Business Credit Scores Credit Rating Scales

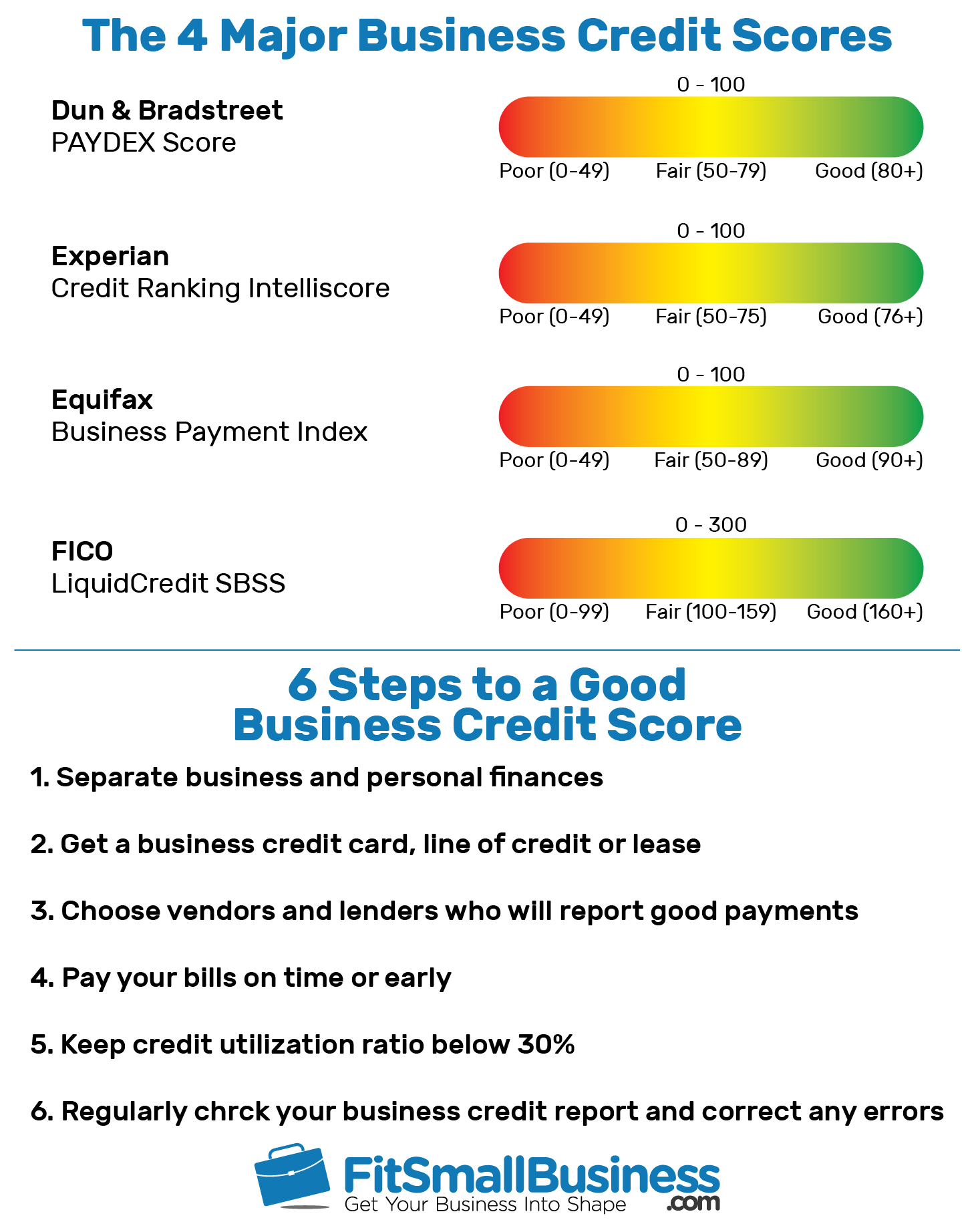

Business Credit Scores Credit Rating Scales The paydex measures a business’s past payment performance based on information in the dun & bradstreet data cloud. on a scale of 1 to 100, scores of 80 and above are considered low risk and could potentially increase a business’s credibility to creditors. a business’s paydex score is roughly equivalent to an individual’s fico credit. Personal credit scores range from 300 to 850. business credit scores range from 0 to 100. major business credit reporting agencies dun & bradstreet, experian, and equifax produce business credit scores and reports. fico scores for small businesses are known as “fico sbss.”.

What Is A юааbusinessюаб юааcreditюаб юааscoreюаб A Beginnerтащs Guide Paydex credit score. the paydex credit score uses data gathered from a company’s suppliers and vendors to determine how good the business’ payment performance has been over the last 12 months. this is scored on a scale of 1 to 100. vendors, suppliers, lenders, and creditors use it when determining trade credit terms, such as the length of. Here’s an overview of the dun & bradstreet business credit rating scale, or the dun & bradstreet paydex score: this is a unique scoring system used by dun & bradstreet, ranging from 0 to 100. a higher paydex score indicates a better payment performance. for example:. Good. a score of 100 means your payments come 30 days soon than your terms specify. 80 indicates on time payments. 50 – 79. fair. a 70 indicates that you are paying 15 days late. a score of 50 indicates you are 30 days late. 0 – 49. bad. 40 or less means your payments are coming 60 days or more past the due date. Lenders typically use this score when qualifying applicants for small business administration (sba) loans. scores range from 0 to 300, but you’ll need a minimum score of 155 to pass the sba’s.

What Is A Good Business Credit Score Quickbooks Good. a score of 100 means your payments come 30 days soon than your terms specify. 80 indicates on time payments. 50 – 79. fair. a 70 indicates that you are paying 15 days late. a score of 50 indicates you are 30 days late. 0 – 49. bad. 40 or less means your payments are coming 60 days or more past the due date. Lenders typically use this score when qualifying applicants for small business administration (sba) loans. scores range from 0 to 300, but you’ll need a minimum score of 155 to pass the sba’s. Put simply, your paydex business credit score is just a numerical representation of how long it typically takes your business to pay its debts. paydex scores range from 0 to 100, with a 100 being the best. if your score is an 80 or above, it means you usually make your payments on time (or earlier), while a score below 80 means that you pay late. Free includes: see risk range indicators for four scores & ratings: paydex ® score. delinquency score. failure score. supplier evaluation risk (ser ®) summary information of legal events and business operations. basic company information. scores, ratings, inquiries, alerts & notifications, both in app and or via email.

Credit Score Rating Scale Chart Put simply, your paydex business credit score is just a numerical representation of how long it typically takes your business to pay its debts. paydex scores range from 0 to 100, with a 100 being the best. if your score is an 80 or above, it means you usually make your payments on time (or earlier), while a score below 80 means that you pay late. Free includes: see risk range indicators for four scores & ratings: paydex ® score. delinquency score. failure score. supplier evaluation risk (ser ®) summary information of legal events and business operations. basic company information. scores, ratings, inquiries, alerts & notifications, both in app and or via email.

Credit Score Rating Scale Chart

Comments are closed.