How To Fill Pmjjby Application Form Pradhan Mantri Jeevan

Pradhan Mantri Jeevan Jyoti Bima Yojana Pmjjby Application Form The cover shall be for one year period stretching from 1st june to 31st may. at the time of enrolment, subscriber has to submit his option on the prescribed form, to join pay by auto debit from the designated individual bank post office account, until further instructions, an amount of rs.436 (rupees four hundred thirty six only) per annum, or any amount as decided from time to time. National toll free 1800 180 1111 1800 110 001. statewise toll free.

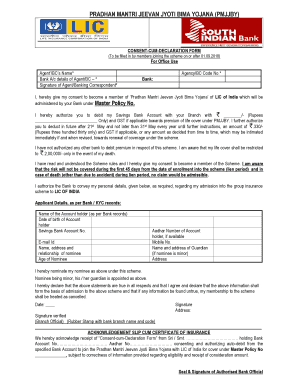

How To Fill Pmjjby Application Form Pradhan Mantri Jeevan Jyoti Bima Pradhan mantri jeevan jyoti bima yojana (pmjjby) is an insurance scheme offering life insurance cover for death due to any reason. it is a one year cover, renewable from year to year. the scheme is offered by banks post offices and administered through life insurance companies. To purchase pm jeevan jyoti bima yojana, you must be between the ages of 18 and 50. pmjjby reaches maturity at the age of 55. this plan must be renewed each year. the maximum sum insured under this scheme is $200,000.00. the pradhan mantri jeevan jyoti bima yojana enrollment period runs from june 1 to may 31. Form for pradhan mantri jeevan jyoti bima yojana. users can download this subscriber registration form to apply for the pradhan mantri jeevan jyoti bima yojana. you need to fill up the form with details such as your name, saving bank account number, email id, address, etc. to apply for this scheme. Pradhan mantri jeevan jyoti bima yojana (pmjjby) is a life insurance scheme in india backed by the government. it was announced in the 2015 budget. the life insurance scheme is valid for one year and is renewable from year to year, offering coverage in case of sudden death. it provides a cover of rs.2 lakh on the sudden demise of a policyholder.

Comments are closed.