Honasa Consumer Ipo Review Date Price Gmp Ipo Gyan

Honasa Consumer Ipo Review Gmp Price Details More Honasa consumer ipo review, date, price, gmp october 25, 2023 october 29, 2023 ipo gyan no comments honasa consumer incorporated in 2016 is the leading beauty and personal care company in india when it comes to revenue for the financial year 2022. Honasa consumer ipo review (may apply) review by dilip davda on october 27, 2023. • hcl is a speedily growing online beauty and personal care product marketing company. • it has posted speedy growth in its top lines with over 65% ebitda margins. • based on fy24 annualized earnings, the issue appears aggressively priced.

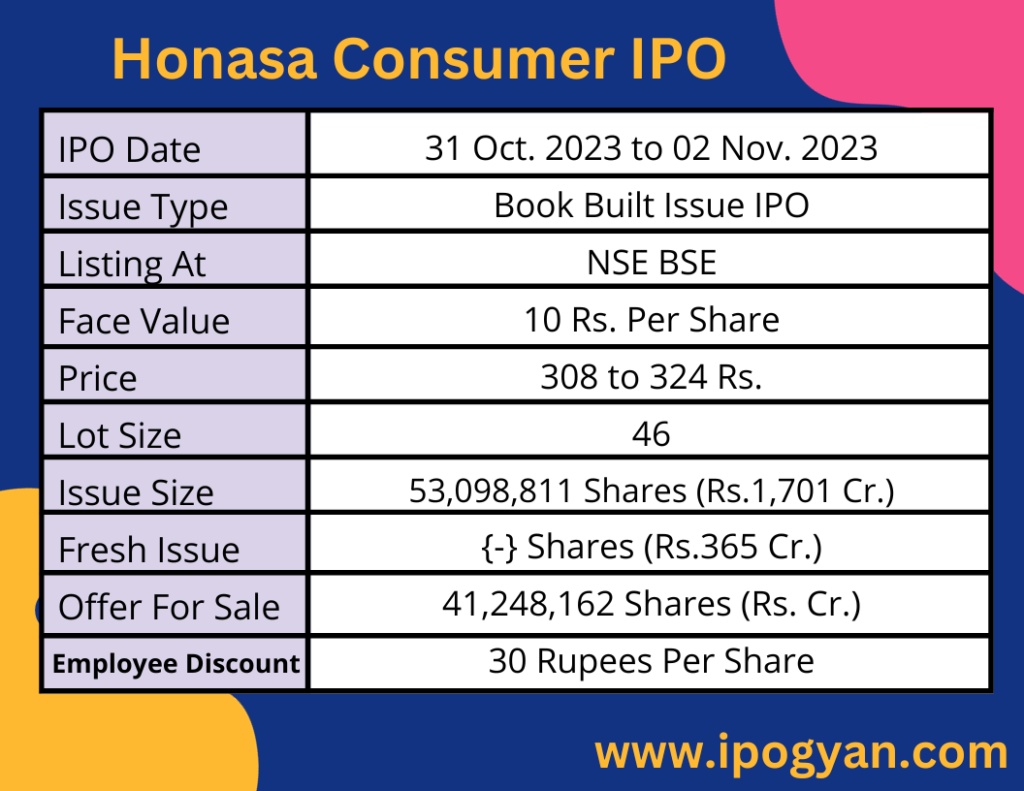

Honasa Consumer Ipo Review Date Price Gmp Ipo Gyan Honasa consumer ipo: get honasa consumer ipo date, subscription rate, lot size, listing date, allotment status, review, share price, analysis, grey market premium, gmp and more on moneycontrol. The ipo page of honasa consumer ltd. captures the details on its issue open date, issue close date, listing date, face value, price band, issue size, issue type, and listing date's open price, high price, low price, close price and volume. it also captures the holding period returns and annual returns. Here we list out important honasa consumer ipo details: 1] mamaearth ipo gmp: shares of the honasa consumer limited are available at a premium of ₹ 10 in grey market today. 2] mamaearth ipo. Honasa consumer ipo review – gmp. as of october 30th october 2023, the ipo for honasa consumer is set at a price band of ₹308 ₹324 per share. the latest grey market price stands at ₹7. the ipo is projected to list at a premium of 2.16%, with an estimated listing price of ₹331.

Ipo Honasa Consumer Ipo Mamaearth To List At Premium Over Rs 308 324 Here we list out important honasa consumer ipo details: 1] mamaearth ipo gmp: shares of the honasa consumer limited are available at a premium of ₹ 10 in grey market today. 2] mamaearth ipo. Honasa consumer ipo review – gmp. as of october 30th october 2023, the ipo for honasa consumer is set at a price band of ₹308 ₹324 per share. the latest grey market price stands at ₹7. the ipo is projected to list at a premium of 2.16%, with an estimated listing price of ₹331. Ipo review of honasa consumer limited aka mamaearth, dated october 30, 2023. this note provides detailed insights into the ipo, including financial data, strategic insights, operational highlights, and future outlooks. below is a comprehensive summary of each aspect of the business. ipo snapshot. issue open dates: october 31 to november 02. The largest digital first beauty and personal care company honasa consumer ipo (mamaearth ipo) will be hit the market 31 october 2023 and closes on 02 november 2023. the company has filed the rhp of this ipo. according to rhp, the company wants to raise ₹1701.00 crore through ipo. the company will issue fresh shares of ₹365 crores through.

Honasa Consumer Ipo Review Date Price Gmp Ipo Gyan Ipo review of honasa consumer limited aka mamaearth, dated october 30, 2023. this note provides detailed insights into the ipo, including financial data, strategic insights, operational highlights, and future outlooks. below is a comprehensive summary of each aspect of the business. ipo snapshot. issue open dates: october 31 to november 02. The largest digital first beauty and personal care company honasa consumer ipo (mamaearth ipo) will be hit the market 31 october 2023 and closes on 02 november 2023. the company has filed the rhp of this ipo. according to rhp, the company wants to raise ₹1701.00 crore through ipo. the company will issue fresh shares of ₹365 crores through.

Comments are closed.