How To Calculate The Total Return On A Stock Explanation Overview

Total Return Formula How To Calculate Total Return Examples How to calculate total stock returns. Example of total return. an investor buys 100 shares of stock a at $20 per share for an initial value of $2,000. stock a pays a 5% dividend the investor reinvests, buying five additional shares.

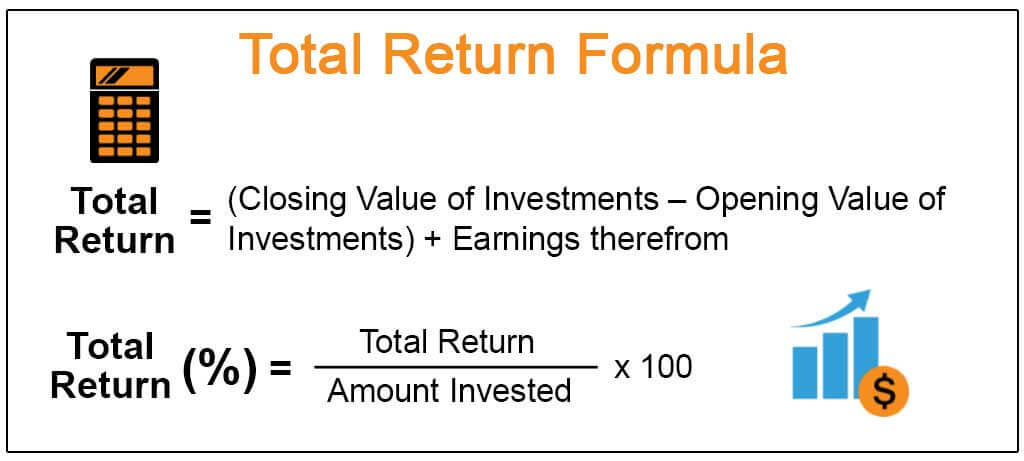

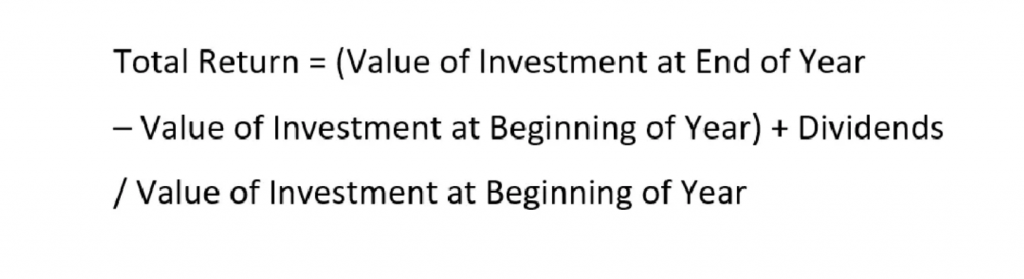

How To Calculate The Total Return On A Stock Explanation Overview Take the percentage total return you found in the previous step (written as a decimal) and add 1. then, raise this to the power of 1 divided by the number of years you held the investment. finally. The total return formula is a calculation used to measure an investment’s overall performance, considering both capital appreciation (or depreciation) and income generated by the asset. the formula for calculating total return is total return = (ending value – beginning value dividends or interest) beginning value * 100. Annualized return = (final value of investment initial value of investment)1 n 1. first, calculate the initial and final value of the investment and then apply it to the formula. initial value of investment = $14 * 150 = $2,100. cash received as dividends over two year period = $2.50 * 150 * 4 = $1,500. Understanding total shareholder return (tsr) an investor makes money from stock in two basic ways: capital gains and current income. a capital gain is a change in the market price of the stock.

How To Calculate Stock Return 4 Most Common Stock Return Formulas Annualized return = (final value of investment initial value of investment)1 n 1. first, calculate the initial and final value of the investment and then apply it to the formula. initial value of investment = $14 * 150 = $2,100. cash received as dividends over two year period = $2.50 * 150 * 4 = $1,500. Understanding total shareholder return (tsr) an investor makes money from stock in two basic ways: capital gains and current income. a capital gain is a change in the market price of the stock. Here’s the basic total return formula: total return = [ (current value – cost basis distributions) cost basis] x 100. let’s say you bought 10 shares of company xyz, valued at $100 a. Total return provides a holistic view of an investment's performance, allowing investors to evaluate the true growth of their portfolios and make strategic choices based on their goals and risk tolerance. the main components of total return are capital gains, dividends, and interest income. by understanding these components, investors can.

Comments are closed.