How To Find Profit And Loss Calculate Profit And Loss Using Formula Profit And Loss

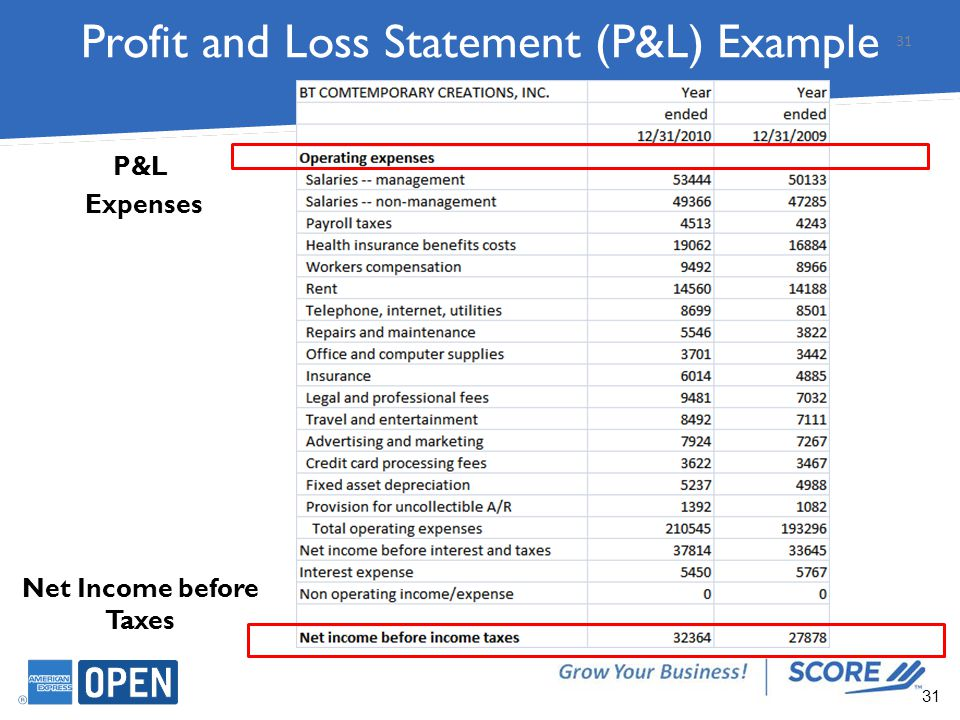

Profit And Loss Formula Definition Calculation Examples Profit and loss formula is used in mathematics to determine the price of a commodity in the market and understand how profitable a business is. every product has a cost price and a selling price. based on the values of these prices, we can calculate the profit gained or the loss incurred for a particular product. Furthermore, each cost and expense is entered as a negative figure to reflect that the line item represents an outflow of cash. the formula for each profit metric on the profit and loss statement (p&l) is stated in the following list: gross profit = $100 million – $40 million = $60 million. ebit = $60 million – $20 million = $40 million.

