How To Find Stock Chart Patterns

Stock Chart Patterns 101 New Trader U Price charts visualize the trading activity that takes place during a single trading period (whether it's five minutes, 30 minutes, one day, and so on). generally speaking, each period consists of several data points, including the opening, high, low, and or closing prices. when reading stock charts, traders typically use one or more of the. The complete stock chart patterns guide stock chart pattern recognition software. understanding and recognizing these chart patterns can be challenging and time consuming. . even when you think you have memorized all 46 chart patterns featured in this guide, recognizing them quickly and effectively when trading is a real i.

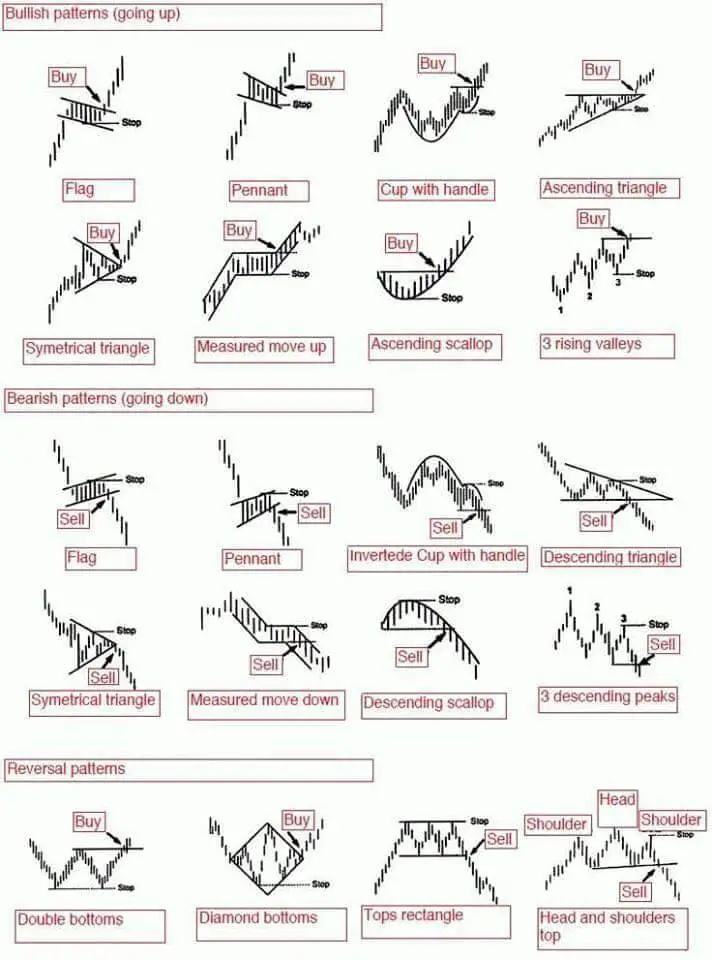

Printable Stock Chart Patterns Cheat Sheet Key takeaways. patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. a pattern is identified by a line. Reversal: a reversal pattern tells a trader that a price trend will likely reverse. 1. ascending triangle. direction: bullish. type: breakout, continuation. ascending triangle trading chart patterns are some of the most widely used stock market patterns. Taking a closer look at any stock chart and performing basic technical analysis allows you to identify chart patterns. the more you practice, the more you will see. in turn, spotting the next big winner will be an easier task. when i started stock trading over 20 years ago, i would look at over one thousand stock charts each week. even today, i. The three types of chart patterns: breakout, continuation, and reversal. charts fall into one of three pattern types — breakout, reversal, and continuation. breakout patterns can occur when a stock has been trading in a range. the top of the range is resistance, and the bottom is support. if the stock breaks through either end of this range.

Chart Patterns January 24 2016 By Thomas Mann All Things Stocks Taking a closer look at any stock chart and performing basic technical analysis allows you to identify chart patterns. the more you practice, the more you will see. in turn, spotting the next big winner will be an easier task. when i started stock trading over 20 years ago, i would look at over one thousand stock charts each week. even today, i. The three types of chart patterns: breakout, continuation, and reversal. charts fall into one of three pattern types — breakout, reversal, and continuation. breakout patterns can occur when a stock has been trading in a range. the top of the range is resistance, and the bottom is support. if the stock breaks through either end of this range. Types of chart patterns. there are two main types of chart patterns: continuation patterns; reversal patterns. in general, for both continuation and reversal patterns, the longer the pattern forms, and the larger the price movement within it, the more significant the predicted move once the price breaks out. Chart pattern analysis can be used to make short term or long term forecasts. the data can be intraday, daily, weekly, or monthly, and the patterns can be as short as one day or as long as many years. gaps and outside reversals may form in one trading session, while broadening tops and dormant bottoms may require many months to form.

Learn Intraday Trading And Earn Money Without Investment Online Types of chart patterns. there are two main types of chart patterns: continuation patterns; reversal patterns. in general, for both continuation and reversal patterns, the longer the pattern forms, and the larger the price movement within it, the more significant the predicted move once the price breaks out. Chart pattern analysis can be used to make short term or long term forecasts. the data can be intraday, daily, weekly, or monthly, and the patterns can be as short as one day or as long as many years. gaps and outside reversals may form in one trading session, while broadening tops and dormant bottoms may require many months to form.

Comments are closed.