How Does The Electronic Fund Transfer Act Protect Consumers

Ppt Financial Law Powerpoint Presentation Free Download Id 5868514 The questions and answers below pertain to compliance with the electronic fund transfer act (efta) and regulation e. this is a compliance aid issued by the consumer financial protection bureau. the bureau published a policy statement on compliance aids, available here, that explains the bureau’s approach to compliance aids. In 1979, the electronic fund transfer act (efta), also known as regulation e, was implemented to protect consumers when they use electronic means to manage their finances. electronic fund transfers are defined as transactions that use computers, phones or magnetic strips to authorize a financial institution to credit or debit a customer’s.

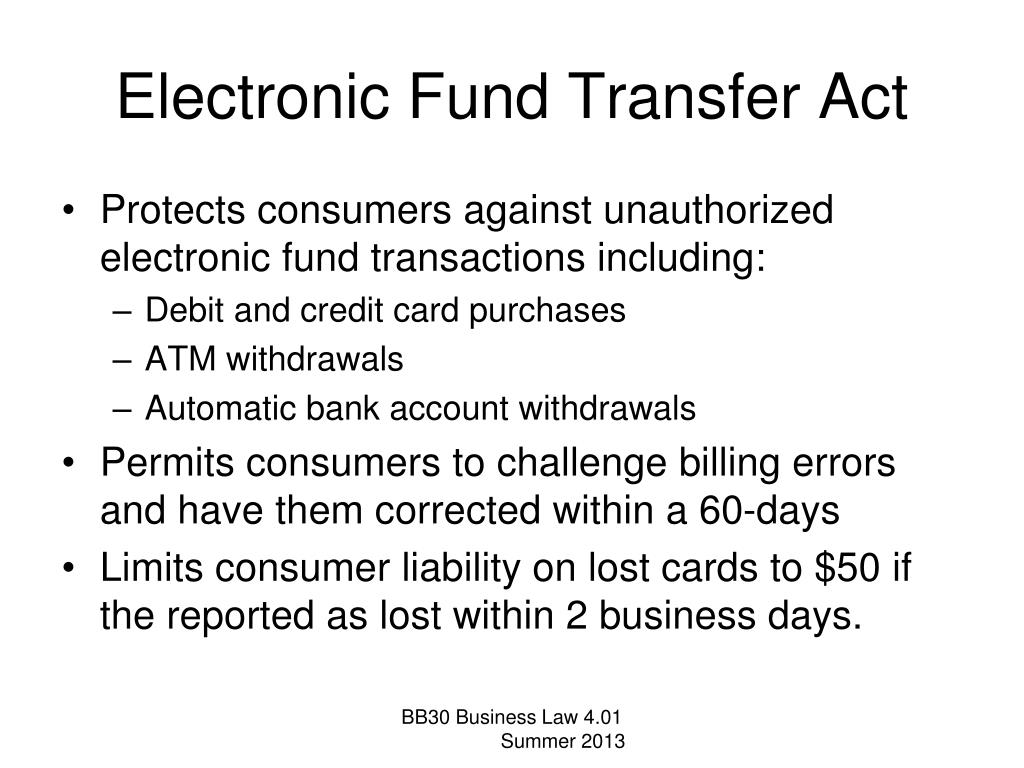

What Is The Purpose Of The Electronic Fund Transfer Act Electronic funds transfer act: a federal law that protects consumers engaged in the transfer of funds through electronic methods. this includes the use of debit cards, automated teller machines. The electronic fund transfer act (efta), sometimes referred to as regulation e or reg e, is a federal law that provides some guardrails for consumers against fraud and account errors. This act (title ix of the consumer credit protection act) establishes the rights, liabilities and responsibilities of participants in electronic fund transfer systems. Browse the electronic fund transfer final rules to see specific amendments to regulation e. regulations and official interpretations. browse regulation e (12 cfr 1005) on: interactive bureau regulations | ecfr. main electronic fund transfers provisions and official interpretations can be found in: §§ 1005.2, and 1005.3, scope and key definitions.

A юааconsumerюабтащs Guide To юааthe Electronicюаб юааfundsюаб юааtransferюаб юааactюаб Schlanger La This act (title ix of the consumer credit protection act) establishes the rights, liabilities and responsibilities of participants in electronic fund transfer systems. Browse the electronic fund transfer final rules to see specific amendments to regulation e. regulations and official interpretations. browse regulation e (12 cfr 1005) on: interactive bureau regulations | ecfr. main electronic fund transfers provisions and official interpretations can be found in: §§ 1005.2, and 1005.3, scope and key definitions. The term “electronic fund transfer” or “eft” means any transfer of funds that is initiated through an electronic terminal, telephone, computer, or magnetic tape for the purpose of ordering, instructing, or authorizing a financial institution to debit or credit a consumer's account. 12 cfr 1005.3(b)(1). The electronic funds transfer act (efta), also known as regulation e, created protections for consumers using certain electronic banking and financial services such as debit card transactions, electronic withdrawals, transfers, and deposits. after the transition from physical checks to electronic monetary transfers, congress enacted the efta in.

Disputes And The Electronic Funds Transfer Act The term “electronic fund transfer” or “eft” means any transfer of funds that is initiated through an electronic terminal, telephone, computer, or magnetic tape for the purpose of ordering, instructing, or authorizing a financial institution to debit or credit a consumer's account. 12 cfr 1005.3(b)(1). The electronic funds transfer act (efta), also known as regulation e, created protections for consumers using certain electronic banking and financial services such as debit card transactions, electronic withdrawals, transfers, and deposits. after the transition from physical checks to electronic monetary transfers, congress enacted the efta in.

Comments are closed.