Different Types Of Insurance Policies Insurance Basics

7 Types Of Insurance Coverage amounts are typically low, usually between $1,000 and $5,000. comprehensive and collision coverage. these coverage types work together to pay for damage to your vehicle. collision. Insurance is a contract (policy) in which an insurer indemnifies another against losses from specific contingencies or perils. there are many types of insurance policies. life, health, homeowners.

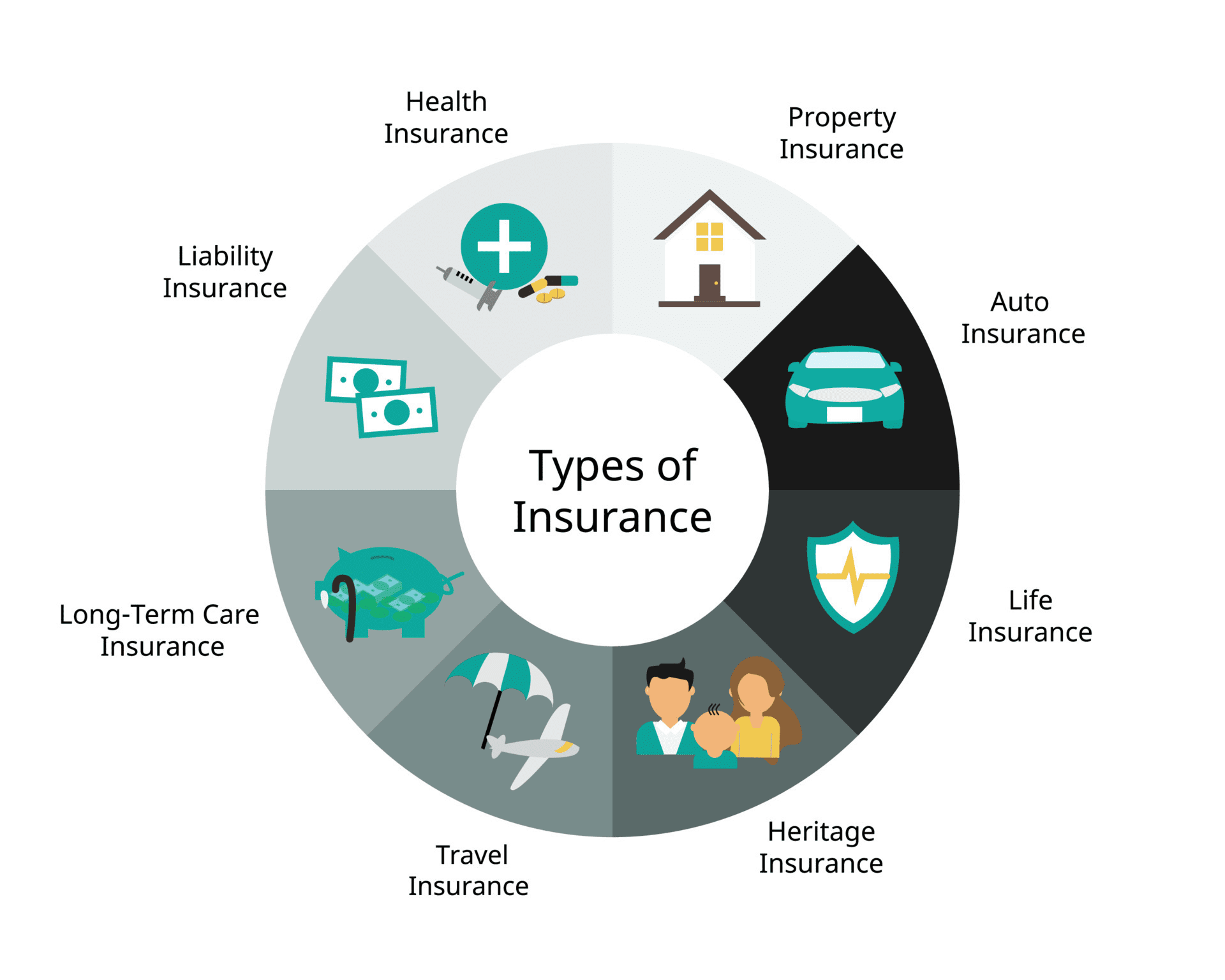

8 Different Types Of Insurance Proguide The most important types of insurance are auto, home, renters, umbrella, health, long term care, disability and life. assessing your personal insurance needs and budget constraints with an. Life insurance. pet insurance. auto insurance. insurance articles. there are several different types of insurance, and it can be hard to know which you need. here's our ultimate guide to the. Conclusion. insurance is a vital tool for protecting yourself, your loved ones, and your assets from unexpected events. by understanding the basics of insurance, different policy types, and the claim process, you can make informed decisions about your coverage. remember to assess your needs, research policies, compare coverage and premiums, and. Learn more about insurance policy types, coverage options and tips for managing your policies in the references below. life insurance riders: everything you need to know: riders can be purchased separately to enhance your insurance policy. learn more about how life insurance riders can help you get more out of your coverage.

What Is Insurance And Types Of Insurance List Networks Blog Conclusion. insurance is a vital tool for protecting yourself, your loved ones, and your assets from unexpected events. by understanding the basics of insurance, different policy types, and the claim process, you can make informed decisions about your coverage. remember to assess your needs, research policies, compare coverage and premiums, and. Learn more about insurance policy types, coverage options and tips for managing your policies in the references below. life insurance riders: everything you need to know: riders can be purchased separately to enhance your insurance policy. learn more about how life insurance riders can help you get more out of your coverage. Farm and ranch insurance provides coverage for household personal property (like clothes, furniture, and appliances) in your dwelling if you live on your farm or ranch, as well as the farm personal property (such as farm machinery, grain, livestock, and farm tools) that you use in your farming operations. learn about farm scheduling versus. A policy that guarantees income replacement is optimal. many policies pay 40% to 70% of your income. the cost of disability insurance is based on many factors, including age, lifestyle, and health.

Types Of Insureance Loan And Insurance Info Farm and ranch insurance provides coverage for household personal property (like clothes, furniture, and appliances) in your dwelling if you live on your farm or ranch, as well as the farm personal property (such as farm machinery, grain, livestock, and farm tools) that you use in your farming operations. learn about farm scheduling versus. A policy that guarantees income replacement is optimal. many policies pay 40% to 70% of your income. the cost of disability insurance is based on many factors, including age, lifestyle, and health.

Comments are closed.