Consumer Credit Scores And Mortgage Deferrals Cmhc

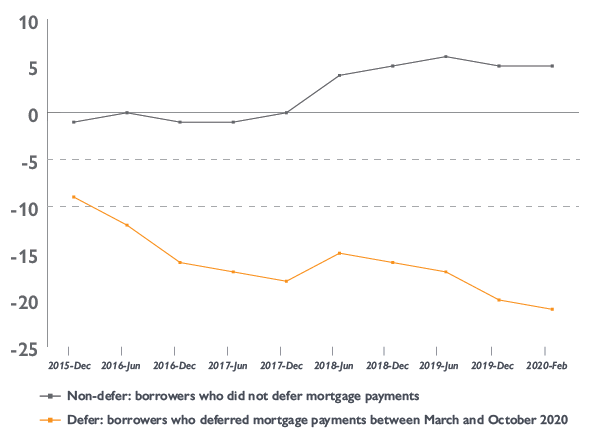

Consumer Credit Scores And Mortgage Deferrals Cmhc Credit scores are often used to assess consumers’ creditworthiness and ability to repay their debt. mortgage deferrals during the pandemic should not negatively impact a consumer’s credit score reported by equifax canada. we analyzed the trend in consumer credit scores before the start of the covid 19 pandemic. Deferrals of insured and uninsured mortgages. since the covid 19 pandemic in march 2020, mortgage deferrals have been used as one of the measures to help ease the financial burden of homeowners in canada. we are developing a series of analysis to gain a better understanding of the impacts of covid 19 on housing.

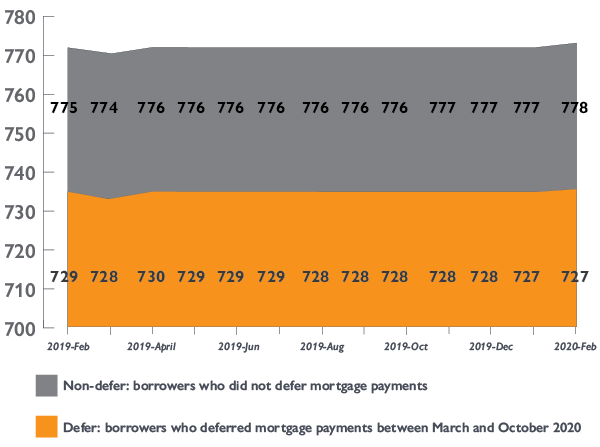

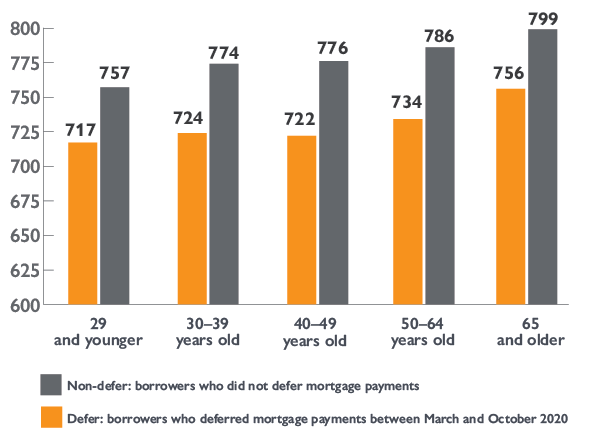

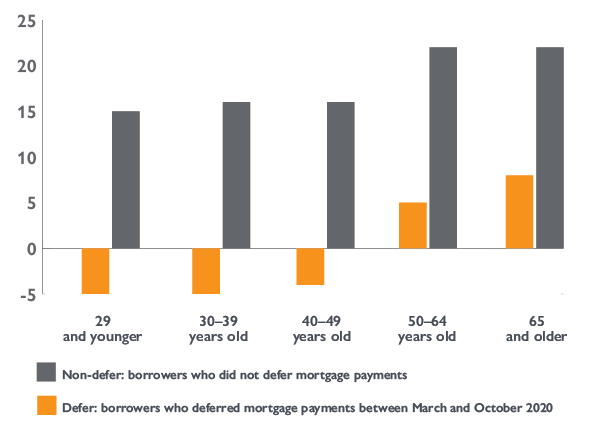

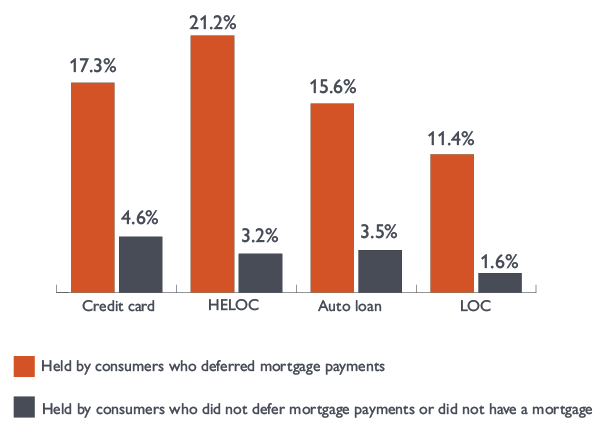

Consumer Credit Scores And Mortgage Deferrals Cmhc Figure 4. share of non mortgage consumer debt balance in deferral was higher for consumers who deferred mortgages than those who did not held by consumers who deferred mortgage payments held by consumers who did not defer mortgage payments or did not have a mortgage; credit card: 17.3% : 4.6%: heloc : 21.2% : 3.2%: auto loan: 15.6% : 3.5%: loc. Consumer credit scores and mortgage deferrals [electronic resource] : an analysis of trends in the credit scores of consumers before they deferred mortgage payments. by canada mortgage and housing corporation. • average credit scores rose from q1 2019 across the board for consumers with and without a mortgage, and for those with a new mortgage. credit scores for consumers with a mortgage were highest among all three groups. • credit scores for consumers with an existing mortgage and those with a new mortgage have been improving. Know the data on your credit report. you know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a right to see that data. use our list of credit reporting companies to request and review each of your reports. browse the list.

Consumer Credit Scores And Mortgage Deferrals Cmhc • average credit scores rose from q1 2019 across the board for consumers with and without a mortgage, and for those with a new mortgage. credit scores for consumers with a mortgage were highest among all three groups. • credit scores for consumers with an existing mortgage and those with a new mortgage have been improving. Know the data on your credit report. you know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a right to see that data. use our list of credit reporting companies to request and review each of your reports. browse the list. Mortgage and consumer credit trends national report q2 2018 3 mortgage and consumer credit risks mortgage delinquency • in the second quarter of 2018, the share of mortgage loans that remained unpaid for 90 days or more continued to descend and reached its lowest point since data became available in 2012. this shows more regular. Average credit scores among mortgage holders remain strong • average credit scores among mortgage holders saw a slight increase in ontario (771) while remaining stable in toronto (774), hamilton (772), and ottawa (771). average credit scores amongst mortgage holders in the province and the aforementioned cmas are all.

Consumer Credit Scores And Mortgage Deferrals Cmhc Mortgage and consumer credit trends national report q2 2018 3 mortgage and consumer credit risks mortgage delinquency • in the second quarter of 2018, the share of mortgage loans that remained unpaid for 90 days or more continued to descend and reached its lowest point since data became available in 2012. this shows more regular. Average credit scores among mortgage holders remain strong • average credit scores among mortgage holders saw a slight increase in ontario (771) while remaining stable in toronto (774), hamilton (772), and ottawa (771). average credit scores amongst mortgage holders in the province and the aforementioned cmas are all.

Deferrals Of Insured And Uninsured Mortgages Cmhc

Comments are closed.