Certification To Investigative Consumer Reporting Agency Hrcalifornia

Certification To Investigative Consumer Reporting Agency Hrcalifornia Certification to investigative consumer reporting agency. give this notice to your selected provider when requesting an investigative consumer report on an applicant or employee. this premium form is available to calchamber members, learn more about membership now. already a member?. Use this form to provide disclosures required by california law and to obtain written authorization from an individual before obtaining an investigative consumer report for employment purposes. provide this form along with the disclosure and authorization to obtain consumer credit report – federal. employers subject to the san francisco fair.

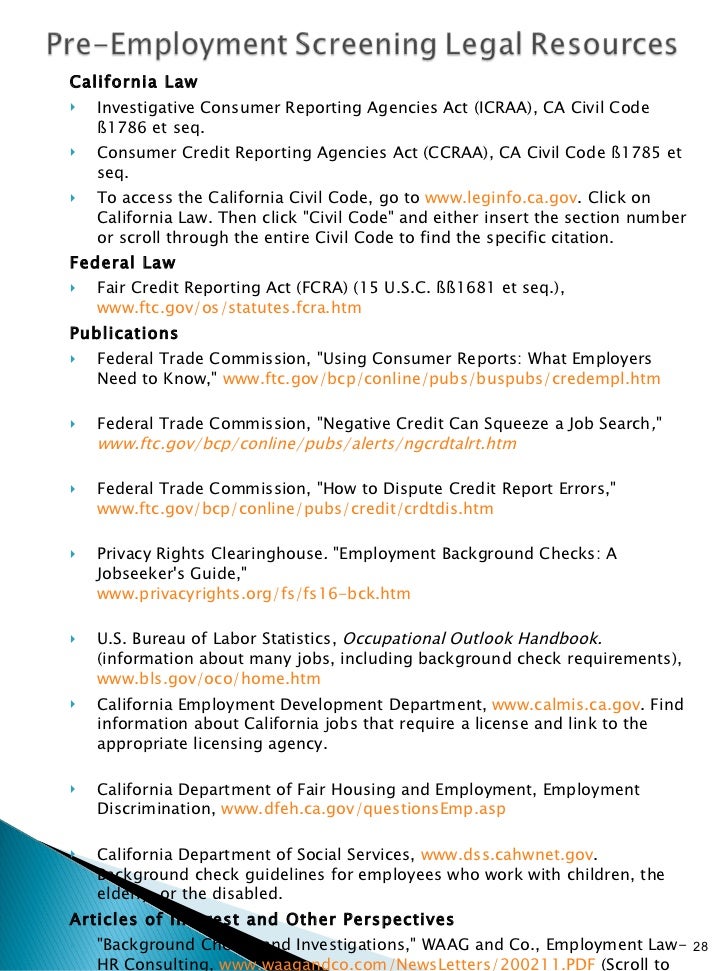

Investigative Consumer Report Presentation Jun 09 07 Version Hiring. limits to conducting background checks on job applicants. hrwatchdog may 8, 20205093. several disclosure requirements and procedural steps are incumbent on both employers and the investigative consumer reporting agencies. my company uses a background check company to conduct background checks on our applicants. The investigative consumer reporting agencies act (icraa) is a california law that requires investigative consumer reporting agencies (icras) to institute reasonable procedures to ensure they provide and use consumer information in a way that is fair, equitable and respects consumers’ right to privacy, particularly with regard to reports furni. The court held that the disclosure required under the federal fair credit reporting act (fcra) can consist only of the frca disclosure; it can’t contain any additional information, including the disclosure required under california’s investigative consumer reporting agencies act (icraa) (gilberg v. An investigative consumer reporting agency is prohibited from reporting on convictions that resulted in full pardons or arrests that did not result in conviction, except where judgment has not yet.

