Government Announces New Nssf Contribution Rates 2024 News Daily

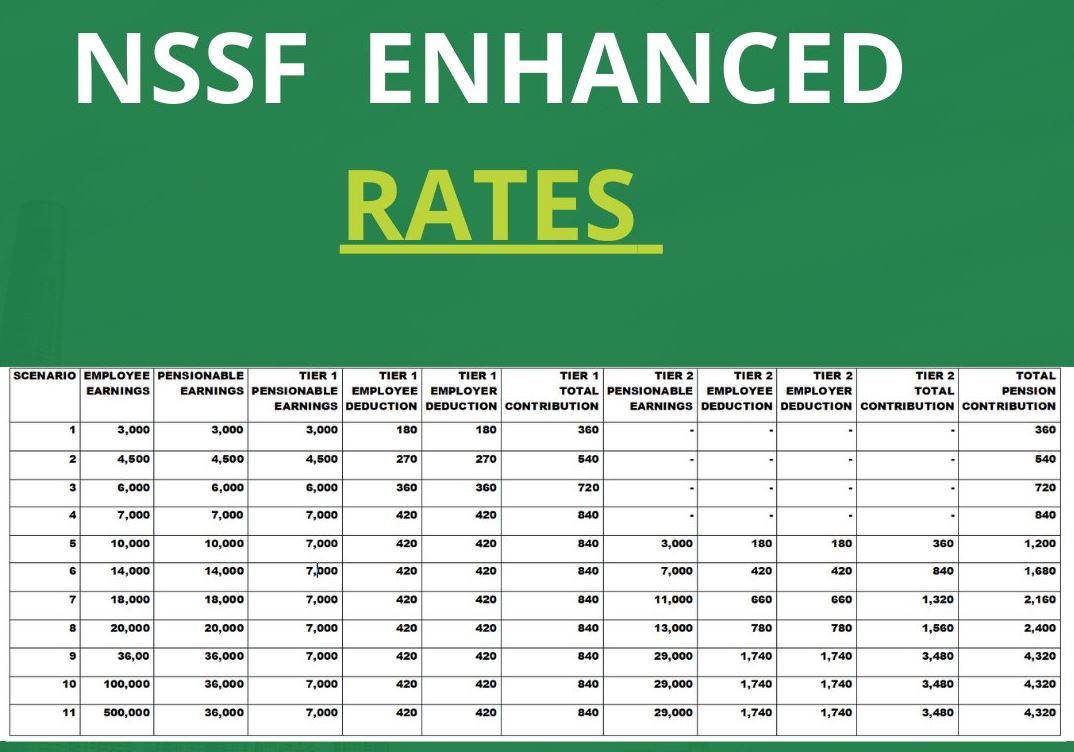

Government Announces New Nssf Contribution Rates 2024 в News Daily A worker earning more than sh18,000 per month could contribute a maximum of sh2,160. the bulk of kenyans would suffer, according to fred okango, the secretary for political affairs at kanu. government announces new nssf contribution rates 2024. raining rates, according to okango, would push people from a state of self sufficiency into poverty. The kenyan government made several changes to national social security fund (nssf) rates in february 2024, including: lower earnings limit: increased from kes 6,000 to kes 7,000. upper earnings limit: increased from kes 18,000 to kes 36,000. monthly contribution: increased by 6% per employee. employer matching: employers must match employee.

New Nssf Rates 2024 For Tier I And Tier Ii Contributions Deadlines Kenyans protest govt plans to raise nssf rates effective february 2024: "increase salaries first". national social security fund (nssf) act 2013 implementations which started in february 2023 comes to an end this month as government plans to announce new rates. kenyans face more payslip deductions as new nssf rates set to take effect. The nssf recently issued a notice to employers detailing adjustments being made in the second year of implementation of the revised tier 1 and tier 2 nssf contributions. effective february 2024, the lower earnings limit will increase from kes 6,000 to kes 7,000. simultaneously, the upper earnings limit will increase from kes 18,000 to kes 36,000. Overview of new nssf rates understanding the new nssf contribution structure. the national social security fund (nssf) has revised its contribution rates in a significant policy shift. starting february 2023, the nssf contribution rate was 12% of pensionable wages. this amount is equally shared between the employer and the employee, with each. Notice to employers on the updated nssf rates.

New Nssf Contribution Rates 2024 Effective February 2024 Nangmak Overview of new nssf rates understanding the new nssf contribution structure. the national social security fund (nssf) has revised its contribution rates in a significant policy shift. starting february 2023, the nssf contribution rate was 12% of pensionable wages. this amount is equally shared between the employer and the employee, with each. Notice to employers on the updated nssf rates. Facts about the new nssf rates. For example, individuals earning ksh 50,000 per month will now contribute around ksh 3,000, a 6% deduction of their monthly income. this rate is matched by an equivalent employer contribution, cumulatively amounting to a 12% monthly contribution towards the nssf . new nssf contributions in kenya (effective february 2024).

Nssf Announces New Employer Contribution Structure For 2024 To Bolster Facts about the new nssf rates. For example, individuals earning ksh 50,000 per month will now contribute around ksh 3,000, a 6% deduction of their monthly income. this rate is matched by an equivalent employer contribution, cumulatively amounting to a 12% monthly contribution towards the nssf . new nssf contributions in kenya (effective february 2024).

Nssf New Contribution Rates For Employed Individuals Kenyayote

Comments are closed.