Consumer Reports Tax Deductible

What Are Tax Deductions And Credits 20 Ways To Save Mint Learn how to itemize your taxes and deduct charitable donations, medical expenses, retirement accounts, and more. find out the rules, tips, and limits for each deduction category. Consumer reports is a nonprofit, tax exempt charitable organization under section 501(c)(3) of the internal revenue code. donations are tax deductible as allowed by law. about us donate.

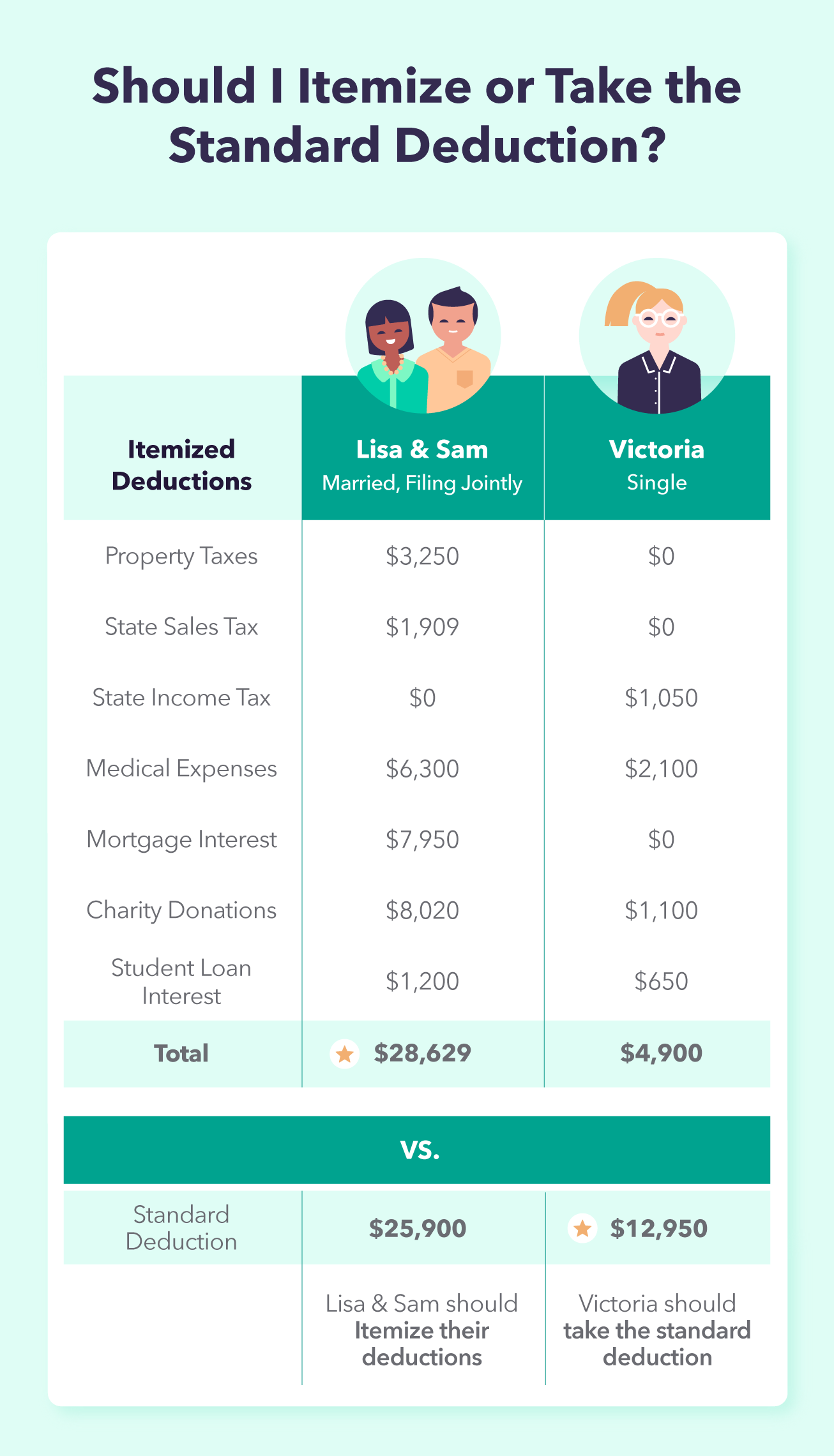

Tax Deductible Definition Expenses Examples Learn how to value your charitable donations correctly and get the best tax deduction for your 2017 return. find out which tools and resources can help you estimate the fair market value of your gifts and keep the right documentation. Consumer reports. attn: development department. 101 truman ave. yonkers, ny 10703. call us. 914 378 2881. consumer reports is a fast company most innovative company and brand that matters. This charity's score is 100%, earning it a four star rating. if this organization aligns with your passions and values, you can give with confidence. this overall score is calculated from multiple beacon scores, weighted as follows: 74% accountability & finance, 10% leadership & adaptability, 16% culture & community. Itemized deductions, definition. itemized deductions are certain expenses allowed by the irs that can decrease your taxable income (aka the amount of your income that's subject to taxes). when you.

Tax Deduction Definition Taxedu Tax Foundation This charity's score is 100%, earning it a four star rating. if this organization aligns with your passions and values, you can give with confidence. this overall score is calculated from multiple beacon scores, weighted as follows: 74% accountability & finance, 10% leadership & adaptability, 16% culture & community. Itemized deductions, definition. itemized deductions are certain expenses allowed by the irs that can decrease your taxable income (aka the amount of your income that's subject to taxes). when you. Donors can use it to confirm that an organization is tax exempt and eligible to receive tax deductible charitable contributions. users can find out if an organization had its tax exempt status revoked. organizations are listed under the legal name or a “doing business as” name on file with the irs. the search results are sortable by name. In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50%, depending on the type of contribution and the organization.

Comments are closed.