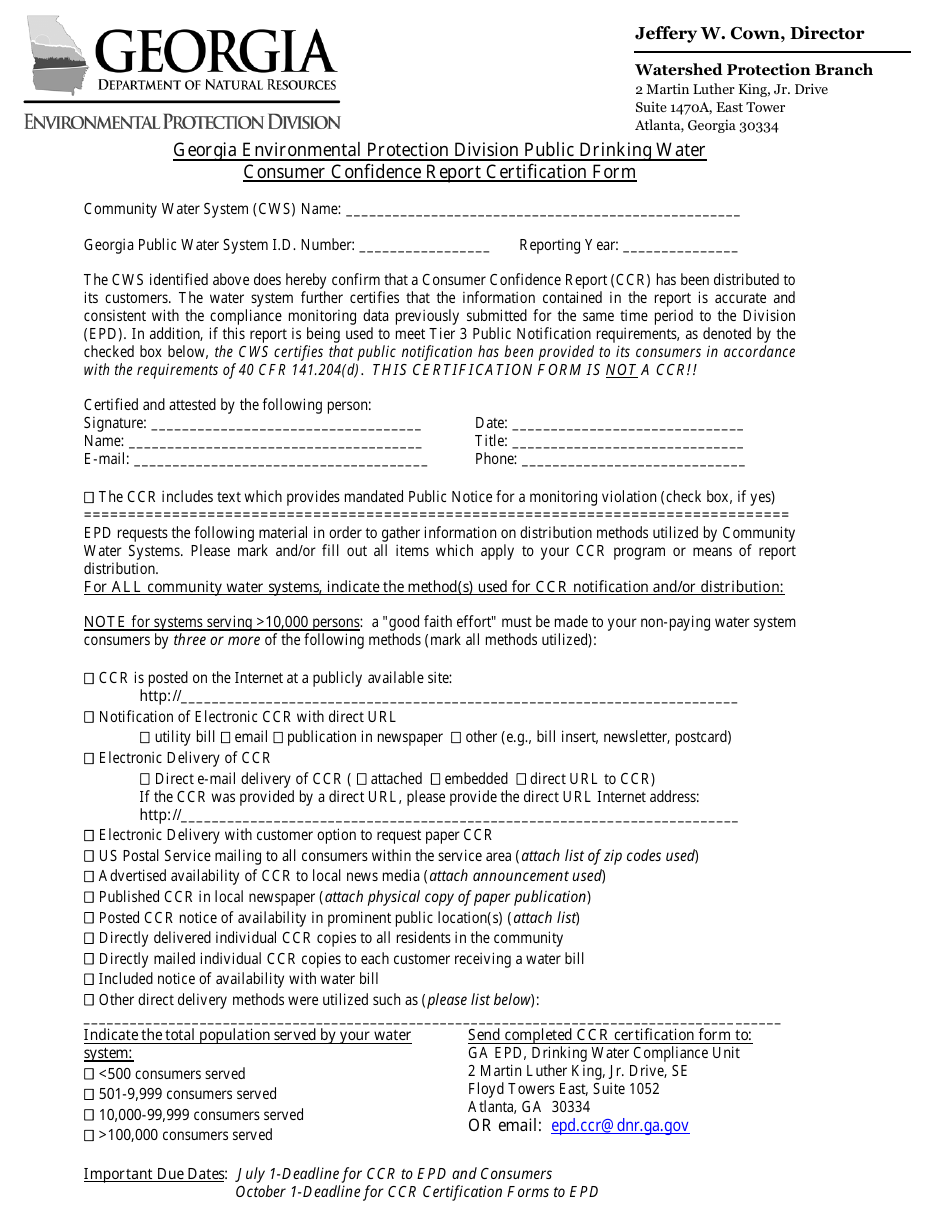

Georgia United States Consumer Confidence Report Certification Form The court held that the disclosure required under the federal fair credit reporting act (fcra) can consist only of the frca disclosure; it can’t contain any additional information, including the disclosure required under california’s investigative consumer reporting agencies act (icraa) (gilberg v. An investigative consumer reporting agency is prohibited from reporting on convictions that resulted in full pardons or arrests that did not result in conviction, except where judgment has not yet. The california investigative consumer reporting agencies act (icraa) has a number of clauses which are stricter than the fcra and must be followed. one clause is in regard to criminal records. the icraa, section 1786.18 (as well as labor code section 432.7), only allows the reporting of criminal convictions, and limits the conviction. Answer: no the answer to this question is not found in the icraa but rather in the consumer credit reporting agencies act (ccraa) section 1785.20.5. the ccraa parallels the icraa in many respects but primarily pertains to credit reports. both credit reports and investigative consumer reports (which are defined by and protected by the icraa.

Comments are closed.