Dti Ratio Nestapple Largest Commission Rebate Nyc

Debt To Income Ratios How To Calculate Dti 49 Off Most lenders want applicants with a 28 36 dti ratio combo or less. the lower your dti, the higher your chance of getting a mortgage amenable to you. between 37 to 49 percent, banks will consider your dti pretty rough. in this range, you might be able to get approved, but most lenders will consider you a risk. How much is required might surprise you. the average down payment in nyc is 20% of the purchase price. it’s possible to put down 10% or less on many condos in the city. most co op apartments have stricter financial requirements, which require a minimum of 20% down. condo buildings in nyc often have minimum financing requirements as well.

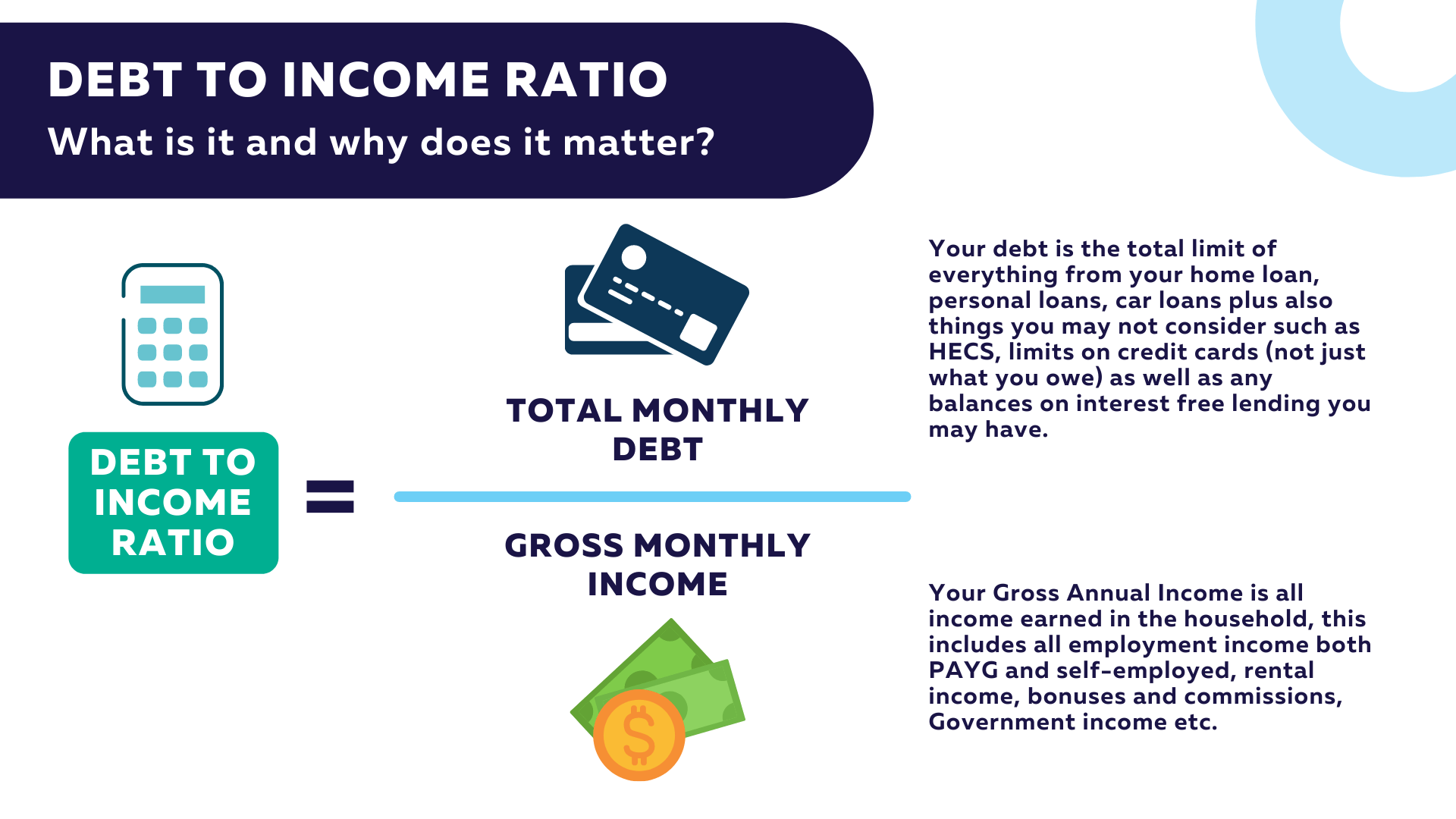

What Is Debt To Income Ratio Dti Rocket Mortgage At nestapple, we offer two thirds of our commission as a rebate if we collect a standard 3% fee from the listing broker (or listing agent) as part of the c0 broke. you will get a check for 2% of the purchase price. so, if you’re purchasing an nyc apartment for $1,000,000, you’d get a $20,000 rebate. We estimate that over $1 billion in nyc real estate sales will be brokered by agents who offer rebates in 2022 meaning that over $20 million will be rebated to buyers. new york real estate commissions are typically 6%, of which the buyer agent collects half. when you work with one of our experienced nyc buyer agent partners, you can get up to a. Specialties: created in 2017, nestapple is a full service real estate brokerage that saves clients up to 2% on the purchase price and sale transactions with our commission rebates and low listing fees. nestapple is paying its clients the commission that realtors usually keep for themselves. nestapple is a licensed brokerage with an efficient platform that assists clients in placing a bid. How to calculate your dti ratio in nyc. the dti ratio is calculated by dividing your total monthly debt payments by your gross income. here is the mathematical expression and steps for calculating your dti: dti = (total monthly debt payments monthly gross income) first, sum up your monthly debt payments.

Dti Ratio вђ Nestapple Largest Commission Rebate Nyc Specialties: created in 2017, nestapple is a full service real estate brokerage that saves clients up to 2% on the purchase price and sale transactions with our commission rebates and low listing fees. nestapple is paying its clients the commission that realtors usually keep for themselves. nestapple is a licensed brokerage with an efficient platform that assists clients in placing a bid. How to calculate your dti ratio in nyc. the dti ratio is calculated by dividing your total monthly debt payments by your gross income. here is the mathematical expression and steps for calculating your dti: dti = (total monthly debt payments monthly gross income) first, sum up your monthly debt payments. Debt to income ratio = 18.75%. what’s interesting about co ops is that each one has its own particular rules about how to calculate dti. for example, many co ops exclude ‘passive’ income for the purposes of computing your monthly income. other co ops will have rules for how you calculate the monthly mortgage payment used in the dti. At hauseit, we offer buyers the ability to save up to 2 percent and reduce buyer closing costs through the largest broker commission rebate in nyc. the buyer of a $2 million property in nyc can save $40,000, assuming that the buyer agent commission being offered is 3 percent. advanced debt to income ratio calculator including front end and back.

Comments are closed.