Cpa Requirements In Texas Accounting

Texas Cpa Requirements R Accounting Within the coursework two semester hours of accounting or business communications are required. the first step to determine your eligibility to take the cpa exam is to submit an application of intent. the website contains detailed information about these and other requirements to take the cpa exam and become a texas cpa. An amendment to board rule 511.57 allows texas cpa exam applicants to take the 30 semester hours of upper level accounting in any format established by the university and has eliminated the required 15 hours of face to face accounting courses. more info about requirements for examination may 1, 2020 • new cpa exam testing faqs.

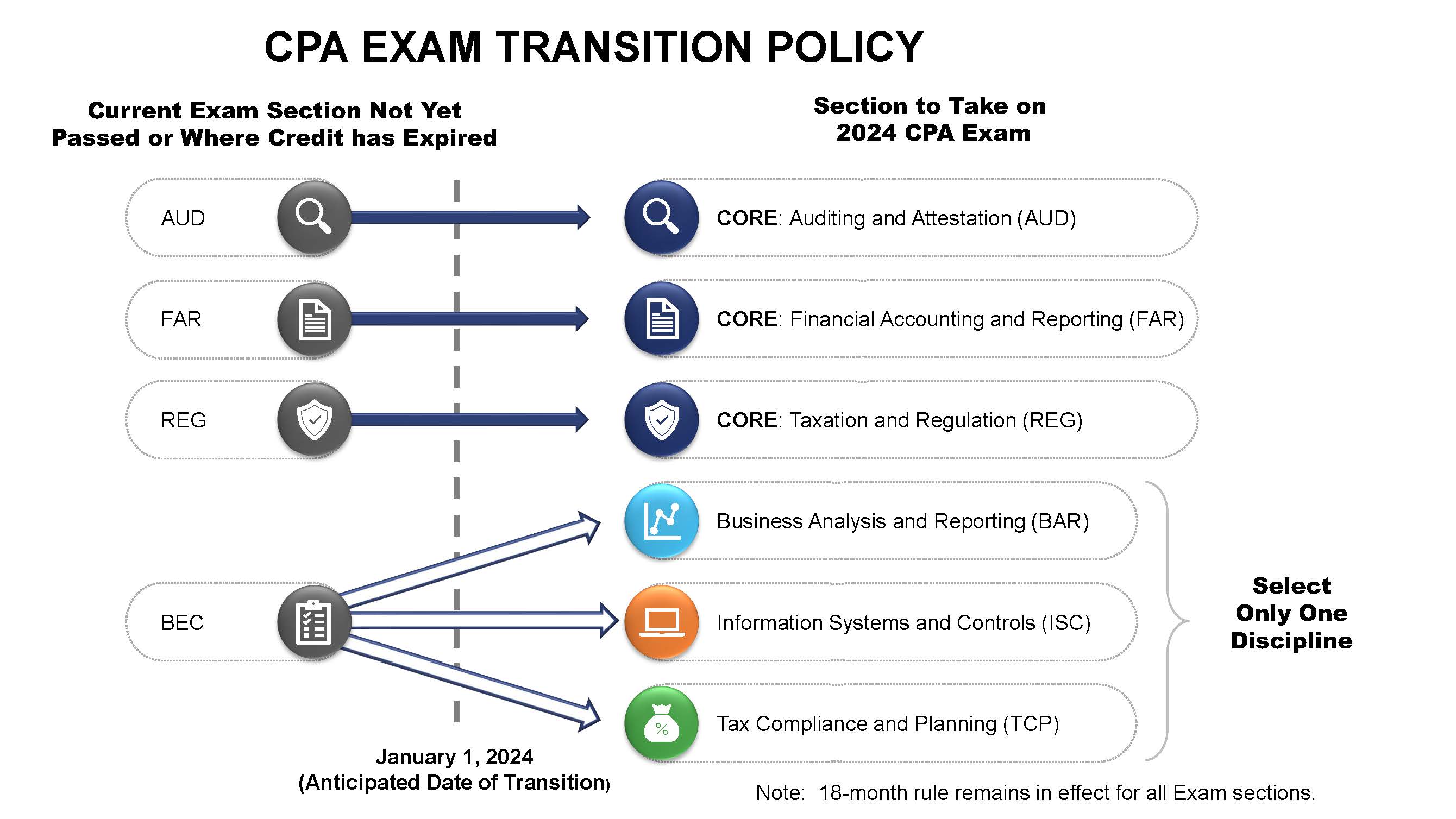

Tsbpa Welcome To Texas State Board Of Public Accountancy The board shall issue a certificate to a person who meets these requirements: pass a background investigation. pass the cpa exam. complete the education requirements of board rule 511.164 within 36 months of passing all sections of the cpa exam. no fewer than 150 semester hours of college coursework taken at an accredited college or university. Here are the cpa license requirements. to obtain your cpa license tx requires: education: obtain 150 credit hours from any regional accredited educational institution. work experience: 1 year of full time “non routine” accounting work experience: by non routine, it generally means:. Expiration of exam credits were also extended from 18 months to 30 months, effective jan. 1, 2024. the applicant reassessment program from the texas state board of public accountancy invites those who lost exam credits between jan. 1, 2020, and jan. 1, 2024, due to expiration to reach out for potential reinstatement of those credits. Regulation in texas. the texas state board of public accountancy is the regulatory agency for public accounting in texas. it is the agency to contact with all questions regarding cpa licensing and examination. for more information about qualifying and applying for the cpa exam contact: texas state board of public accountancy (tsbpa) 505 e.

Comments are closed.