Fraud Management In Customer Payments Digital Ordering Done Right

Fraud Management In Customer Payments Digital Ordering Done Right Digital adoption leapfrogged a decade in days during the covid 19 pandemic, accelerating the shift to digital and multichannel client service that began in the 2010s. the pandemic driven boost to e commerce is estimated to have exceeded $200 billion in 2020 and 2021. 1 april berthene, “coronavirus pandemic adds $219 billion to us ecommerce sales in 2020 2021,” digital commerce 360, march. Legacy approaches to fraud management have not kept pace with perpetrators. advanced analytics integrates data across silos, a means to automate and enhance expert knowledge, and the right tools to prevent, predict, detect, and remediate fraud. analytics is not an overnight fix, but it can pay immediate benefits while creating the foundation for anti fraud operating models of the future.

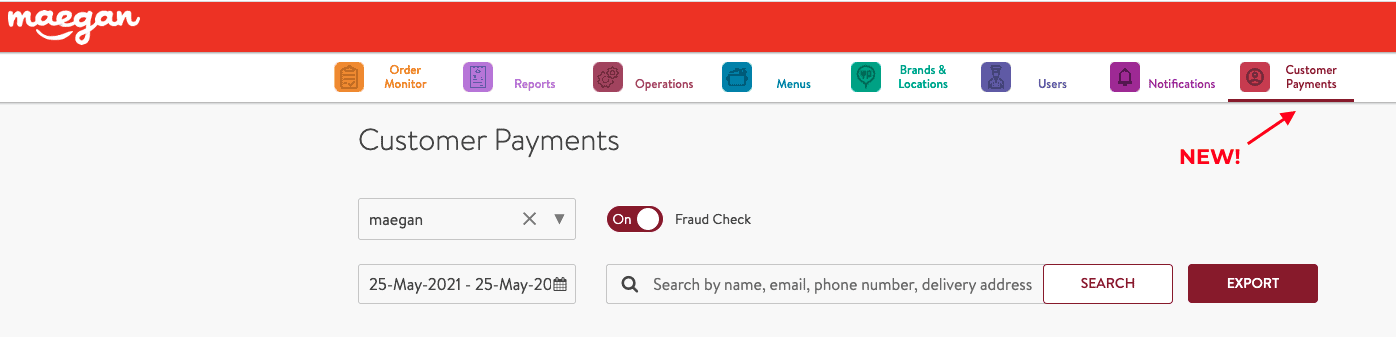

Payment Processing Fraud Management Services Pfs An integrated risk strategy to addressing payments fraud consists of four key elements: operational fraud: post authorization fraud management. transactional fraud: in authorization fraud management. customer service: fraud analysts to detect and report fraud through interactions in real time with customers. An institution should embed the objective to improve the customer experience throughout its processes for fraud prevention (such as authentication, onboarding, and fraud alerts) and fraud management. roles and responsibilities. it is important to have staff with the right fraud management skills, process knowledge, and analytic capabilities. Senior fraud and compliance professionals can refer to the following steps as a list of best practices to enhance their firm’s fraud risk management programs. 1. assess risk and vulnerabilities. first, compliance teams should conduct a comprehensive risk assessment to uncover potential areas of fraud. to do this effectively, there should be. Phishing is a type of payment fraud in which attackers use deceptive emails, text messages, or websites to trick individuals into providing sensitive information, such as login credentials, credit card numbers, and personal data. the fraudulent actors then use this information to commit unauthorised transactions or other forms of financial fraud.

The Fraud Prevention Checklist For Digital Goods Payments Free Checklist Senior fraud and compliance professionals can refer to the following steps as a list of best practices to enhance their firm’s fraud risk management programs. 1. assess risk and vulnerabilities. first, compliance teams should conduct a comprehensive risk assessment to uncover potential areas of fraud. to do this effectively, there should be. Phishing is a type of payment fraud in which attackers use deceptive emails, text messages, or websites to trick individuals into providing sensitive information, such as login credentials, credit card numbers, and personal data. the fraudulent actors then use this information to commit unauthorised transactions or other forms of financial fraud. Payment fraud can take the form of: fraudulent or unauthorized transactions. merchandise stolen or criminally removed, or. false requests for refunds and returns (also known as chargebacks). there are countless methods of committing payment fraud, including physical, in person attacks and digital fraud attacks. Fraud prevention is the process of preventing fraudulent activities from impacting the business, customer, or financial institution. to do this effectively, businesses need to maintain full control and reduce operational workload. this is done by combining risk rules with machine learning and manual reviews.

Comments are closed.