Defined Contribution Vs Benefit Pension Plan For Employees 4 Corner

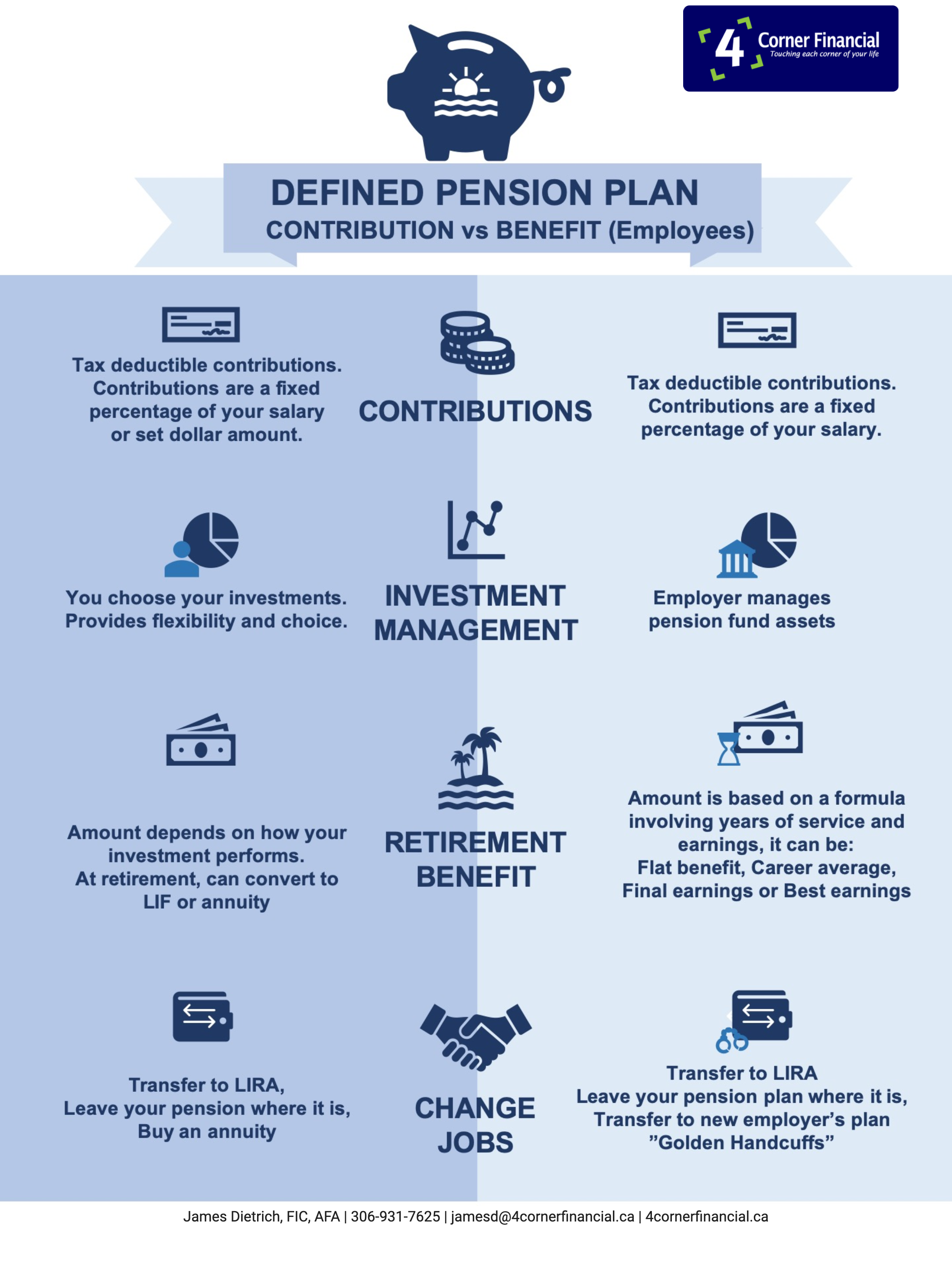

Defined Contribution Vs Benefit Pension Plan For Employees 4 Corner A defined benefit pension plan offers your employees a set amount of money when they retire, whereas a defined contribution pension plan does not. there are four key areas you should be aware of for pension plans: we will walk you through each of these to help give you a better understanding of the differences between the two types of pension. Whereas defined benefit plans offer a guaranteed income in retirement, defined contribution plans place the responsibility to save on the employees—and simply put, many don't. an estimated 40%.

