Automation The Future Of Mortgage Underwriting

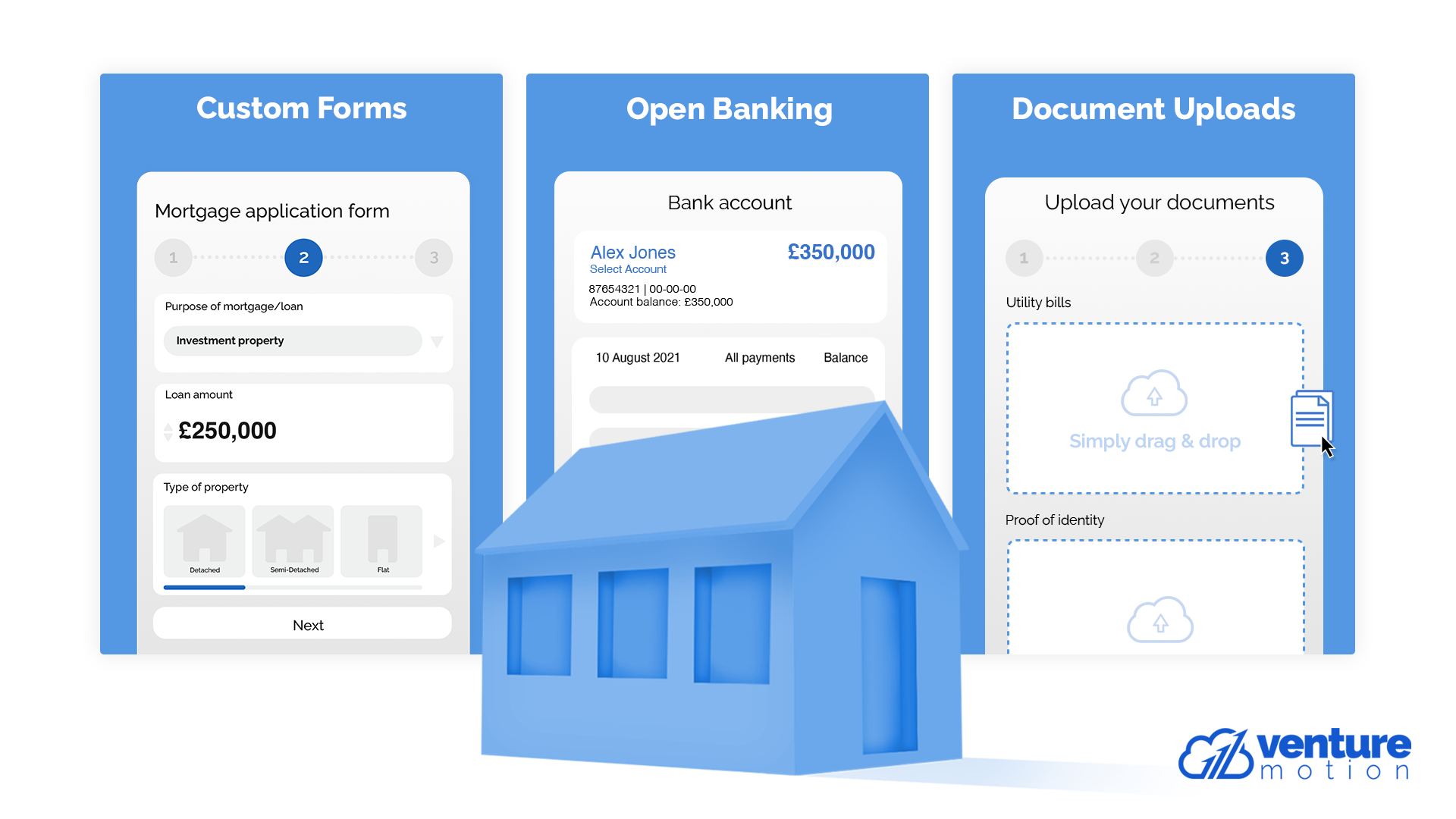

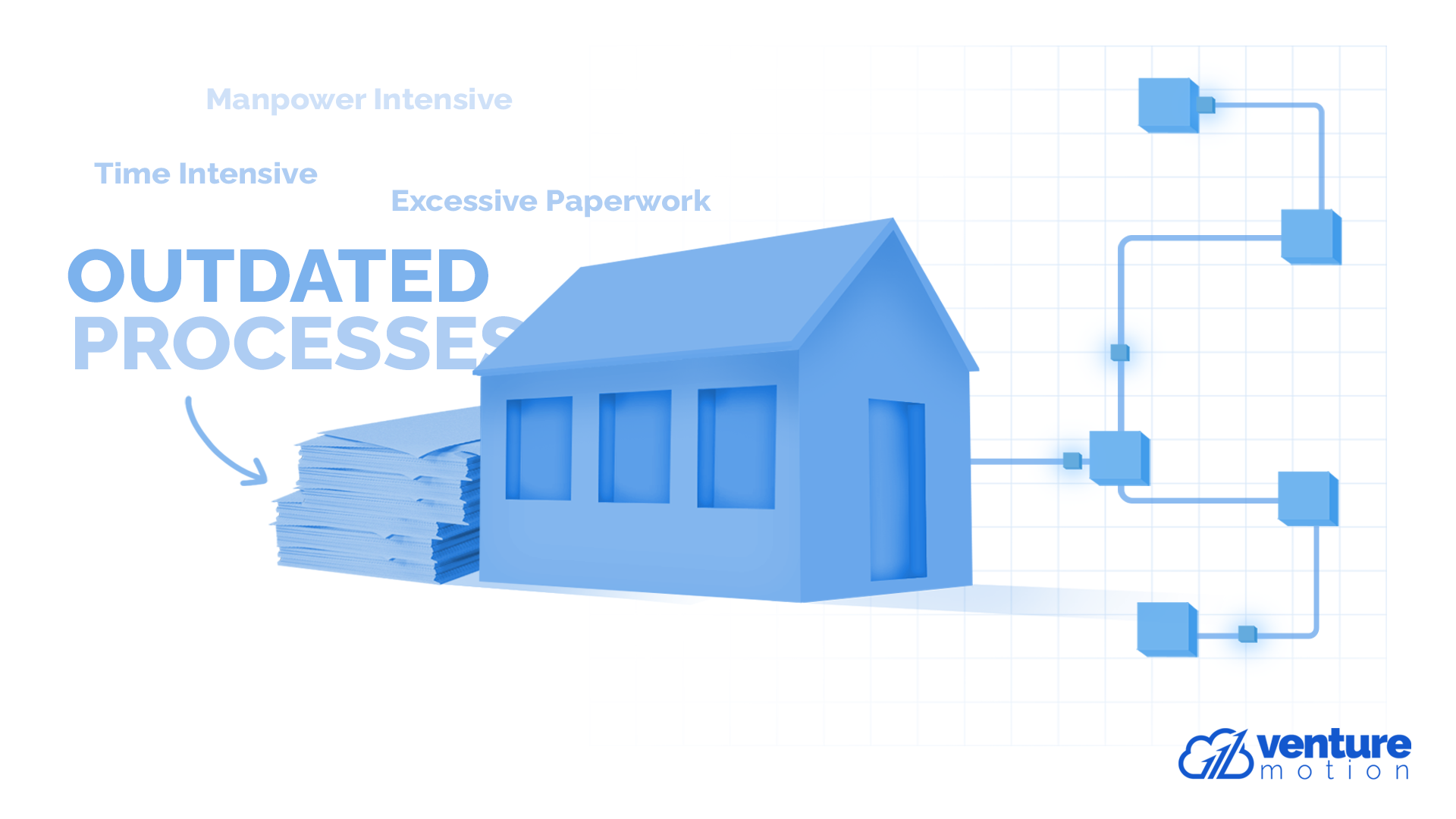

Automation The Future Of Mortgage Underwriting With Tidalwave receiving its first approvals for integrations with automated underwriting systems, its CEO explains why the current environment represents a good opportunity for a new mortgage startup Many banks have already invested in some form of automation can fill the gaps between mortgage origination and other business applications, accelerating underwriting and mortgage review

Document Verification Why Automation Is The Future Of Mortgage Product diversification helps Zacks Multiline Insurance industry players lower concentration risk, ensure uninterrupted revenue generation and improve retention ratio Better pricing, prudent Insurance underwriting of the future may include myriad data points You also might have experienced automation in the insurance buying process since some companies use AI for fast underwriting Editor's Note: APYs listed in this article are up-to-date as of the time of publication They may fluctuate (up or down) as the Fed rate changes CNBC will update as changes are made public More than three-quarters of homebuyers took out a mortgage to finance their purchase in 2023, according to the National Association of Realtors There's an army of lenders out there

Automation The Future Of Mortgage Underwriting Editor's Note: APYs listed in this article are up-to-date as of the time of publication They may fluctuate (up or down) as the Fed rate changes CNBC will update as changes are made public More than three-quarters of homebuyers took out a mortgage to finance their purchase in 2023, according to the National Association of Realtors There's an army