Bootstrapping Vs Venture Capital Effective Strategies For Startup

Bootstrapping Vs Venture Capital Effective Strategies For Startup Here are our thoughts on the trade offs of bootstrapping vs. funding through venture capital. when we use the term bootstrapping, we’re not strictly referring to companies who have taken zero outside investment. according to our definition, a is one that relies primarily on the company’s cash flow to grow the business, taking on little. A global startup community designed to educate, inspire, and connect entrepreneurs, the blog section features stories on bootstrapping, venture capital, and more. 4. both sides of the table. written by mark suster, a 2x entrepreneur turned vc, this blog delves into the nuances of startup financing, venture capital, and entrepreneurship. 5. the.

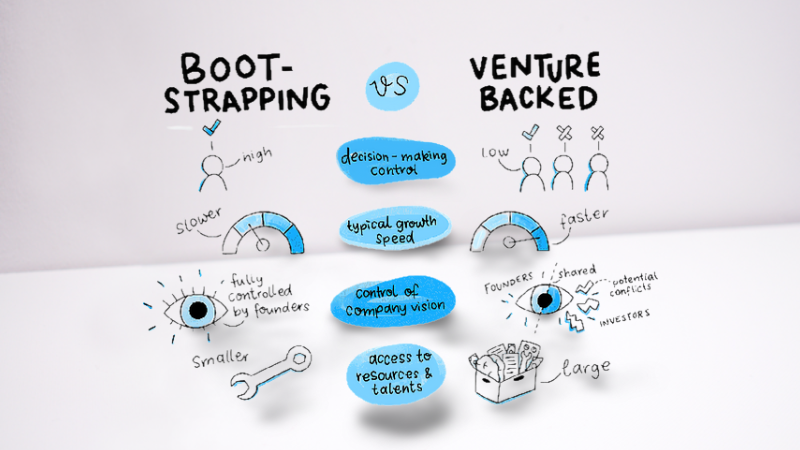

Bootstrapping Vs Vc Funding How To Finance Your Startup In 2023 If your score, as calculated through the scorecard, is below 30, you should seriously consider bootstrapping. if your score is above 40, you’re probably a good candidate for fundraising. if you’re between 30 and 40, you’re in a zone that requires more consideration of the pros and cons of both options before choosing. Venture capital: vc funding can supercharge a startup's expansion, providing the necessary capital to seize market opportunities, invest in research and development, and scale operations rapidly. bootstrapping: growth is typically more gradual, as it's tied to the company's earnings and the founder's personal savings. Understand risk tolerance: assess your appetite for risk and personal financial liability. bootstrapping means the burden of financial risk is placed firmly on the founder, while venture capital shares the risk with external investors. consider your comfort level with assuming personal liability and the potential consequences of a failed venture. Venture capital is a type of financing through private equity. in other words, investors put money into your business, betting that it will become a successful venture. by going with venture.

Bootstrapping Vs Venture Capital Effective Strategies For Startup Understand risk tolerance: assess your appetite for risk and personal financial liability. bootstrapping means the burden of financial risk is placed firmly on the founder, while venture capital shares the risk with external investors. consider your comfort level with assuming personal liability and the potential consequences of a failed venture. Venture capital is a type of financing through private equity. in other words, investors put money into your business, betting that it will become a successful venture. by going with venture. You can bootstrap a company to get it to the point of viability, then take on investments to grow the business and place it on a trajectory for long term profitability. the reality, though, is. Advantages of bootstrap. cost effective: bootstrap allows startups to keep costs low by eliminating the need for substantial external funding. this means entrepreneurs can focus on developing their product or service without the financial constraints associated with venture capital. flexibility: bootstrap enables startups to be agile and.

Bootstrapping Vs Venture Capital The Pros Cons And Criteria You can bootstrap a company to get it to the point of viability, then take on investments to grow the business and place it on a trajectory for long term profitability. the reality, though, is. Advantages of bootstrap. cost effective: bootstrap allows startups to keep costs low by eliminating the need for substantial external funding. this means entrepreneurs can focus on developing their product or service without the financial constraints associated with venture capital. flexibility: bootstrap enables startups to be agile and.

Bootstrapping Vs Venture Capital Pptx

Comments are closed.