How To Find The Annual Percentage Rate Apr Using A Table Dr Choden

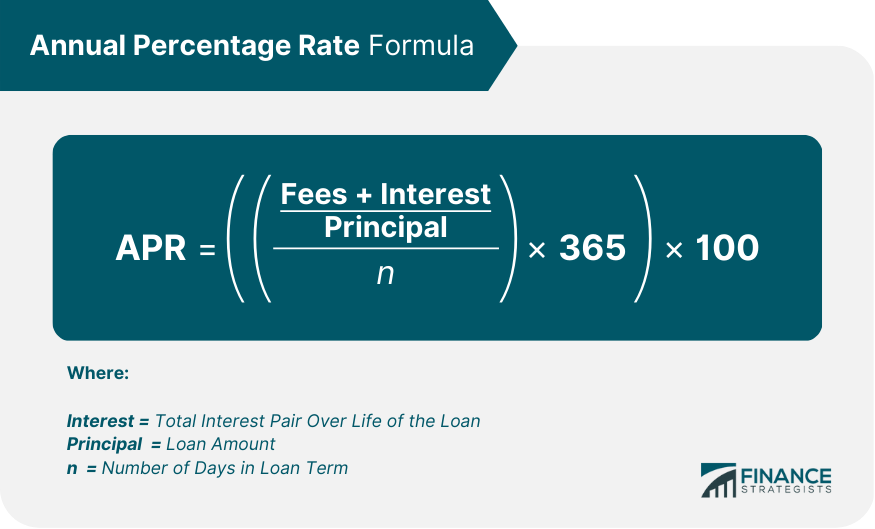

Top 8 Calculate Apr From Interest Rate 2023 Business math,finance math,excel business math,business maths,business,business mathematics,math,business maths ip,business maths bba,business maths 2nd year. The annual percentage rate (apr) is calculated using the following formula. annual percentage rate (apr) = (periodic interest rate x 365 days) x 100. where: periodic interest rate = [ (interest expense total fees) loan principal] number of days in loan term. to express the apr as a percentage, the amount must be multiplied by 100.

Annual Percentage Rate Apr Definition Calculation Types Apr calculator is an advanced device that helps you to compute the annual percentage rate (apr), that is, the annual rate charged for the credit. apr then represents the total cost of the borrowed money. by computing the apr rate, you can easily compare different loan offers so that you can have a better understanding of the real cost of borrowing. While apr includes interest rates, it also includes other fees, so it provides a more accurate picture of the total cost of borrowing. apy. apy, or annual percentage yield, is similar to apr, but it’s used to calculate the interest earned on savings accounts or other interest bearing accounts. apy takes into account the compounding interest. The advanced apr calculator finds the effective annual percentage rate (apr) for a loan (fixed mortgage, car loan, etc.), allowing you to specify interest compounding and payment frequencies. input loan amount, interest rate, number of payments and financing fees to find the apr for the loan. you can also create a custom amortization schedule. For example, if a loan of $100 includes an apr of 10%, the equation below calculates the equivalent interest paid at year end: therefore, the borrower will pay the lender $10.47 in interest. in comparison, if a $100 savings account includes an apy of 10.47%, the interest received at the end of the year is: $100 × 10.47% = $10.47.

How To Calculate Annual Percentage Rate 12 Steps With Pictures The advanced apr calculator finds the effective annual percentage rate (apr) for a loan (fixed mortgage, car loan, etc.), allowing you to specify interest compounding and payment frequencies. input loan amount, interest rate, number of payments and financing fees to find the apr for the loan. you can also create a custom amortization schedule. For example, if a loan of $100 includes an apr of 10%, the equation below calculates the equivalent interest paid at year end: therefore, the borrower will pay the lender $10.47 in interest. in comparison, if a $100 savings account includes an apy of 10.47%, the interest received at the end of the year is: $100 × 10.47% = $10.47. The formula for calculating the annual percentage rate (apr) is: apr = [ (total interest fees) principal loan amount] x (365 number of days in loan term) x 100. this formula takes into account the total interest and fees paid, the principal loan amount, and the duration of the loan. 4. Calculate the apr (annual percentage rate) of a loan with pre paid or added finance charges.

Comments are closed.