Consumer Health And Savings Account Fsa

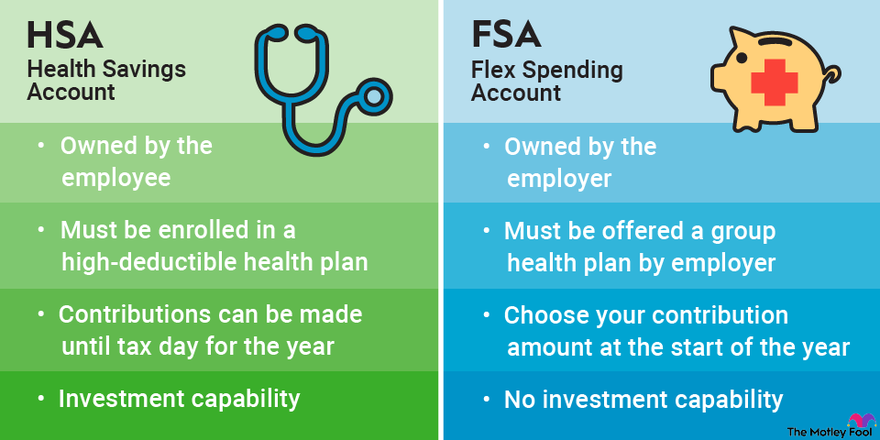

Hsa Vs Fsa Accounts Side By Side Healthcare Comparison The Motley Fool Flexible spending account (fsa) explained. Health savings accounts are not typical savings accounts, and they’re available only to people who have a high deductible health plan, or hdhp. in 2023, an hdhp is any plan with a deductible of.

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference Fsa vs. hsa: what to know about the accounts to pay. A high yield savings account (hysa) can earn a sizable return while leaving money readily available. you don't have to be enrolled in a high deductible health plan and, unlike an fsa, an hysa isn. A health savings account (hsa) offers the opportunity to build a stash of cash that can help you pay medical expenses for years or even decades. but not everybody is eligible for an hsa. on the. An hsa, or health savings account, is a tax advantaged health savings vehicle that allows consumers enrolled in high deductible health care plans to make tax free contributions, grow tax free.

Hsa Versus Fsa Brandongaille A health savings account (hsa) offers the opportunity to build a stash of cash that can help you pay medical expenses for years or even decades. but not everybody is eligible for an hsa. on the. An hsa, or health savings account, is a tax advantaged health savings vehicle that allows consumers enrolled in high deductible health care plans to make tax free contributions, grow tax free. Using an fsa hra together. you can use an fsa and hra together. if you have an fsa, expenses typically come from that account first. funds from the hra are then used to cover other medical expenses. using an fsa hsa together. it’s uncommon to have an fsa and hsa at the same time, but not impossible. Flexible spending accounts (fsas) and health savings accounts (hsas) let you set aside pre tax money, sometimes directly from your paycheck, to pay for eligible medical expenses. guard this card carefully as you may not have the same rights to get your money back if it is stolen as you do with your bank or credit union debit card.

Comments are closed.