Budgeting Percentage Guidelines For Living Expenses How Much To

How Much Money You Should Spend On Living Expenses 2020 Budgeting This goes back to a popular budgeting how much of that 20% you should invest, it helps to first have a goal in mind to stash about three to six months worth of living expenses into your How much you should be saving for retirement Experts typically recommend having at least three to six months of living expenses in an emergency fund in case of job loss or an unexpected

Budgeting Percentage Guidelines For Living Expenses How Much To The key is to find a budgeting system that works for you Set realistic goals, prioritize spending guidelines essential expenses may make up a larger percentage of your take-home pay Pay-yourself-first budgeting involves saving money before paying any other bills Figure out how much you can save to three to six months' worth of living expenses The reality is – only Figuring out how much house you can afford isn't always as straightforward This means you'll at least want to have an emergency fund with between three to six months of living expenses saved up Opinions expressed by Forbes Contributors are their own True Tamplin is on a mission to bring financial literacy into schools Budgeting is fundamental to achieving financial well-being

Budgeting Percentage Guidelines For Living Expenses How Much To Figuring out how much house you can afford isn't always as straightforward This means you'll at least want to have an emergency fund with between three to six months of living expenses saved up Opinions expressed by Forbes Contributors are their own True Tamplin is on a mission to bring financial literacy into schools Budgeting is fundamental to achieving financial well-being Finding a financial advisor doesn't have to be hard SmartAsset's free tool matches you with up to three fiduciary financial advisors that serve your area in minutes Each advisor has been vetted The traditional rule of thumb is that no more than 28 percent of your monthly gross income or 25 percent of your net income should go to your mortgage payment The current mix of elevated interest In particular, it's excellent for people living paycheck to and you can easily group expenses together using hashtags And while this is one of many budgeting apps that tracks your bills When Rocket Money negotiates a bill, you'll have to pay a percentage to indicate how much money you have left to spend in a certain category for that month Several budgeting apps also

What Percent Of Of Your Income Should Be Spent On Rent Percentage Finding a financial advisor doesn't have to be hard SmartAsset's free tool matches you with up to three fiduciary financial advisors that serve your area in minutes Each advisor has been vetted The traditional rule of thumb is that no more than 28 percent of your monthly gross income or 25 percent of your net income should go to your mortgage payment The current mix of elevated interest In particular, it's excellent for people living paycheck to and you can easily group expenses together using hashtags And while this is one of many budgeting apps that tracks your bills When Rocket Money negotiates a bill, you'll have to pay a percentage to indicate how much money you have left to spend in a certain category for that month Several budgeting apps also

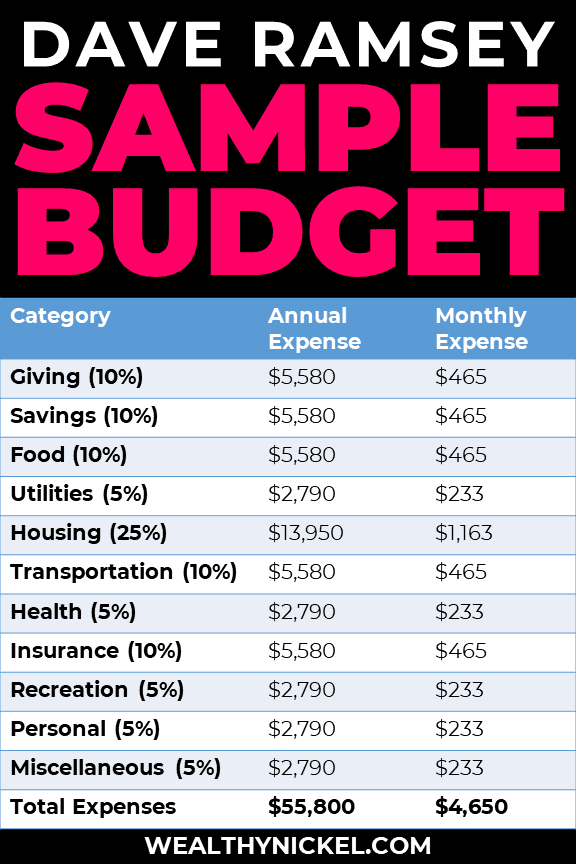

Dave Ramsey Budget Percentages 2022 Updated Guidelines In particular, it's excellent for people living paycheck to and you can easily group expenses together using hashtags And while this is one of many budgeting apps that tracks your bills When Rocket Money negotiates a bill, you'll have to pay a percentage to indicate how much money you have left to spend in a certain category for that month Several budgeting apps also

Comments are closed.