Bullish Divergence And Bearish Divergence Chart Pattern In Forex

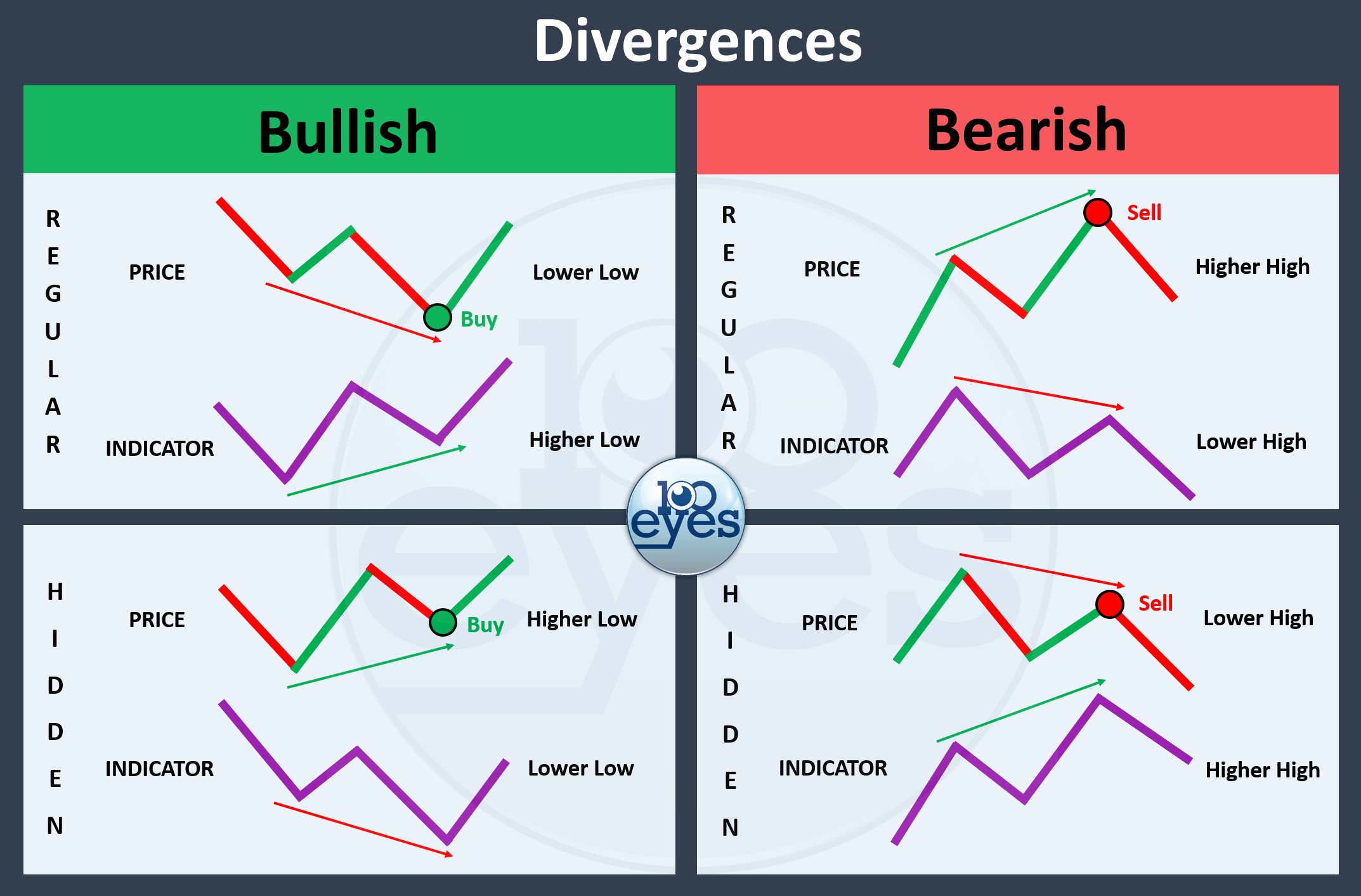

Divergence Trading 100eyes Scanner There are three types of divergence: bullish (positive), bearish (negative), and hidden. refer to the chart below for easy distinctions between them and read about each in more depth underneath. price movement. indicator movement. divergence type. high > higher high. high > lower high. bearish divergence. low > lower low. We confirm a hidden bearish divergence when the price shows lower tops, and the indicator gives higher tops. the regular divergence pattern is used to forecast an upcoming price reversal. when you spot a regular bearish divergence, you expect the price to cancel its bullish move and switch to a downward movement. practice this strategy.

Bullish Divergence And Bearish Divergence Chart Pattern In Forex Class a bearish divergences often signal a sharp and significant reversal toward a downtrend. class a bullish divergences occur when prices reach a new low but an oscillator reaches a higher. The bullish divergence has absolutely the same characteristics as the bearish divergence, but in the opposite direction. we have a bullish divergence when the price makes lower bottoms on the chart, while your indicator is giving you higher bottoms. after a bullish divergence pattern, we are likely to see a rapid price increase. A bullish divergence occurs when the price of an asset is creating new lows while a momentum indicator or oscillator is moving in the opposite direction. this bullish trend reversal pattern signals that the momentum of the trend is weakening and the trend is about to reverse. the most reliable indicators to use include macd, rsi, and stochastic. Chart patterns – some patterns, like the bullish and bearish divergence patterns, will help you get the confirmation needed to enter a trader. also, you can use other suitable chart patterns to confirm the trade, especially harmonic chart patterns that are extremely accurate in predicting price movements.

Comments are closed.