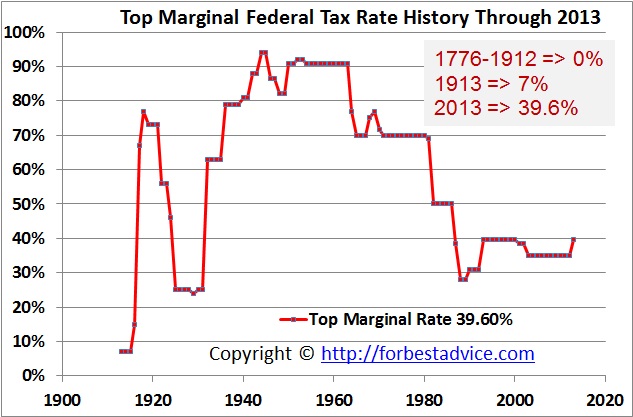

Historical Chart Of Income Tax Rates

Data Driven Viewpoints A 99 Year History Of Tax Rates In America 90.0%. >. $300,000. explore historical income tax rates and brackets, 1862 2021. compare historical federal income tax rates and historical federal tax rates. Federal individual income tax rates history nominal dollars income years 1913 2013 nominal married filing jointly married filing separately single head of household.

Taxing The Rich The Evolution Of Americaтащs Marginal юааincomeюаб юааtaxюаб юааrateюаб The highest income tax rate was lowered to 37 percent for tax years beginning in 2018. the additional 3.8 percent is still applicable, making the maximum federal income tax rate 40.8 percent. what this means for you . this history is important because it shows that the tax law is always changing. Historical highest marginal income tax rates. 1913 to 2023. download toprate historical.pdf (31.55 kb) download toprate historical.xlsx (12.48 kb) may 11, 2023. Appendix to selected historical and other data tables. data presented. tax years. table. u.s. individual income tax: personal exemptions and lowest and highest bracket tax rates, and tax base for regular tax. 1913 2018. table 23 xls. page last reviewed or updated: 24 apr 2024. our agency. Your average tax rate is the percentage of your overall income that you pay in taxes. say your taxable income is $50,000 and you owe $6,000 of that money in taxes to the u.s. government. your average tax rate would be 12% ($6,000 divided by $50,000 works out to .12, or 12%).

Historical Highest Marginal Income Tax Rates Tax Policy Center Appendix to selected historical and other data tables. data presented. tax years. table. u.s. individual income tax: personal exemptions and lowest and highest bracket tax rates, and tax base for regular tax. 1913 2018. table 23 xls. page last reviewed or updated: 24 apr 2024. our agency. Your average tax rate is the percentage of your overall income that you pay in taxes. say your taxable income is $50,000 and you owe $6,000 of that money in taxes to the u.s. government. your average tax rate would be 12% ($6,000 divided by $50,000 works out to .12, or 12%). The us uses a system of graduated income taxes. everyone’s first $8,700 is taxed at 10%, your next $26,649 is taxed at 15%, and so on up to $388,350, at which point every additional dollar. The lowest rate for 1932 is, therefore, shown as 4 percent (the lower of the two normal tax rates) and the highest rate as 63 percent (the sum of the 8 percent higher, graduated rate for normal tax on income over $4,000, plus 55 percent, the highest of the graduated, surtax rates, on income over $1 million.).

Us Top Marginal Tax Rates Data The us uses a system of graduated income taxes. everyone’s first $8,700 is taxed at 10%, your next $26,649 is taxed at 15%, and so on up to $388,350, at which point every additional dollar. The lowest rate for 1932 is, therefore, shown as 4 percent (the lower of the two normal tax rates) and the highest rate as 63 percent (the sum of the 8 percent higher, graduated rate for normal tax on income over $4,000, plus 55 percent, the highest of the graduated, surtax rates, on income over $1 million.).

Comments are closed.