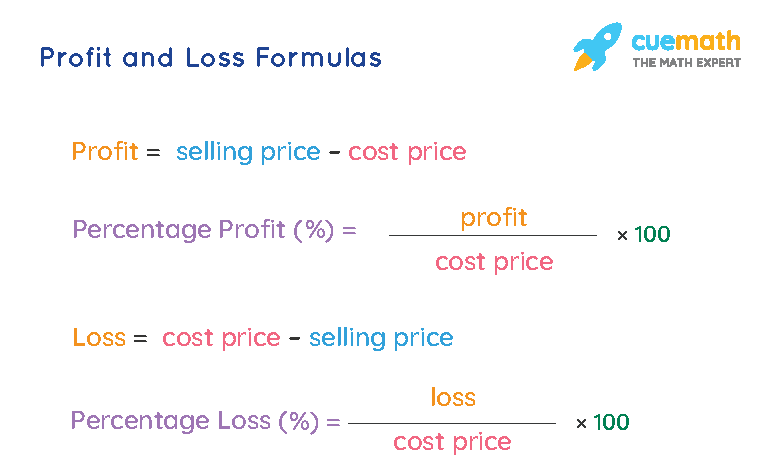

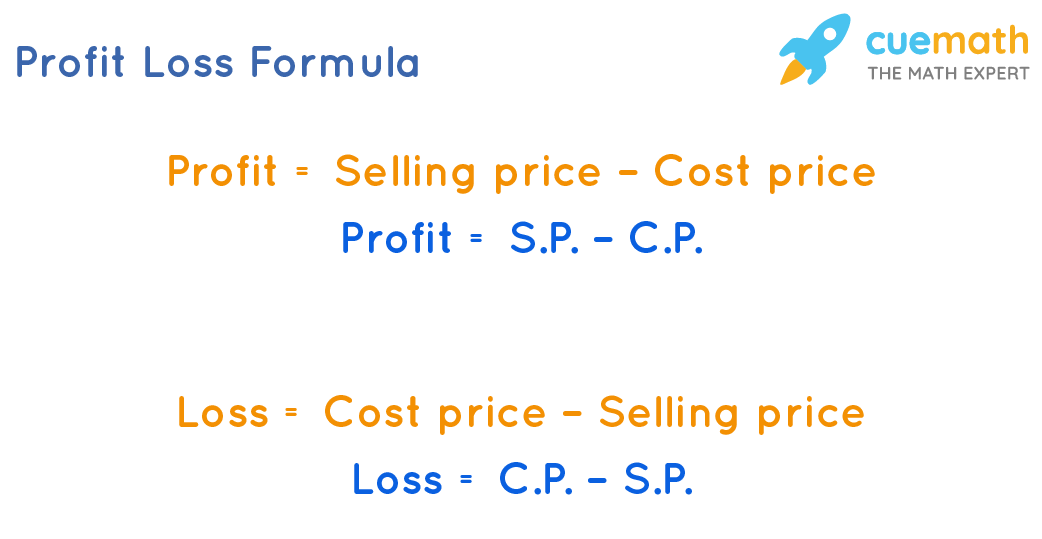

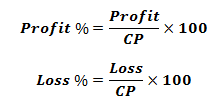

Profit And Loss Formula Profit And Loss Percentage Formulas Exam Solution: given, cp = $720 and loss = 6%; using the profit and loss formulas, we will calculate the selling price of the calculator. if loss is 6%, it means that if the cost price is $100, the loss incurred is $6. if cp is $100, sp = $94. if cp is $720, sp = (94 100) × 720 = $676.8. Formulas used for calculations on this page: profit = sales cost. profit margin = profit sales * 100. profit percentage = profit cost * 100. a negative profit value means a loss. the percentage of profit or loss is calculated on the cost price whereas profit margin is calculated on the selling price. Use this profit loss calculator to find the profit or loss (percent or amount) of a business transaction. the calculator will show you the formula and steps to get the answer. Profit percent = (profit × 100) c.p. where c.p. is cost price of goods. loss percentage. the loss percentage formula is used to compute the percentage loss in any parameter and as we already know that the difference between the cost price and the selling price is known as the loss.

Profit Loss Profit And Loss Important Formulas Youtube Use this profit loss calculator to find the profit or loss (percent or amount) of a business transaction. the calculator will show you the formula and steps to get the answer. Profit percent = (profit × 100) c.p. where c.p. is cost price of goods. loss percentage. the loss percentage formula is used to compute the percentage loss in any parameter and as we already know that the difference between the cost price and the selling price is known as the loss. Profit = price cost. when determining the profit for a higher quantity of items, the formula looks like this: total profit = revenue total cost, or expressed differently. total profit = unit price × quantity unit cost × quantity. all sorts of reverse calculations are possible, and you don't have to start entering variables from the top. The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. this summary provides a net income (or bottom line) for a reporting period. the p&l reporting period can be any length of time, but the most common are monthly, quarterly, and annually. a p&l statement is also known as:.

How To Calculate Accounting Profit And Loss Simple Accounting Profit = price cost. when determining the profit for a higher quantity of items, the formula looks like this: total profit = revenue total cost, or expressed differently. total profit = unit price × quantity unit cost × quantity. all sorts of reverse calculations are possible, and you don't have to start entering variables from the top. The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. this summary provides a net income (or bottom line) for a reporting period. the p&l reporting period can be any length of time, but the most common are monthly, quarterly, and annually. a p&l statement is also known as:.

Profit And Loss As Percentage Formula Examples Techniques

Comments are closed.