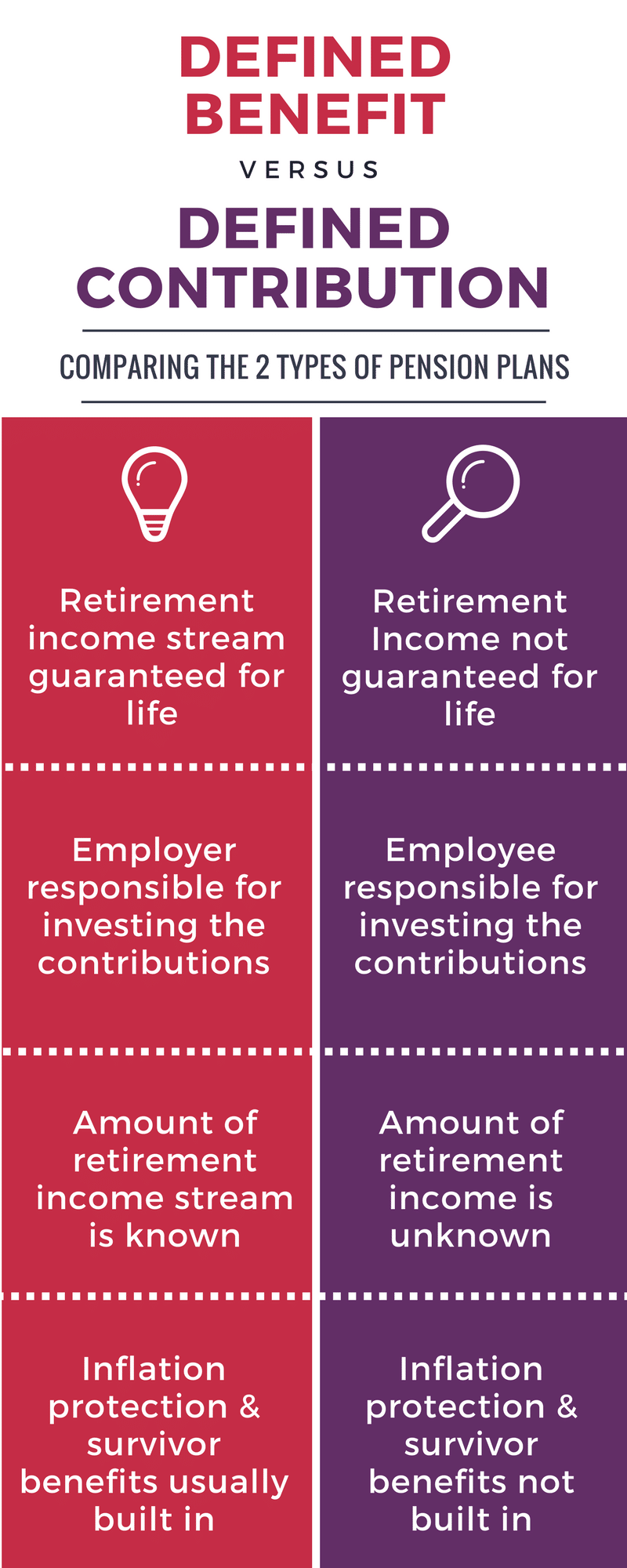

Pension Plans Part 2 Defined Benefit Vs Defined Contributionо Stay ahead in 2024 with our comprehensive financial calendar! from tax filing to benefit distributions, we guide you through key dates like the $7,000 tfsa contribution and $8,000 first home savings account. bookmark now for a financially savvy year!. The difference between them lies primarily in who takes responsibility for funding the plans, managing the assets, and, ultimately, ensuring that retirees actually enjoy financial security. a defined benefit plan is the responsibility of the employer, while the employee takes responsibility for a defined contribution plan. Defined contribution plan s are employer sponsored retirement plans where money is put in regularly over time, either by you or your employer. common types of defined contribution plans where employees do most of the contributing include 401 (k)s, 403 (b)s and 457 (b)s. these can be supplemented with employer contributions as well. The employee retirement income security act (erisa) covers two types of retirement plans: defined benefit plans and defined contribution plans. a defined benefit plan promises a specified monthly benefit at retirement. the plan may state this promised benefit as an exact dollar amount, such as $100 per month at retirement.

Defined Contribution Plan Vs Defined Benefit Plan What S T Defined contribution plan s are employer sponsored retirement plans where money is put in regularly over time, either by you or your employer. common types of defined contribution plans where employees do most of the contributing include 401 (k)s, 403 (b)s and 457 (b)s. these can be supplemented with employer contributions as well. The employee retirement income security act (erisa) covers two types of retirement plans: defined benefit plans and defined contribution plans. a defined benefit plan promises a specified monthly benefit at retirement. the plan may state this promised benefit as an exact dollar amount, such as $100 per month at retirement. For most canadians, the average salary from ages 25 to 64 is $62,833. if you were part of the pension plan for 30 years with a 2% benefit percentage, your annual pension would be: $62,833 x 30 x 2% = $37,700 or $3,141 a month, before taxes. flat benefit – in this case, the formula uses a fixed monthly rate that is multiplied by the number of. A defined contribution plan is a tax deferred retirement plan in which employees contribute a set amount or a percentage of their income to a retirement account. such investments grow tax deferred, meaning no taxes are paid until the money is withdrawn. one key benefit of these plans is that they offer flexibility.

Defined Contribution Vs Benefit Pension Plan For Employees вђ 4 Corner For most canadians, the average salary from ages 25 to 64 is $62,833. if you were part of the pension plan for 30 years with a 2% benefit percentage, your annual pension would be: $62,833 x 30 x 2% = $37,700 or $3,141 a month, before taxes. flat benefit – in this case, the formula uses a fixed monthly rate that is multiplied by the number of. A defined contribution plan is a tax deferred retirement plan in which employees contribute a set amount or a percentage of their income to a retirement account. such investments grow tax deferred, meaning no taxes are paid until the money is withdrawn. one key benefit of these plans is that they offer flexibility.

Comments are closed.