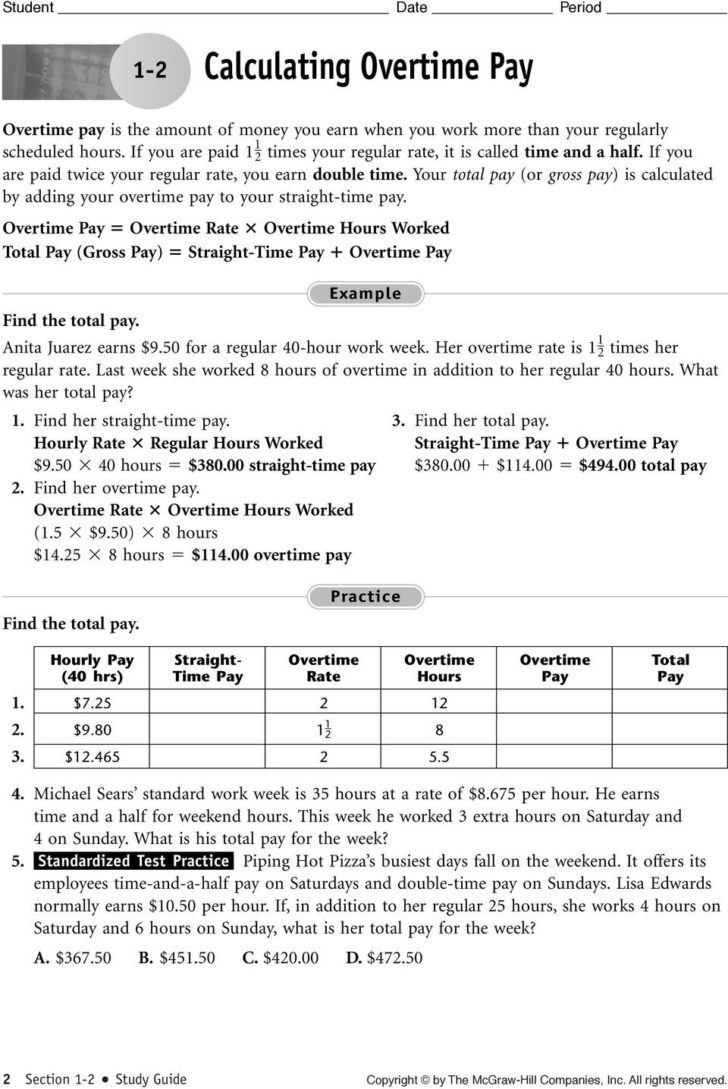

Calculating Overtime Pay Worksheets

Calculating Overtime Pay Worksheets This employee’s total pay due, including the overtime premium, for the workweek can be calculated as follows: (35 hours x $12) (10 hours x $15) = $570 base pay. $570 45 total hours = $12.67 regular rate of pay. $12.67 x 0.5 = $6.34 overtime premium rate. $6.34 x 5 overtime hours = $31.70 total overtime premium pay. The overtime rate is usually 1.5 times an employee’s regular hourly pay. in some cases, such as on sundays, an employer may pay double time or 2 times an employee’s regular pay. 1. your answer on the line provided. carol jones is a receptionist in a doctor’s office. she worked 35 hours this week.

Calculating Overtime Pay Worksheet Below is an example of the calculation: regular pay = $15 per hour x 43 hours = $645. total pay with bonus = $645 $50 = $695. implied hourly rate with bonus = $480 43 hours = $16.16 per hour. overtime pay = $16.16 per hour x 1.5 x 3 hours = $72.72. total pay = $695 $72.72 = $767.72. This tutorial will demonstrate how to calculate overtime pay in excel & google sheets. calculate total pay. to get the total pay, we use the above formula in cell h6 like this: =(f6*h6) (g6*h6*1.5) to breakdown the formula, (f5*h5) calculates the pay for the regular hours and (g5*h5*1.5) calculates the pay for working overtime. by adding these. Step 1: because the tip credit was taken, use the full minimum wage to calculate the overtime rate. $7.25 x 1.5 = $10.88. step 2: subtract the appropriate tip credit from the overtime rate to achieve the adjusted overtime rate and multiply by the number of overtime hours worked that week. Under this system, the employee is entitled to overtime for all hours worked in excess of eight hours in any workday and in excess of 80 hours in such 14 day period. three conditions must be met.

Calculating Overtime Pay Worksheet вђ Db Excel Step 1: because the tip credit was taken, use the full minimum wage to calculate the overtime rate. $7.25 x 1.5 = $10.88. step 2: subtract the appropriate tip credit from the overtime rate to achieve the adjusted overtime rate and multiply by the number of overtime hours worked that week. Under this system, the employee is entitled to overtime for all hours worked in excess of eight hours in any workday and in excess of 80 hours in such 14 day period. three conditions must be met. Q2 if felicity works overtime she is paid more than her normal rate which is $12.75 p.h. for the first 8 hours of work per day. felicity earns time and a half for the next 2 hours, then double time for any hours worked after that. calculate felicity s pay on days in which she worked the following:. Calculating overtime pay . fill in the chart to determine the overtime pay, regular pay for 40 hours and total pay. hourly rate overtime rate total hours regular pay overtime pay total pay $7.00 42 $14.00 41 $9.50 48 $21.00 50 $20.00 45 $14.00 42 $12.50 50 44 $440.00 45 $350.00.

Comments are closed.