How Much Consumer Debt In Us

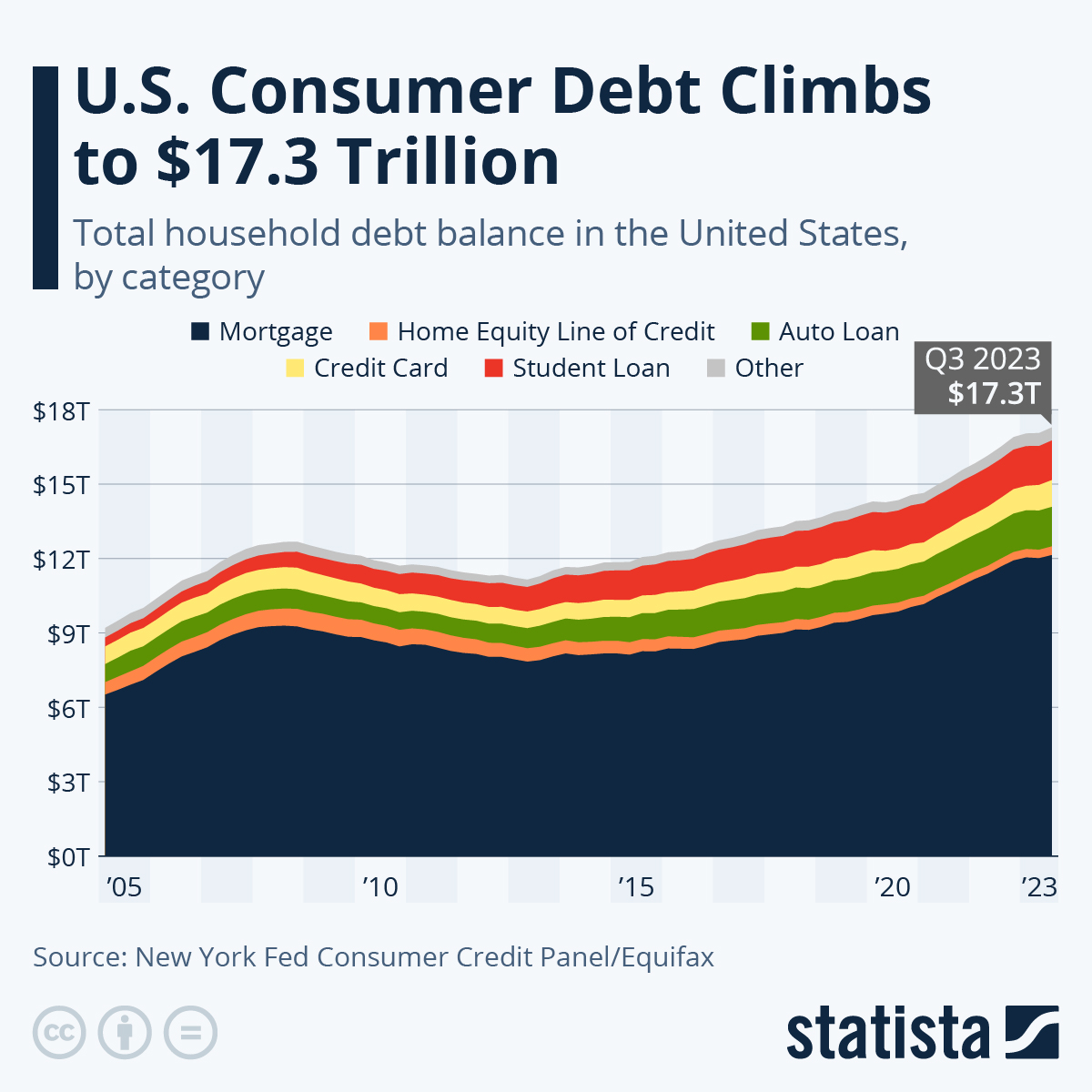

Chart U S Consumer Debt Climbs To 17 3 Trillion Statista Total household debt rose by $109 billion to reach $17.80 trillion, according to the latest quarterly report on household debt and credit. mortgage balances were up $77 billion to reach $12.52 trillion, while auto loans increased by $10 billion to reach $1.63 trillion and credit card balances increased by $27 billion to reach $1.14 trillion. Record high debt: american households carry $17.796 trillion in debt as of q2 2024, averaging $104,215 per household. mortgage dominates debt: mortgage debt comprises 70% of total household debt.

Consumer Debt Trends Penn Mutual Asset Management This chart shows the total household debt balance in the united states. looking at total consumer debt, 97 percent of the total balance was current or non delinquent (i.e. all payments made on. Average household debt in 2023. as of the third quarter of 2022, the average american held $101,915 in debt, according to experian. keep in mind that while this number might seem staggering, it. Data from experian breaks down the average debt a consumer holds based on type, age, credit score, and state. note: total household debt in the us is $17.987 trillion as of the first quarter. Consumers in the united states owed $17.1 trillion in total debt as of the third quarter (q3) of 2023, according to experian data. much of that debt is secured by assets: for instance, the $11 trillion u.s. homeowners owe primarily on their residences is secured by real estate that has collectively appreciated in value by a similar amount in just the past two years, according to federal.

Charting 17 Years Of American Household Debt Data from experian breaks down the average debt a consumer holds based on type, age, credit score, and state. note: total household debt in the us is $17.987 trillion as of the first quarter. Consumers in the united states owed $17.1 trillion in total debt as of the third quarter (q3) of 2023, according to experian data. much of that debt is secured by assets: for instance, the $11 trillion u.s. homeowners owe primarily on their residences is secured by real estate that has collectively appreciated in value by a similar amount in just the past two years, according to federal. The report shows total household debt increased by $109 billion (0.6%) in q2 2024, to $17.80 trillion. the report is based on data from the new york fed’s nationally representative consumer credit panel. it includes a one page summary of key takeaways and their supporting data points. The report shows total household debt increased by $184 billion (1.1%) in the first quarter of 2024, to $17.69 trillion. the report is based on data from the new york fed’s nationally representative consumer credit panel .

Comments are closed.