Bankruptcy Vs Consumer Proposal Which Is Better Youtube

Consumer Proposal Vs Bankruptcy Full Comparison W Chart Are you wondering what the difference is between bankruptcy and a consumer proposal? check out this video and find out which of these insolvency solutions mi. Consumer proposal vs bankruptcy – which one is right for you? if you struggling with debt, how do you know which debt relief option is right for you? both.

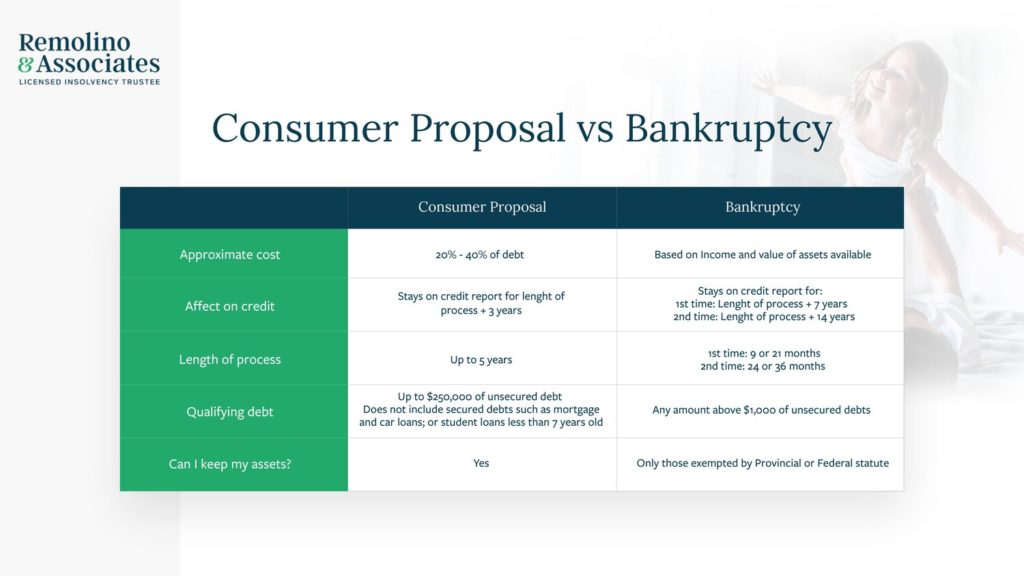

Bankruptcy Vs Consumer Proposal What S The Difference Debt Not sure bankruptcy or consumer proposal? the choice of which insolvency process to go with can be a difficult one. find more information at afar. For many debtors, a consumer proposal is a better option than filing for bankruptcy. if you meet the requirements for filing a consumer proposal, which includes having a stable monthly income, it can be better. the costs may be lower than bankruptcy depending on the amount of debt you are carrying. the best way to determine the right option for. Deciding between a consumer proposal and bankruptcy to manage your debt can feel overwhelming. a consumer proposal lets you repay part of your debt, helping you avoid the severe impact on your credit score that comes with bankruptcy. in contrast, bankruptcy quickly discharges your debt but brings significant long term credit consequences. The biggest difference between a consumer proposal and bankruptcy is the impact on your assets. a consumer proposal allows you to renegotiate your unsecured debts (credit cards, lines of credit, etc.) and keep your assets and secured debts, like your mortgage and car loan, separate. if you file for bankruptcy, your unsecured debts are.

Bankruptcy Vs Consumer Proposal Know Your Options The Story Siren Deciding between a consumer proposal and bankruptcy to manage your debt can feel overwhelming. a consumer proposal lets you repay part of your debt, helping you avoid the severe impact on your credit score that comes with bankruptcy. in contrast, bankruptcy quickly discharges your debt but brings significant long term credit consequences. The biggest difference between a consumer proposal and bankruptcy is the impact on your assets. a consumer proposal allows you to renegotiate your unsecured debts (credit cards, lines of credit, etc.) and keep your assets and secured debts, like your mortgage and car loan, separate. if you file for bankruptcy, your unsecured debts are. A consumer proposal is a legal agreement that allows you to pay off debts for less than what’s owed. it’s possible to reduce and pay off up to $250,000 in unsecured debt with a consumer proposal. debt payments can extend up to five years, though not all debts are eligible. secured debts (debts with collateral to back them) and certain. A bankruptcy can be expensive if your income is high, or is expected to increase. in a bankruptcy you lose your tax refund and possibly other assets. a consumer proposal is much simpler than bankruptcy. consumer proposal terms are determined up front. a consumer proposal is proactive. you decide what you can afford to pay.

Comments are closed.