Consumer Credit Transaction Example

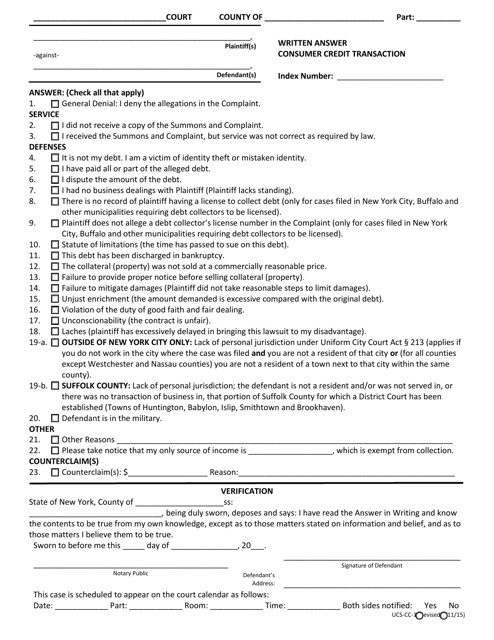

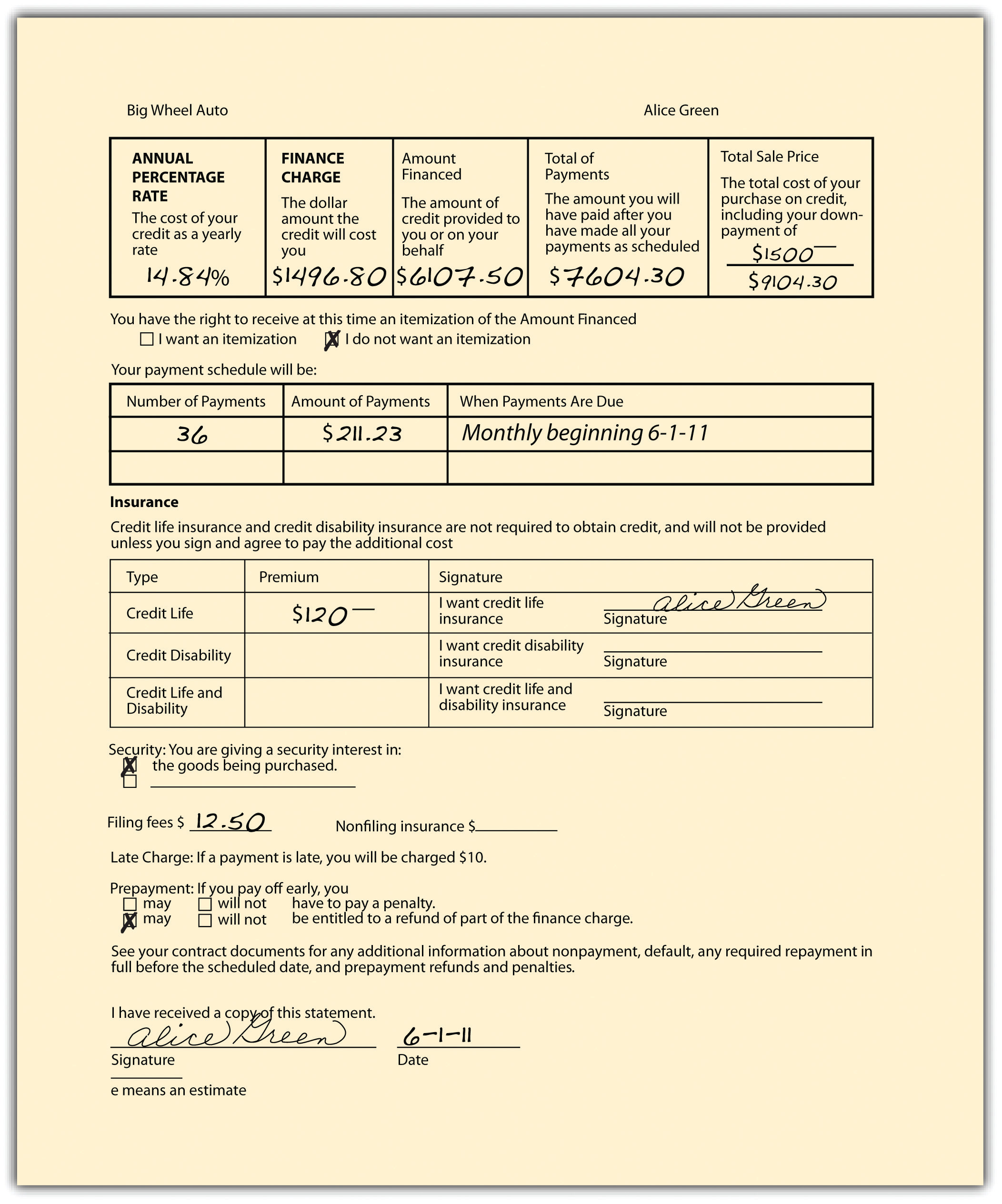

Form Ucs Cc 1 Fill Out Sign Online And Download Fillable Pdf New What is consumer credit in financial services? definition. Consumer credit transaction means a transaction between a natural person and another person in which property, services, or money is acquired on credit by that natural person from the other person primarily for personal, family, or household purposes. sample 1 sample 2 sample 3. based on 9 documents.

Consumer Credit Transactions Libretexts. the amount of consumer debt, or household debt, owed by americans to mortgage lenders, stores, automobile dealers, and other merchants who sell on credit is difficult to ascertain. one reads that the average household credit card debt (not including mortgages, auto loans, and student loans) in 2009 was almost $16,000. In this chapter, we focus on the consumer credit transaction. chapter 19 "secured transactions and suretyship" and chapter 20 "mortgages and nonconsensual liens" explore different types of security that a creditor might require. chapter 21 "bankruptcy" examines debtors’ and creditors’ rights under bankruptcy law. Second, after a consumer has contracted for credit, certain statutes give a consumer the right to cancel the contract and correct billing mistakes. third, if the consumer fails to pay a debt, the creditor has several traditional debt collection remedies that today are tightly regulated by the government. 24.1: entering into a credit transaction. Consumer credit law & practice in the u.s.1. 1. introduction. consumer credit is an important element of the united states economy. a consumer’s ability to borrow money easily allows a well managed economy to function more efficiently and stimulates economic growth.

Ppt Chapter 5 Introduction To Consumer Credit Powerpoint Presentation Second, after a consumer has contracted for credit, certain statutes give a consumer the right to cancel the contract and correct billing mistakes. third, if the consumer fails to pay a debt, the creditor has several traditional debt collection remedies that today are tightly regulated by the government. 24.1: entering into a credit transaction. Consumer credit law & practice in the u.s.1. 1. introduction. consumer credit is an important element of the united states economy. a consumer’s ability to borrow money easily allows a well managed economy to function more efficiently and stimulates economic growth. Definition and examples of consumer credit . consumer credit is money that consumers can borrow to pay for goods or services. access to credit allows consumers to make purchases today and then pay for them over a period of time. banks, financial institutions, and businesses make credit available to consumers. If payment or receipt of cash in result of a transaction is postponed at some future date, then this transaction will be known as “credit transaction.“ example. purchased furniture on credit $10,000 is a credit transaction. purchased stationery on credit $7,000 is a credit transaction.

Comments are closed.