Finding The Best Consumer Credit Counseling Agency Kaiser Magazine

Finding The Best Consumer Credit Counseling Agency Kaiser Magazine Forbes advisor compared the top credit counseling services on the market today to find the best options for the largest number of consumers. we considered each organization’s variety of services. With that in mind, it’s a good idea to vet any potential credit counseling agency carefully. before you sign up with one, run its name by the national foundation for credit counseling and or the association of independent consumer credit counseling agencies. checking with your local branch of the better business bureau is a good idea too.

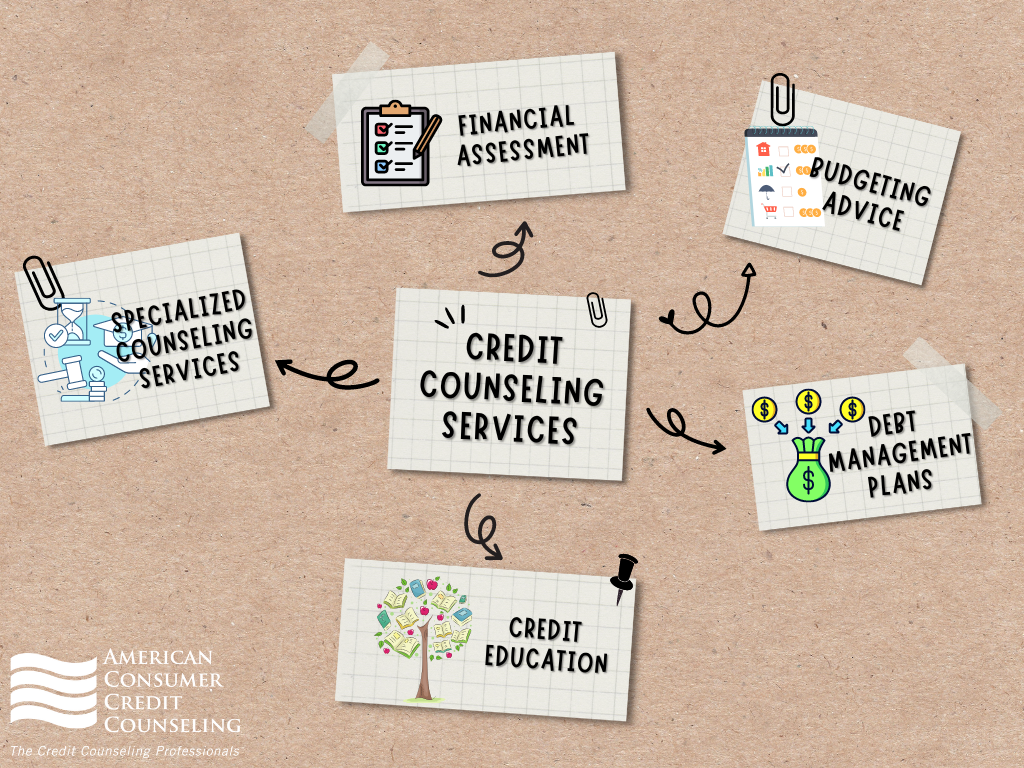

Find The Right Credit Counseling Agency To Work With How credit counseling works. credit counseling is designed to help you create a game plan for managing your finances. this involves having a credit counselor look over your finances and use their. Fee based services include debt management programs, bankruptcy counseling and education, housing (pre purchase, foreclosure prevention, reverse mortgage), and credit report review. dmp has a one time setup fee of $50 and monthly fees from $10 to $50 depending on your state. "a " rated and accredited by the bbb. Cambridge’s initial counseling sessions are free, and dmp fees will vary based on state of residence. the maximum enrollment fee is $75, and the maximum monthly fee is $50. on average, according. Cambridge credit counseling provides a dashboard where you can track the payments made on your behalf (if you’re working under a debt management plan) and other valuable information. fees for.

Consumer Credit Counseling Companies Choosing The Best Cambridge’s initial counseling sessions are free, and dmp fees will vary based on state of residence. the maximum enrollment fee is $75, and the maximum monthly fee is $50. on average, according. Cambridge credit counseling provides a dashboard where you can track the payments made on your behalf (if you’re working under a debt management plan) and other valuable information. fees for. If the front line counselor is honest and helpful, that culture is much more likely to be part of the agency itself. if you are looking to work with a consumer credit counseling service that has set itself apart from the others out there, call 888 317 8770. that call will put you in touch with a counselor at one of the top credit counseling. Monthly fee. $25 on average. overview. money management international is a nonprofit credit counseling agency founded in 1958 and provides debt relief services in all 50 states (although in person.

Consumer Credit Counseling What It Is How It Works If the front line counselor is honest and helpful, that culture is much more likely to be part of the agency itself. if you are looking to work with a consumer credit counseling service that has set itself apart from the others out there, call 888 317 8770. that call will put you in touch with a counselor at one of the top credit counseling. Monthly fee. $25 on average. overview. money management international is a nonprofit credit counseling agency founded in 1958 and provides debt relief services in all 50 states (although in person.

Comments are closed.