How To Find Entry Exit Point In Stocks Entry And Exit Point For

How To Find Entry Exit Point In Stocks Entry And Exit Point For An especially popular method for determining entry and exit points is monitoring two different sets of moving averages — say a 20 day ma, and a 100 ma — and executing on positions when the shorter term ma crosses the longer one. the longer ma indicates a more stable pattern; typically, its rises and falls are very mild. Typically, the investor closes their position by selling the asset at the exit point. nevertheless, if the investor is brief, they may buy at an exit point to shut their stance. best entry and exit point indicators. every trader wants to identify the ideal entry points and also find the exit points. but, alas, finding these points isn't.

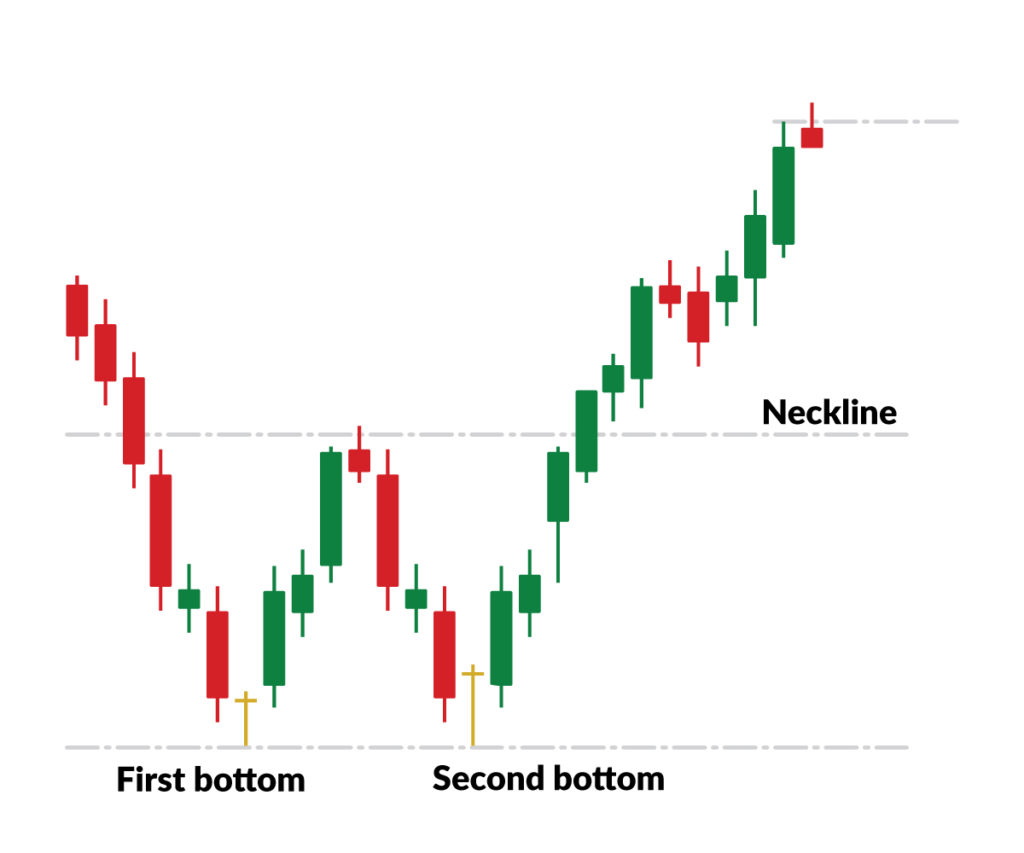

3 Ways To Find Better Entry And Exit Points On The Chart Marketech Traders watch for crossovers between short term and long term mas to identify possible entry and exit points for their trades. entry: crossovers between short term (e.g., 20 day) and long term (e.g., 50 day) mas signal potential entry points. exit: a crossover in the opposite direction or price movement beyond mas may indicate an exit opportunity. Identifying exit points. 1. trendlines. trendlines are lines drawn on a chart to show the trend’s direction. a break of a trend line in a direction opposite to your trade may be a sign for you to exit. for instance, should price trade north of a trendline resistance, as shown on the chart below, this may be considered a signal to exit short. The 6 best entry and exit indicators for day traders. How to identify entry and exit points in intraday trading.

How To Identify Entry And Exit Points In Intraday Trading The 6 best entry and exit indicators for day traders. How to identify entry and exit points in intraday trading. Determine exit and entry •generally, the area above 80 indicates an overbought region, while the area below 20 is considered an oversold region. •a sell signal is given when the oscillator is above the 80 level and then crosses back below 80. conversely, a buy signal is given when the oscillator is below 20 and then crosses back above 20. An entry point refers to the price at which an investor initiates a position in a security. a trade entry can be initiated with either a buy order for a long position, or sell order for a short.

Comments are closed.