have additional.

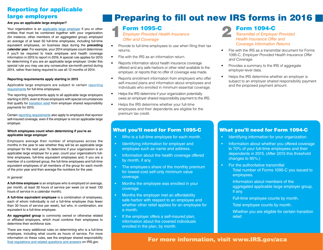

Affordable Care Act Reporting Requirements For Applicable Large Basic information two provisions of the affordable care act apply only to applicable large employers (ales): the employer shared responsibility provisions; and the employer information reporting provisions for offers of minimum essential coverage whether an employer is an ale is determined each calendar year, and generally depends on the. Rs published the final aca reporting instructions. the 2021 taxyear, including the final 1094 c and 1095 c forms. this includes reporti. requirements for certain large employers, as defined by the law. under the affordable care act, applicable large employers (those employers with 50 or more full time plus full time equivalent employees) must. The affordable care act (aca) requires applicable large employers (ales) to report each year on whether they did or did not offer health coverage to each of their full time employees. to meet this reporting requirement, the ale uses two forms designed by the irs: • form 1095 c “ employer provided health insurance offer and coverage ” is the. The deadline for filing paper forms 1094 c and 1095 c with the irs is feb. 28, 2024. the due date for electronic filing is april 1, 2024. the affordability rate for plan years beginning in 2024 is 8.39% (a decrease from 9.12% for plan years beginning in 2023). businesses subject to aca tracking and reporting requirements have several deadlines.

Affordable Care Act Reporting Requirements For Applicable Large The affordable care act (aca) requires applicable large employers (ales) to report each year on whether they did or did not offer health coverage to each of their full time employees. to meet this reporting requirement, the ale uses two forms designed by the irs: • form 1095 c “ employer provided health insurance offer and coverage ” is the. The deadline for filing paper forms 1094 c and 1095 c with the irs is feb. 28, 2024. the due date for electronic filing is april 1, 2024. the affordability rate for plan years beginning in 2024 is 8.39% (a decrease from 9.12% for plan years beginning in 2023). businesses subject to aca tracking and reporting requirements have several deadlines. Following our article reminding employers of the aca reporting deadlines, we thought it may be helpful to provide a list of frequently asked questions (faqs). all applicable large employers (ales) must complete one form 1094 c and a form 1095 c for each employee who was full time for at least one month during 2023. The reporting requirements are complex, due in part to how the health care reform law was drafted. the affordable care act added two sections to the internal revenue code: sections 6055 and 6056. the sections are found next to each other in the code; however, they apply to different types of entities.

Comments are closed.