Depositing A Check With Mobile Deposit

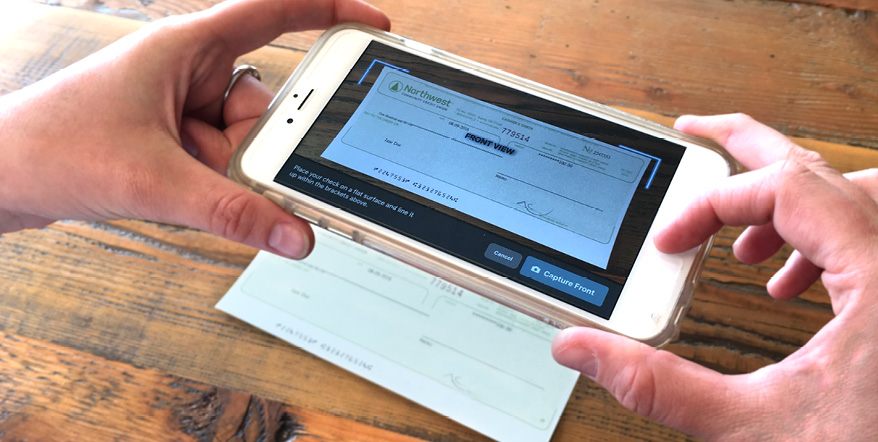

Depositing A Check With Mobile Deposit Youtube Bottom line. mobile check deposit can be a convenient way to handle deposits to a checking, savings or money market account. there are plenty of banks and credit unions that offer mobile check. How to deposit checks with our mobile banking app. open the app, use your fingerprint to securely log in. footnote [3] and select deposit checks. sign the back of the check and write “for deposit only at bank of america”. take photos of the front and back of the check with your smartphone — just select the front of check and back of check.

Deposit Checks From Your Phone With Mobile Deposit Capture We only accept checks from a u.s. financial institution, in u.s. dollars. 2 the following items are eligible for mobile deposit: personal checks. business checks. government treasury checks. cashier's checks. please visit a financial center to deposit the following items which are currently not accepted via mobile deposit: u.s. savings bonds. Mobile deposits are considered as safe and secure as any other bank approved method of depositing a check. the chase mobile ® app, for instance, never stores passwords or image data on your device when using chase quickdeposit℠. additionally, mobile deposits to fdic insured accounts are protected the same as any other deposit. 1. enter the check amount. your account’s remaining daily and 30 day mobile deposit limit will also display on the screen. 2. make sure the amount entered matches the amount on your check, and select. 1. sign the back of your check and write “for mobile deposit at wells fargo only” below your signature (or if available, check the box that. 3. open the bank app on your mobile device and select the mobile deposit function. after you’ve endorsed the check, open your bank’s app on your mobile device and then choose the function for.

Deposit Checks With Your Smartphone Nwcu 1. enter the check amount. your account’s remaining daily and 30 day mobile deposit limit will also display on the screen. 2. make sure the amount entered matches the amount on your check, and select. 1. sign the back of your check and write “for mobile deposit at wells fargo only” below your signature (or if available, check the box that. 3. open the bank app on your mobile device and select the mobile deposit function. after you’ve endorsed the check, open your bank’s app on your mobile device and then choose the function for. Mobile deposit means customers can deposit checks 24 7 and avoid trips to a physical bank or credit union branch. funds from mobile check deposits are typically available the next day, compared to. What is a mobile check deposit? mobile check depositing allows a customer to save time and energy by depositing a check remotely on their smartphone through a bank’s mobile app. the customer can.

Mobile Check Deposit Deposit Your Checks From Anywhere Manasquan Bank Mobile deposit means customers can deposit checks 24 7 and avoid trips to a physical bank or credit union branch. funds from mobile check deposits are typically available the next day, compared to. What is a mobile check deposit? mobile check depositing allows a customer to save time and energy by depositing a check remotely on their smartphone through a bank’s mobile app. the customer can.

Mobile Check Deposit First Priority Credit Union

Comments are closed.