Determining If You Meet The Means Test In A Chapter 7 Bankruptcy

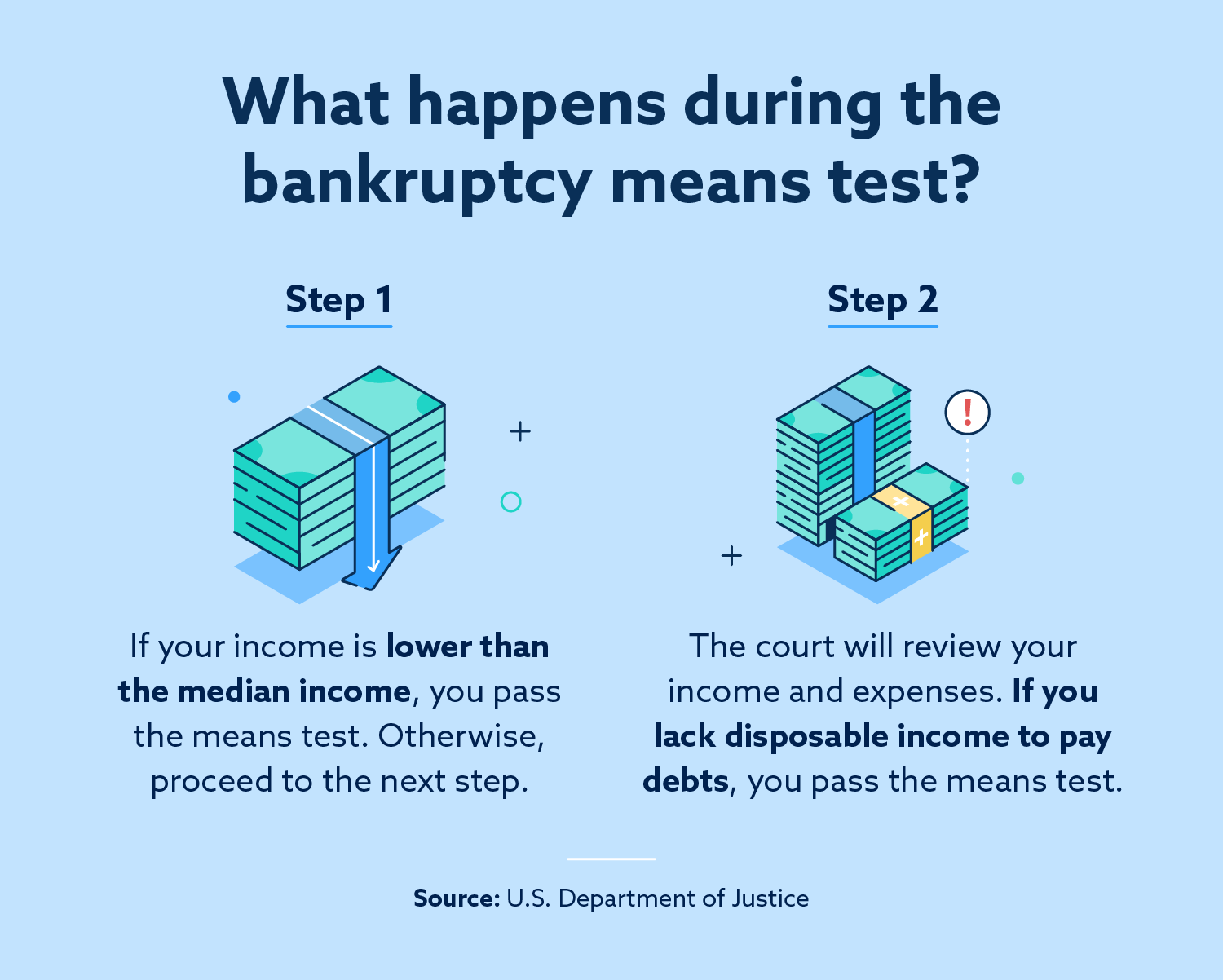

Chapter 7 Means Test Calculator Ascend Expenses that can help you pass bankruptcy's means test. For many people, overcoming the means test is the main challenge to qualify for chapter 7. the means test consists of two parts: median income and disposable income. if you successfully pass the first part and your income falls below the median, you are exempt from the second part and can qualify for chapter 7 bankruptcy.

Determining If You Meet The Means Test In A Chapter 7 Bankruptcy The first means test form, chapter 7 statement of your current monthly income (form 122a 1), determines whether your income is below your state's median income. if it is, you qualify for a chapter 7 bankruptcy and don't need to fill out the other two forms. form 122a 2. if your income is above the state median, you still might qualify. Final step: check your income and expense forms. even if you pass the chapter 7 means test, the chapter 7 trustee will review the income and expenses disclosed in the bankruptcy forms. unlike the means test that uses past earnings, the income and expense figures on your bankruptcy forms represent your current budget. Select bankruptcy under “court type” and enter your zip code, and then click “go”. if you don’t yet have a bankruptcy case number, leave that field blank. step 2: fill in your marital and filing status. you’ll then need to pick your marital and filing status from the following options: not married. The bankruptcy means test separates people who can legally afford to pay their debts from those who can’t. filers who pass the first part of the test can head straight to chapter 7 and work on.

Bankruptcy Means Test Who Qualifies For Chapter 7 Lexington Law Select bankruptcy under “court type” and enter your zip code, and then click “go”. if you don’t yet have a bankruptcy case number, leave that field blank. step 2: fill in your marital and filing status. you’ll then need to pick your marital and filing status from the following options: not married. The bankruptcy means test separates people who can legally afford to pay their debts from those who can’t. filers who pass the first part of the test can head straight to chapter 7 and work on. To qualify for chapter 7 bankruptcy, you need to pass a means test. in the test, you compare your income with the median income of a similar size household in your state. if your income is lower, you pass the test. if it’s higher, you have to move on to the next step in the means test, which takes your expenses and disposable income into account. Instead, your bankruptcy could be converted from chapter 7 to chapter 13, the section of the bankruptcy code that allows debtors to keep certain assets but requires a portion of what is owed to be repaid in a three to five year period. the means test has two steps. the first considers whether the filer’s income is below the chapter 7 income.

Comments are closed.