Flat Interest Rate Vs Reducing Balance Interest Rate Blog By Tic

Flat Interest Rate Vs Reducing Balance Interest Rate The formula for calculating interest under the reducing balance method is as follows: for example, if you take a loan of rs 5,00,000 at an interest rate of 15% for a period of five years, the emi here would be rs 11,895 per month. out of the total emi paid in the first year of rs 1,42,740, rs 72,596 is the principal amount repaid and rs 70,143. The difference is that you will have only paid a total of $2,183 over the life of the loan, of which $183 was for interest payments. the interest paid is 47.7% lower than the $350 you would have paid if it was a flat rate loan! flat rate vs reducing balance. completed .

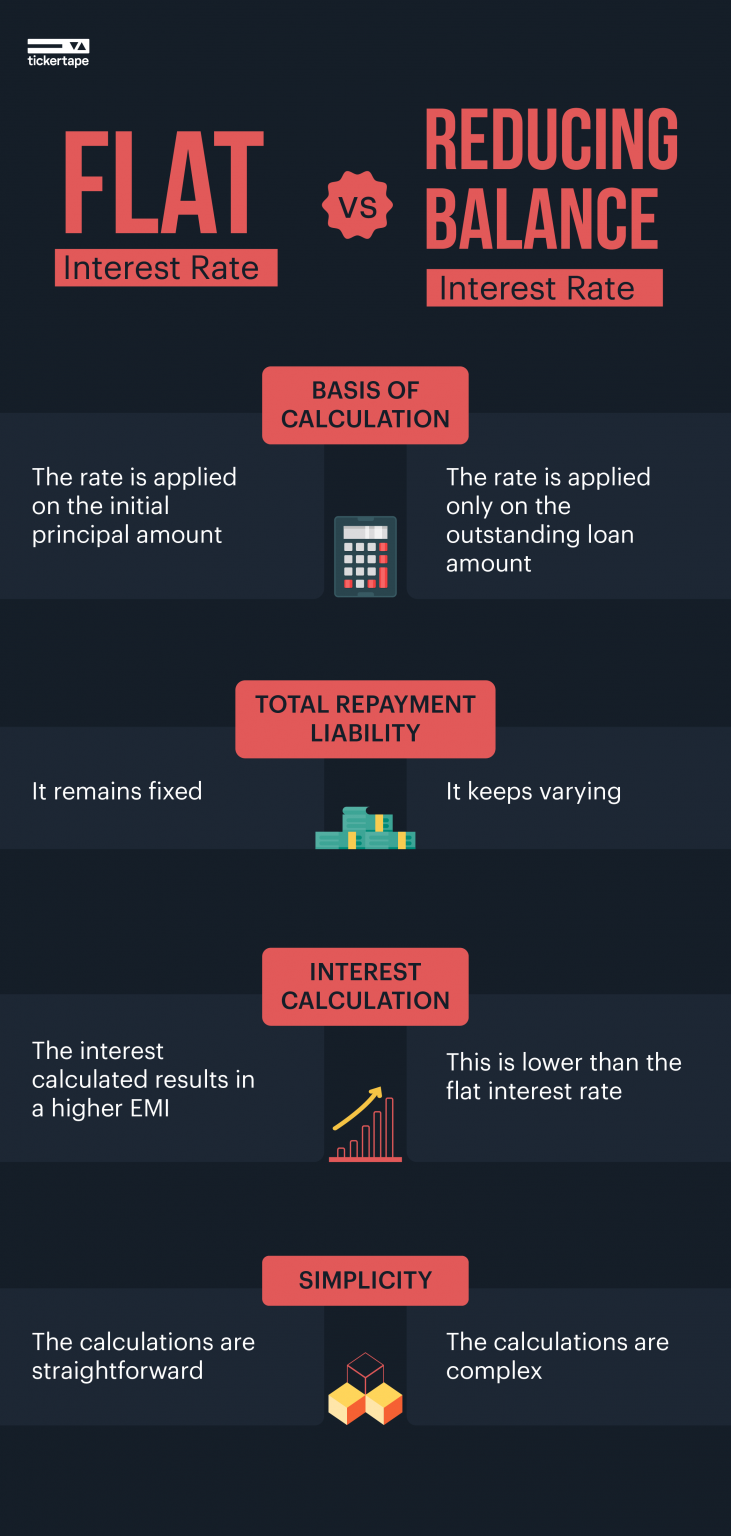

How To Calculate Flat Rate Interest And Reducing Balance Rate Flat interest rate vs reducing balance. Benefits of reducing balance interest rate. the main advantage of a reducing balance interest rate is that, over time, the applicant has to pay less interest compared to loans with flat interest rates. difference between flat interest rate and reducing balance interest rate: the loan's principal amount is used to calculate the flat rate of. A reducing interest rate personal loan bases this interest on a reducing principal balance, while a fixed or flat rate interest remains unchanged depending on the original principal balance. most lenders offer fixed rate loans, but to ensure you find a fixed rate personal loan that will work best for your situation, shop around and compare the. Flat interest rate vs. reducing rate of interest.

Flat Interest Rate Vs Reducing Rate Of Interest Understand A reducing interest rate personal loan bases this interest on a reducing principal balance, while a fixed or flat rate interest remains unchanged depending on the original principal balance. most lenders offer fixed rate loans, but to ensure you find a fixed rate personal loan that will work best for your situation, shop around and compare the. Flat interest rate vs. reducing rate of interest. Difference between flat and reducing interest rate. Flat interest rate = $10,000 * 10% * 5 years = $5,000. it means you will have to pay an total of $5,000 as a interest in the entire loan duration. and the interest in each instalment would be = $5000 60= $83.33 each month. flat rate interest are easy to understand and budget for.

Flat Interest Rate Vs Reducing Balance Interest Rate Difference between flat and reducing interest rate. Flat interest rate = $10,000 * 10% * 5 years = $5,000. it means you will have to pay an total of $5,000 as a interest in the entire loan duration. and the interest in each instalment would be = $5000 60= $83.33 each month. flat rate interest are easy to understand and budget for.

Comments are closed.