Consumer Financing Options

Consumer Loan What Is It Examples Types Interest Eligibility Customer financing is any type of buy now pay later arrangement. typically, the customer will have to pay a portion of the total cost before the goods services are released. this sort of financing is usually a business to customer (b2c) arrangement instead of a business to business (b2b) arrangement. related:. Learn how to offer customer financing options to boost sales, increase conversions, and improve customer loyalty. compare in house and third party financing platforms, choose a provider, integrate financing across sales channels, and advertise your options.

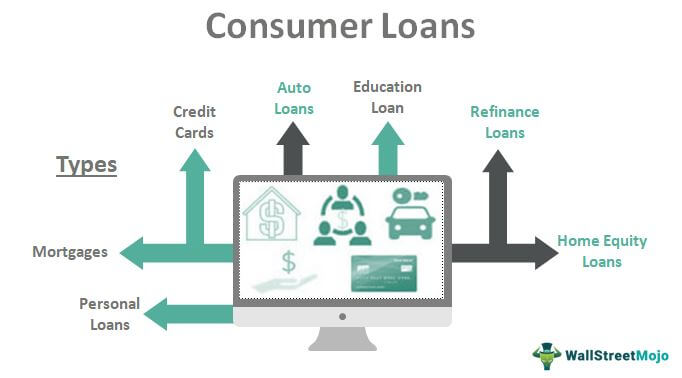

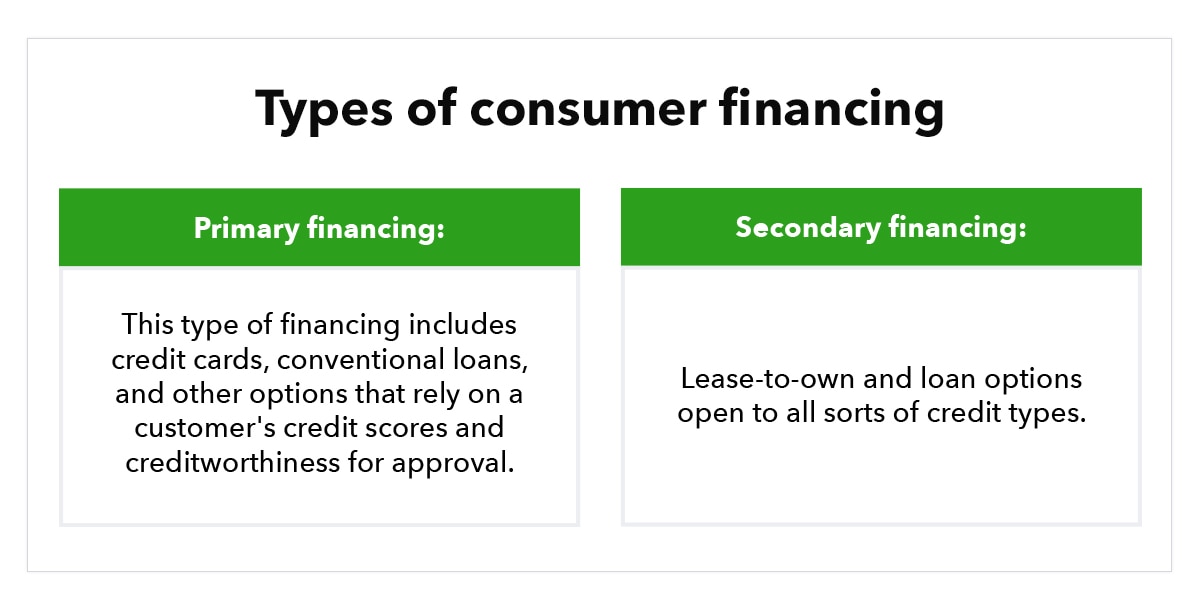

How To Offer Customer Financing Without Breaking The Bank Customer financing plans come in many forms, from simple credit cards to full installment loans. you can manage these finance options yourself or partner with a third party finance company to do the work. by stretching out payments, consumer financing makes your products and services more affordable. When using a third party provider, here’s how to offer financing to customers: first, the customer sees a product or service they want to buy, either in store or online. next, because the customer can’t afford the full price, but still want to buy the product, they’ll apply for financing. Customer financing is a program or service offered by a business to help customers pay for products, goods, or services over time. usually, financing involves an application process and spreads payments over a period, such as six weeks or 24 months. if you are a small business owner, the financial resources of your customers can play a key. Follow these steps to offer in house customer financing: set up financing plans. determine the details of your different financing plans, including fixed or variable interest rates, term lengths, and payment schedules. track monthly payments, so you can accurately collect interest on late payments. train your team (and eventually grow it).

How Small Businesses Can Offer Customer Financing вђ Finance My Customer Customer financing is a program or service offered by a business to help customers pay for products, goods, or services over time. usually, financing involves an application process and spreads payments over a period, such as six weeks or 24 months. if you are a small business owner, the financial resources of your customers can play a key. Follow these steps to offer in house customer financing: set up financing plans. determine the details of your different financing plans, including fixed or variable interest rates, term lengths, and payment schedules. track monthly payments, so you can accurately collect interest on late payments. train your team (and eventually grow it). Select direct to merchant financing options can offer consumers up to 10 years to pay back the money the business receives upfront after the purchase has been made. direct to merchant financing. Consumer financing programs provide loans or lines of credit to individual consumers, offering them more choice when it comes to making purchases. imagine a customer who is shopping online for a new couch. when considering the purchase, the buyer knows that cheap furniture probably can't stand up to kids, pets, life and time — but also thinks.

Comments are closed.