How Much Does A Roth Ira Grow In 10 Years Ira Vs 401k

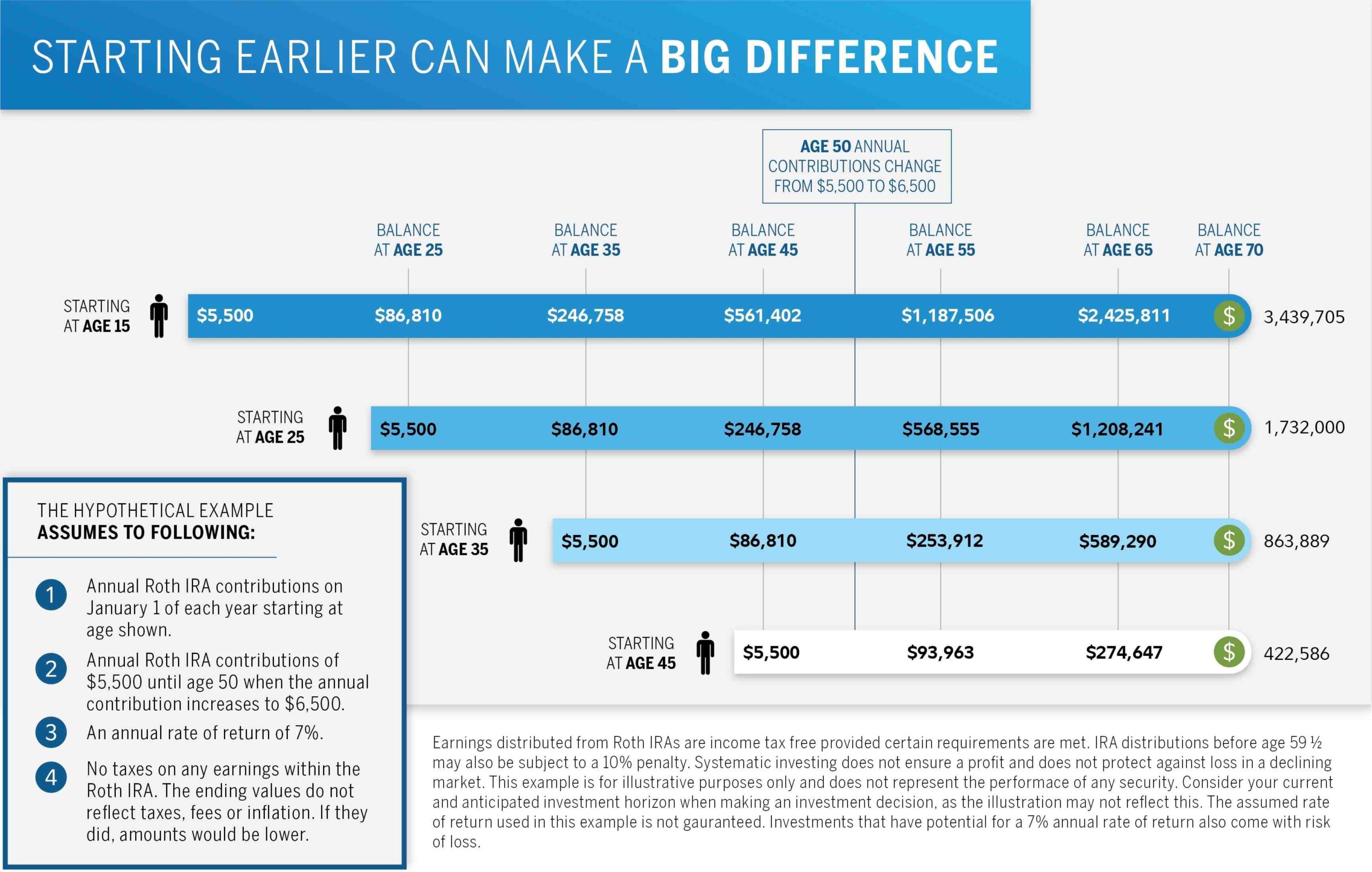

How Much Does A Roth Ira Grow In 10 Years Ira Vs 401k The amount you can contribute to a roth ira depends on your annual income. the roth ira contribution limit for 2024 is $7,000 in 2024 ($8,000 if age 50 or older). at certain incomes, the. The amount of growth that your account generates can increase each year because of the magic of compound interest. here’s an example: assume that you contribute $3,000 to your roth ira each year.