of lenders out there This has kept homebuying demand low Predictions and future outlook for mortgage rates Most major forecasts expect rates to continue to fall throughout the remainder of this year and 2025 Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term Underwriting: Some factors that car insurance Combining steering assistance with braking and acceleration automation would place the vehicle in Level 2 Vehicles categorized as Level 2 have Whether you need a mortgage now or are planning to buy in the future, comparing multiple wait for the underwriting process to conclude, have your home appraised and close on your new loan

Automation The Future Of Mortgage Underwriting This has kept homebuying demand low Predictions and future outlook for mortgage rates Most major forecasts expect rates to continue to fall throughout the remainder of this year and 2025 Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term Underwriting: Some factors that car insurance Combining steering assistance with braking and acceleration automation would place the vehicle in Level 2 Vehicles categorized as Level 2 have Whether you need a mortgage now or are planning to buy in the future, comparing multiple wait for the underwriting process to conclude, have your home appraised and close on your new loan

How Mortgage Automation Streamlines Mortgage Underwriting Journal Underwriting: Some factors that car insurance Combining steering assistance with braking and acceleration automation would place the vehicle in Level 2 Vehicles categorized as Level 2 have Whether you need a mortgage now or are planning to buy in the future, comparing multiple wait for the underwriting process to conclude, have your home appraised and close on your new loan

Comments are closed.