Forex Leverage Explained Youtube

What Is Leverage In Forex Risks You Should Know Learn the basics of leverage for forex trading. this video explains forex leverage in simple terms and is ideal for beginners. episode outline:0:00 episode s. Tmafx forex leverage is a great tool for beginners in forex trading to understand. in this video i will explain everything you need to know about.

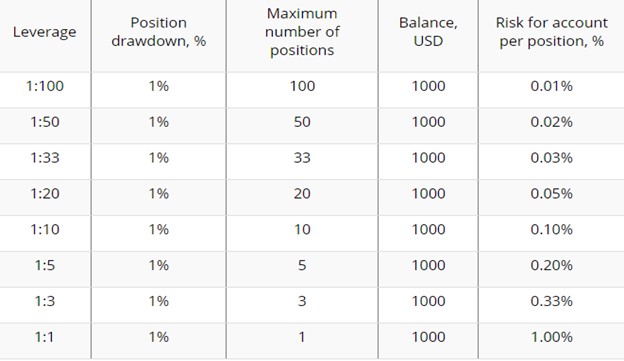

أفضل الرافعة المالية للمبتدئين في الفوركس إيجابيات وسلبيات Understanding forex leverage and margins can be tricky as a new forex trader. i personally got tired of buying houses every time i wanted to learn about leve. Forex leverage is a tool that allows traders to open positions that are significantly larger than their initial investment. it is expressed as a ratio, such as 1:50 or 1:100. for example, with a leverage ratio of 1:50, a trader can control a position that is 50 times larger than their capital. this means that for every $1 invested, they can. You have $1,000 in your account. multiply your capital by your leverage to get your “buying power”. you can take $100,000 worth of positions (100 x $1,000). if you have 50:1 leverage, you have $50,000 in buying power. just because you have this much buying power leverage doesn’t mean you need to use it. Leverage in forex trading is a mechanism that enables traders to control larger positions in the market with a smaller amount of capital. it is expressed as a ratio, such as 1:50 or 1:200, indicating how much capital a trader can control compared to the amount deposited in their trading account. for example, with a leverage ratio of 1:100, a.

Forex Leverage Explained Youtube You have $1,000 in your account. multiply your capital by your leverage to get your “buying power”. you can take $100,000 worth of positions (100 x $1,000). if you have 50:1 leverage, you have $50,000 in buying power. just because you have this much buying power leverage doesn’t mean you need to use it. Leverage in forex trading is a mechanism that enables traders to control larger positions in the market with a smaller amount of capital. it is expressed as a ratio, such as 1:50 or 1:200, indicating how much capital a trader can control compared to the amount deposited in their trading account. for example, with a leverage ratio of 1:100, a. Leverage & margin in forex explained. leverage works by letting traders enter into trades with only a fraction of the money down. in straight stock trading, traders have to pay for every dollar they invest. for example; if a trader buys $5,000 worth of stock xyz, they would then have to front up the whole $5,000 to buy those shares. Here’s the formula: margin based leverage = total transaction value required margin. let’s say you have a margin of 1% and wish to trade a standard lot of eur usd, which is $100,000. your.

Comments are closed.