How To Estimate Your Personal Income Taxes

How To Estimate Your Personal Income Taxes Youtube Age: enter the age you were on jan. 1, 2024. your age can have an effect on certain tax rules or deductions. for example, people aged 65 or older get a higher standard deduction. 401 (k. The tax withholding estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers. we don't save or record the information you enter in the estimator. for details on how to protect yourself from scams, see tax scams consumer alerts. check your w 4 tax withholding with the irs tax.

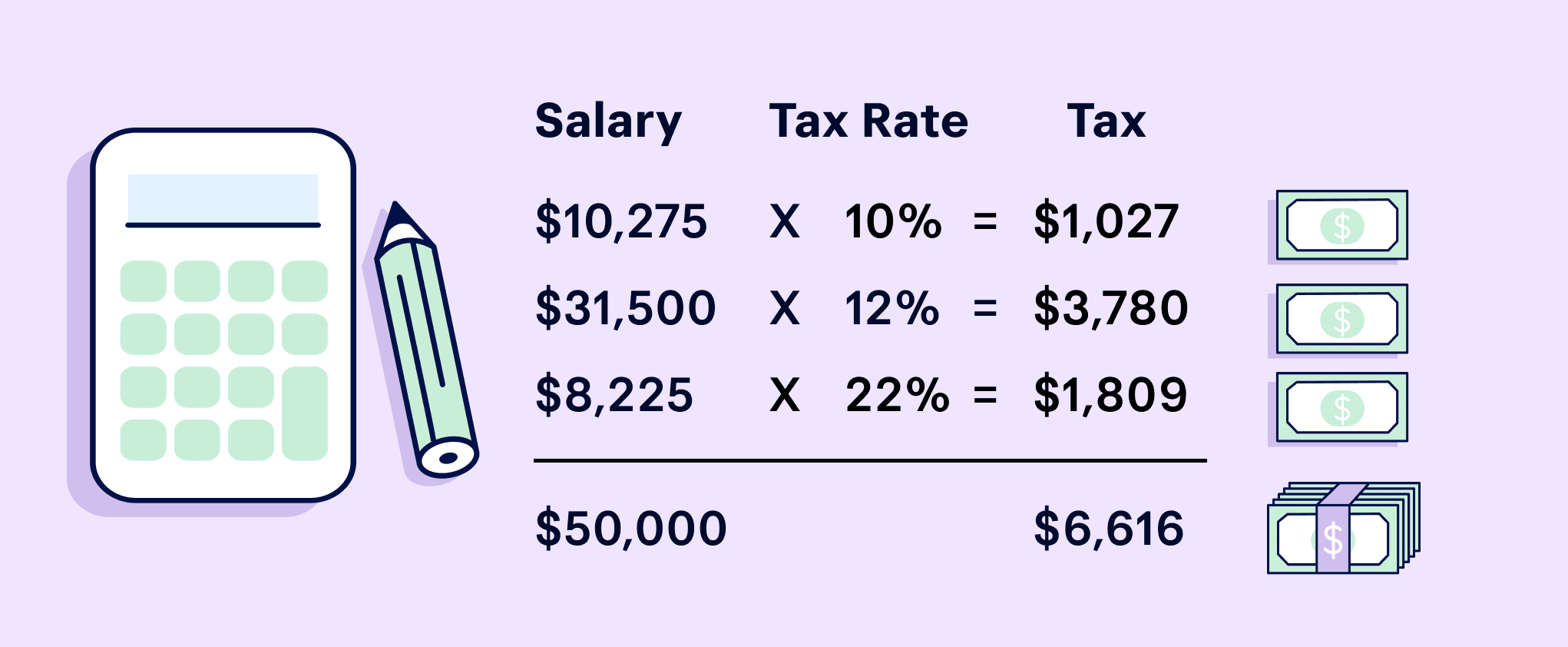

Income Tax Calculator Estimate Your Refund In Seconds For Free Federal income tax$7,660. state taxes. marginal tax rate5.85%. effective tax rate 4.88%. new york state tax$3,413. gross income$70,000. total income tax $11,074. after tax income$58,926. 1040 tax calculator. enter your filing status, income, deductions and credits and we will estimate your total taxes. based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the irs next april. change the information currently provided in the calculator to match your personal information. Income in america is taxed by the federal government, most state governments and many local governments. the federal income tax system is progressive, so the rate of taxation increases as income increases. marginal tax rates range from 10% to 37%. enter your financial details to calculate your taxes. household income. Valid at participating u.s. offices for new clients only who complete and submit a 2023 personal income tax return between april 4 to 10, 2024. while supplies last. coupon code 76862 must be presented prior to completion of initial tax office interview. qualifying clients will receive their domino’s® coupon on or before april 15, 2024.

Comments are closed.