Cpa Vs Tax Accountant What Is The Difference

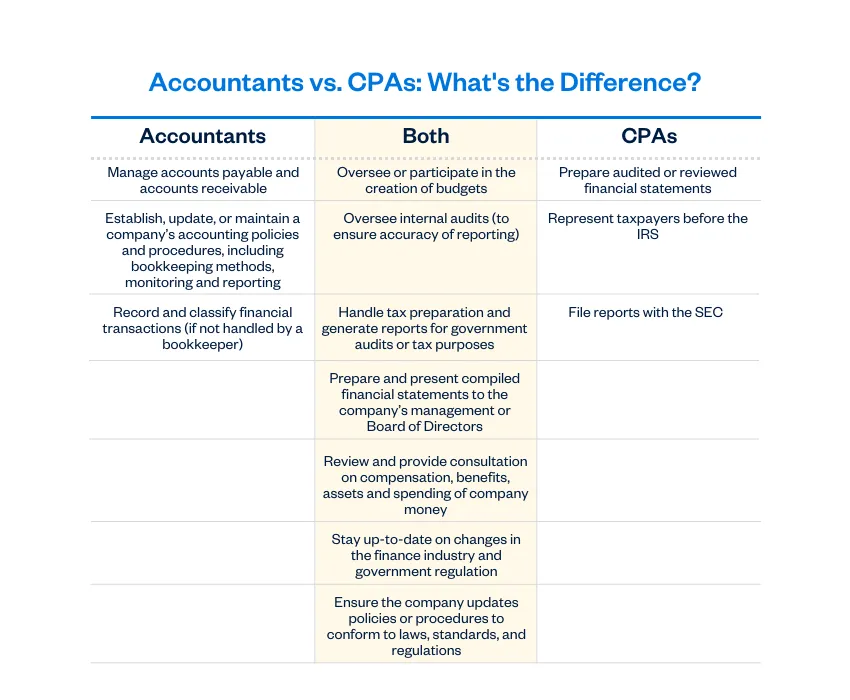

Cpa Vs Accountant What Is The Difference Cpas can do everything accountants do, but accountants can’t do everything cpas do. cpas can perform audits while accountants cannot. cpas are professionally licensed, but accountants are not. if you’re considering working with a cpa or an accountant, you may want to consult with a financial advisor first. try using smartasset’s free. Knowing the difference between these two types of tax professionals is useful in deciding which one is right for you. accountants and taxes accounting professionals typically have substantial.

Accountant Vs Cpa Difference Between Accountant Certified Public Cpas are best for help with the business and accounting side of taxes, such as filing taxes, finding deductions and credits, accounting, and providing tax and financial planning. tax attorneys are best for legal advice in writing and representation in court. when hiring a cpa or tax attorney, look for someone who specializes in an area that. A certified public accountant, or cpa, is a full service financial professional. the title of cpa is a formal credential issued by the american institute of certified public accountants, or aicpa. it means that this person is a professional accountant who has also met the standards for cpa certification. this requires two elements:. A cpa, or certified public accountant, is someone who specializes in taxes and can manage the math involved with them. a tax attorney is a lawyer who knows how to review your tax decisions to see what the irs allows. each plays a distinct role, and there’s a good rule of thumb for choosing one: if you need someone to handle the numbers, to. Key takeaways: a certified public accountant (cpa) is a financial expert who helps clients manage their budgets and prepare for retirement. tax preparers focus on communicating with tax authorities, reviewing tax codes and filing tax paperwork. the primary difference between these careers is that cpas offer a wider range of services outside of.

Tax Accountant Vs Cpa The Difference You Should Know A cpa, or certified public accountant, is someone who specializes in taxes and can manage the math involved with them. a tax attorney is a lawyer who knows how to review your tax decisions to see what the irs allows. each plays a distinct role, and there’s a good rule of thumb for choosing one: if you need someone to handle the numbers, to. Key takeaways: a certified public accountant (cpa) is a financial expert who helps clients manage their budgets and prepare for retirement. tax preparers focus on communicating with tax authorities, reviewing tax codes and filing tax paperwork. the primary difference between these careers is that cpas offer a wider range of services outside of. Due to their higher skill level, in most cases, cpas earn more than general accounting professionals. accountants may earn around $61,480 per year, while senior cpas earn an average of $92,795 annually. for partners in a cpa firm, the average cpa salary is $166,572. this figure does not include bonuses or other benefits. What's the difference between a cpa and a licensed tax preparer? certified public accountants (cpas) are accounting professionals who have met education and professional requirements and have passed the four part uniform cpa exam. the credential is granted by states, so education and professional requirements can vary accordingly.

Comments are closed.