How To Calculate Startup Valuation Part One Dealum Blog

How To Calculate Startup Valuation Part One в Dealum Blog The method is based on multiplying any underlying metric, such as ebitda, revenue, number of users, number of square hectares of terrain where we can grow crops for an agricultural business, number of employees etc. the multiple itself is generally calculated as the average or median of multiples of similar companies. French business angel networks move startup deal flow to dealum. dealum is now the investment process management platform for france angels, one of the leading national networks federation in europe for business angels and early stage investors. this is the first nationwide adoption of dealum, onboarding 64 angel investor groups to the platform.

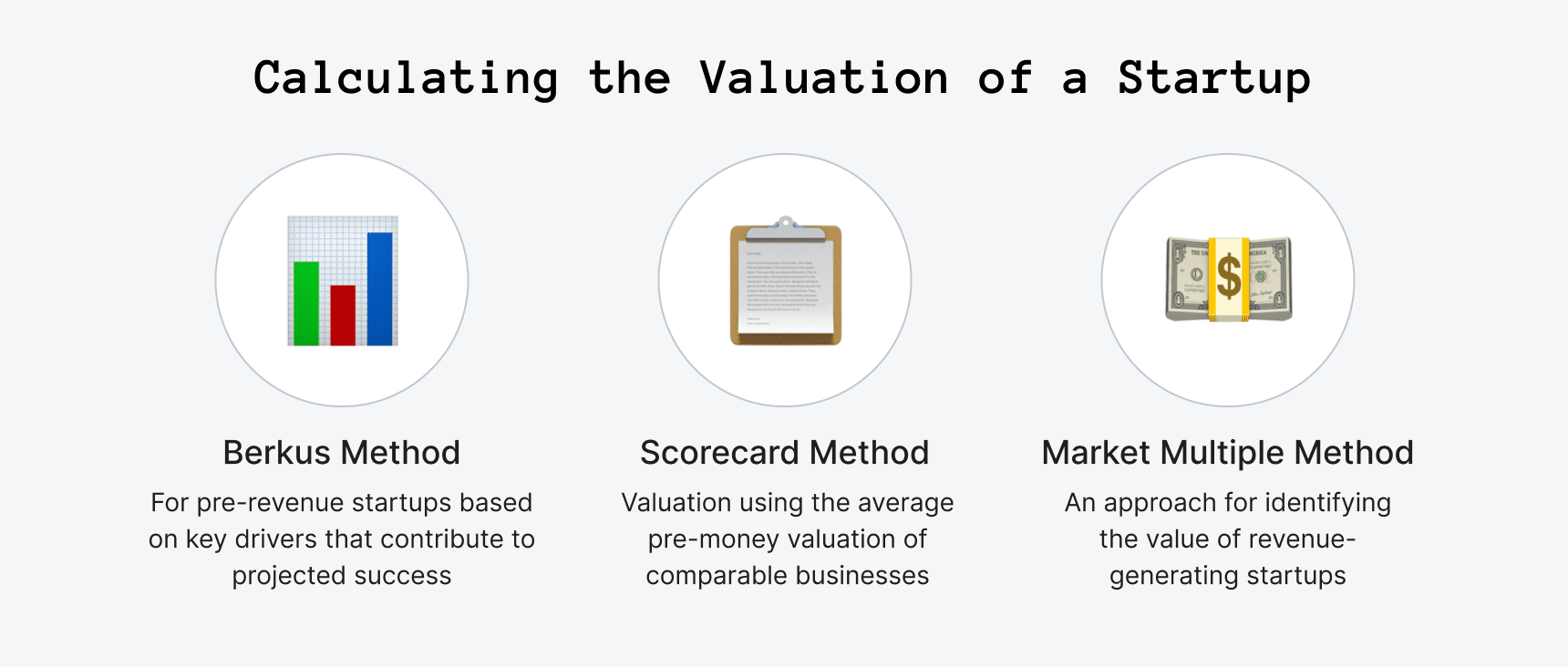

How To Calculate Startup Valuation Part One в Dealum Blog How to calculate startup valuation? in april, we celebrated dealum’s fifth anniversary with a series of webinars together with equidam. now we have prepared a summary of the core principles and methods of the startup valuation based on what was spoken at the webinar. This free webinar was part two of the series for all startup angel investors and investment group managers who want to learn more about startup valuation. enjoy the recording to learn more about valuation specifically through the lens of early stage investors, and how it can be addressed by business angel networks. the webinar topics include. Step 1: verifiable characteristics. start with the basics: focus on qualitative traits, especially in the early stages. assess the team’s expertise, market traction, product uniqueness, and competitive positioning. use comparative methods: apply methods like the scorecard and checklist to benchmark your startup against peers or industry. Open an account. 5. risk factor summation method. this is a broader method of valuing your startup. start with an initial valuation based on one of the other methods mentioned here. then, increase or decrease that monetary value in multiples of $250,000 based on risks affecting your business.

What Is Startup Valuation And How To Calculate It Step 1: verifiable characteristics. start with the basics: focus on qualitative traits, especially in the early stages. assess the team’s expertise, market traction, product uniqueness, and competitive positioning. use comparative methods: apply methods like the scorecard and checklist to benchmark your startup against peers or industry. Open an account. 5. risk factor summation method. this is a broader method of valuing your startup. start with an initial valuation based on one of the other methods mentioned here. then, increase or decrease that monetary value in multiples of $250,000 based on risks affecting your business. The post money valuation can be determined by adding the pre money valuation and the investment with the formula below. post money valuation = pre money valuation investment. startup valuation is both an art and a science. in this guide, we break down how to value a startup, as well as why it’s important. An investor decides to invest $1 million in exchange for 100 shares of stock. the company value before the investment is $10 million and the post money value is $11 million. to lower risk, investors will put money into a startup over later rounds of investing instead of all at once. this invest as you go model is common.

Comments are closed.