Frm Part 2 Hazard Rate Cfa Frm And Actuarial Exams Study Notes

Frm Part 2 Hazard Rate Calculation Cfa Frm And Actuaria Frm part 2 hazard rate cfa, frm, and actuarial exams study notes. save 10%on all analystprep 2024 study packages with coupon code blog10. payment plans. product list. partnerships. Risk identification. 21 aug 2023. after completing this reading, you should be able to: compare different top down and bottom up approaches and tools for identifying operational risks. describe best practices in the process of scenario analysis for operational risk. describe and apply an operational risk taxonomy and give examples of different.

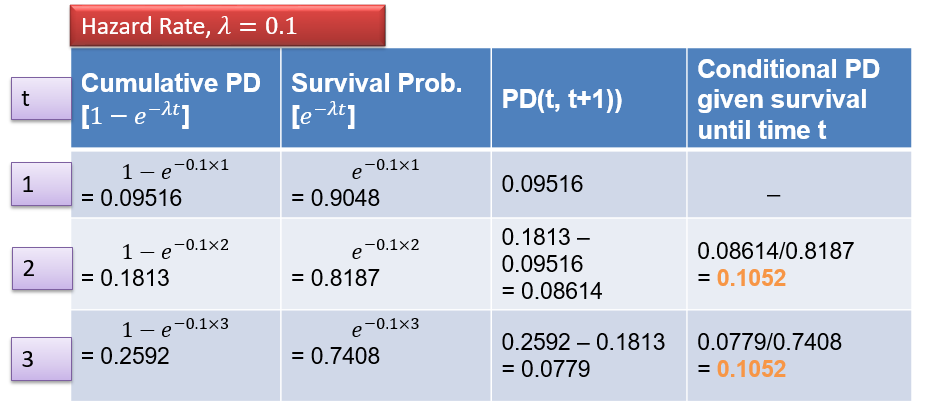

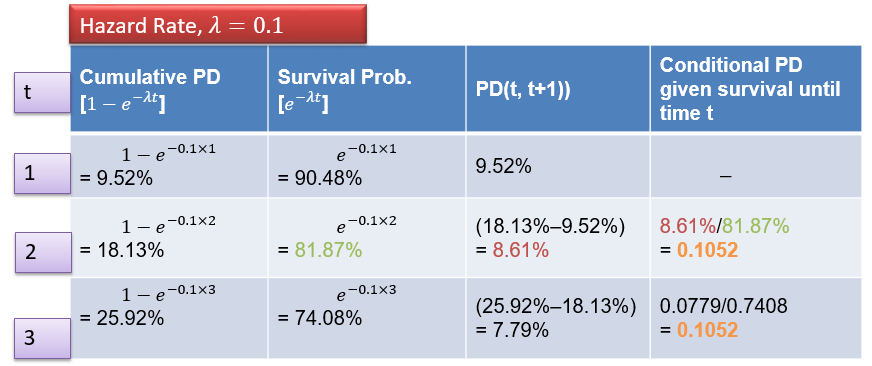

Frm Part 2 Hazard Rate Cfa Frm And Actuarial Exams Study Notes Frm part ii market risk measurement and management. 1. estimating market risk measures 2. non parametric approaches 3. parametric approaches (ii): extreme value 4. backtesting var 5. var mapping 6. messages from the academic literature on risk management for the trading book 7. some correlation basics: properties, motivation, terminology 8. In this short video from frm part 2 (credit risk section), we explore the various interpretations of the hazard rate default intensity a construct that w. Frm exam part ii study modules. 1. analyzing market risk and correlation risk. (p 1 16) kevin dowd, measuring market risk, 2nd edition (west sussex, england: john wiley & sons, 2005). chapter 3. estimating market risk measures: an introduction and overview. (p 17 34) kevin dowd, measuring market risk, 2nd edition (west sussex, england: john. What kaplan schweser customers say. explore kaplan schweser's frm part 2 study materials. find the right study tools for your learning style now.

Comments are closed.