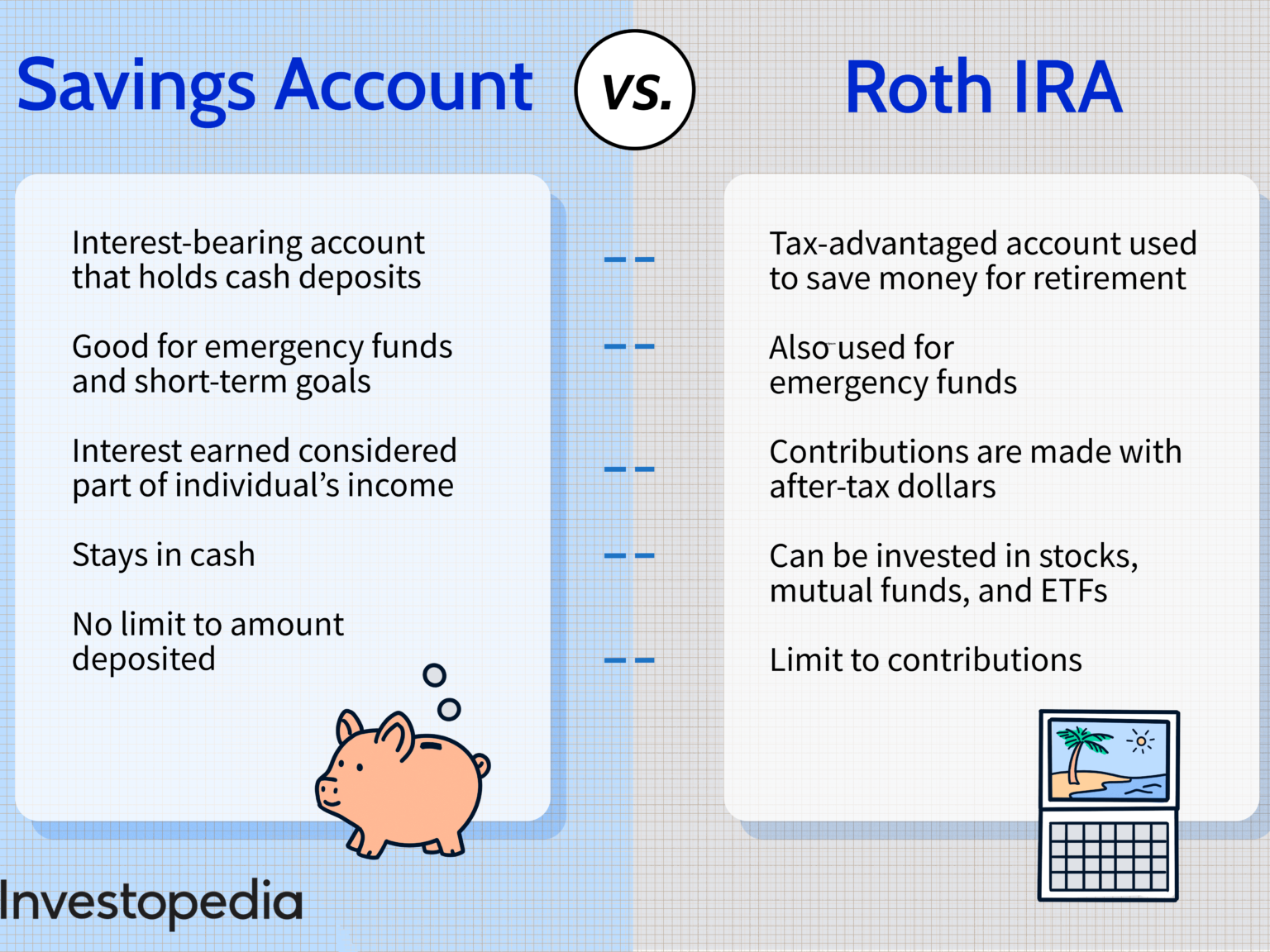

How Much Does A Roth Ira Grow In 10 Years Ira Vs 401k Unlike taxable investment accounts, you can’t put an unlimited amount of money into a roth ira. currently, you can save a maximum of $6,000 a year, or $7,000 if you’re 50 or older, in your. How a roth ira grows over time. Roth 401(k) vs. roth ira: which is right for you?. Keep in mind that while there are no income limitations to contribute to a traditional ira, you are not eligible for a roth ira if your income level is too high. learn more about the differences between a roth vs. traditional ira, or call us at 866 855 5635 for help.

Roth 401 K Vs Roth Ira What S The Difference District Capital Roth 401(k) vs. roth ira: which is right for you?. Keep in mind that while there are no income limitations to contribute to a traditional ira, you are not eligible for a roth ira if your income level is too high. learn more about the differences between a roth vs. traditional ira, or call us at 866 855 5635 for help. Roth ira growth calculator. our roth ira growth calculator provides you a simple way to see how much your roth ira will grow based on your contributions and your expected growth rate. for more assistance with the calculator see the help guide below. this calculator is designed to estimate the balance of an individual retirement account (ira) at. The roth ira annual contribution limit is $7,000 in 2024 ($8,000 if age 50 or older). if you open a roth ira and fund it with $7,000 each year for 10 years, and your investments earn 6% annually.

Comments are closed.