How To File Bir Form 2550q Quarterly Value Added Tax Declaration Using Ebirforms

How To File Bir Form 2550q Quarterly Value Added Tax #taxtrainingbyelsamcaneteguide on how to file bir form 2550q quarterly value added tax declaration using ebirforms. quarterly value added tax declaration using ebirforms. In the example, please select “12 2020”. 2. quarter. select applicable quarter. in the example please select “3rd “. 3. return period. automatically filled out based on the selection in item 1 and 2. in our example, the period is from “07 01 2020” to “09 30 2020”.

Need To Know Bir Form 2550q New Rmc 59 2023 #birform2550q #2550q #quarterlyvathow to compute, file and submit online using ebirform.tutorials1. open broadcaster software (obs) – tutorial video for live. About press copyright contact us creators advertise developers terms privacy policy & safety how works test new features nfl sunday ticket press copyright. The bureau of internal revenue (bir) website ( bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the philippine tax laws and their implementing regulations and revenue issuances, including information on bir programs and projects. it also contains copy of the tax code, bir forms, zonal values of real properties, and. In this case, quarterly using bir form 2550q. finally, annual registration is required not later than january 31 for p500. the 2550q form. so since you already have an idea of the importance of vat, it is only apt to know more about the bir 2550q form. for experienced vat registered businessmen, filing vat returns may be monthly or quarterly.

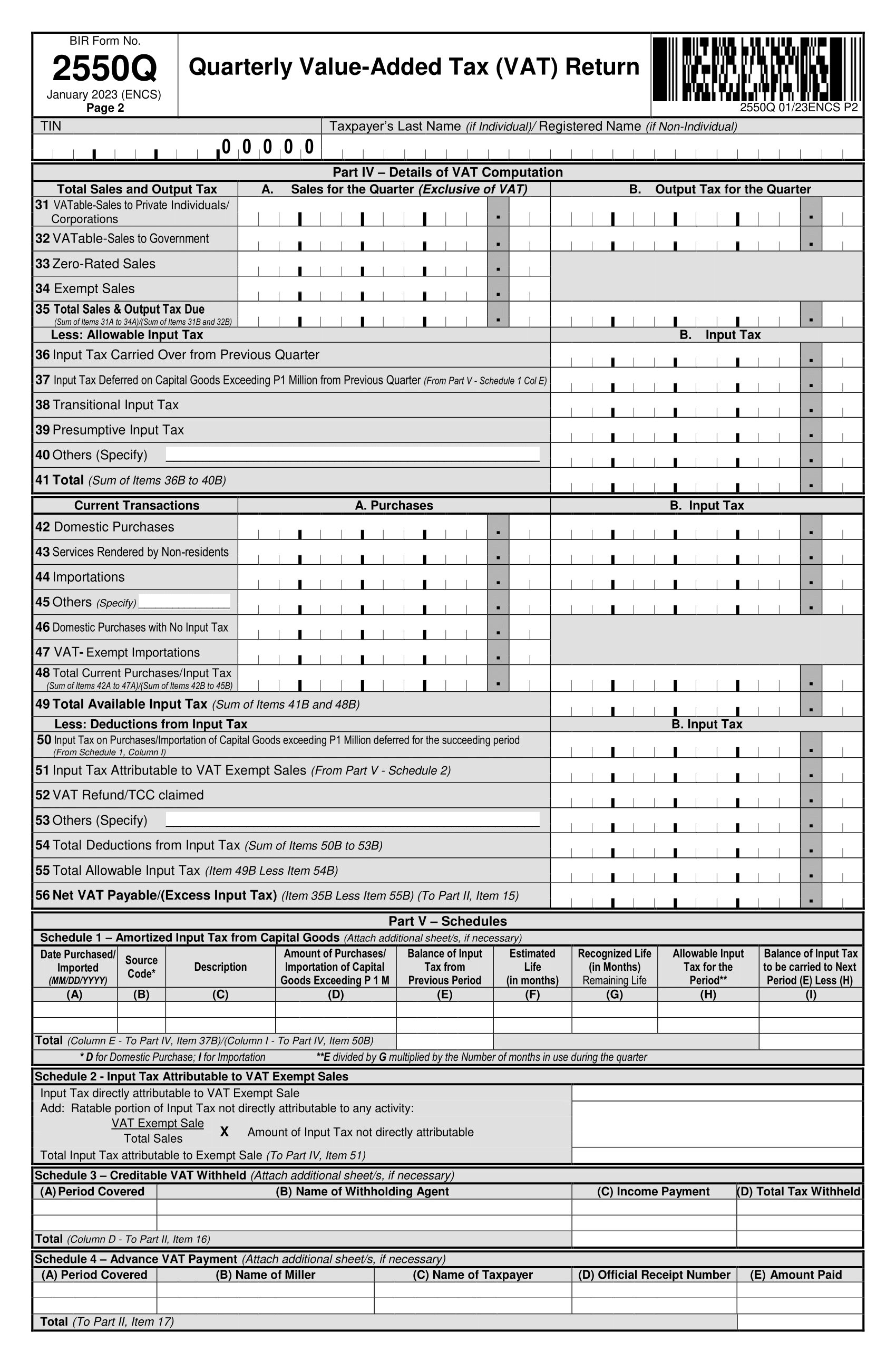

Need To Know Bir Form 2550q New Rmc 59 2023 The bureau of internal revenue (bir) website ( bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the philippine tax laws and their implementing regulations and revenue issuances, including information on bir programs and projects. it also contains copy of the tax code, bir forms, zonal values of real properties, and. In this case, quarterly using bir form 2550q. finally, annual registration is required not later than january 31 for p500. the 2550q form. so since you already have an idea of the importance of vat, it is only apt to know more about the bir 2550q form. for experienced vat registered businessmen, filing vat returns may be monthly or quarterly. The bureau of internal revenue (bir) released the revised bir form 2550q in line with the following amendments on the filing, payment and reporting of value added tax (vat) under republic act no. 19963 (train law) attached is the copy of the revised bir form 2550 q (january 2023 encs) (“annex a”). efps filers and ebir forms filers shall. Quarterly value added tax return who shall file this return shall be filed in triplicate by the following taxpayers: 1. a vat registered person; and 2. a person required to register as a vat taxpayer but failed to register. this return must be filed by the aforementioned taxpayers for as long as the vat registration has not yet been cancelled.

Solved Download File Of Bir Form 2550q Version 2007 At Www Bir Gov Ph The bureau of internal revenue (bir) released the revised bir form 2550q in line with the following amendments on the filing, payment and reporting of value added tax (vat) under republic act no. 19963 (train law) attached is the copy of the revised bir form 2550 q (january 2023 encs) (“annex a”). efps filers and ebir forms filers shall. Quarterly value added tax return who shall file this return shall be filed in triplicate by the following taxpayers: 1. a vat registered person; and 2. a person required to register as a vat taxpayer but failed to register. this return must be filed by the aforementioned taxpayers for as long as the vat registration has not yet been cancelled.

Bir Form 2550m Sample Fill Online Printable Fillable Blank Pdffiller

Comments are closed.