How To Manage Risk In Forex Trading Howtotrade

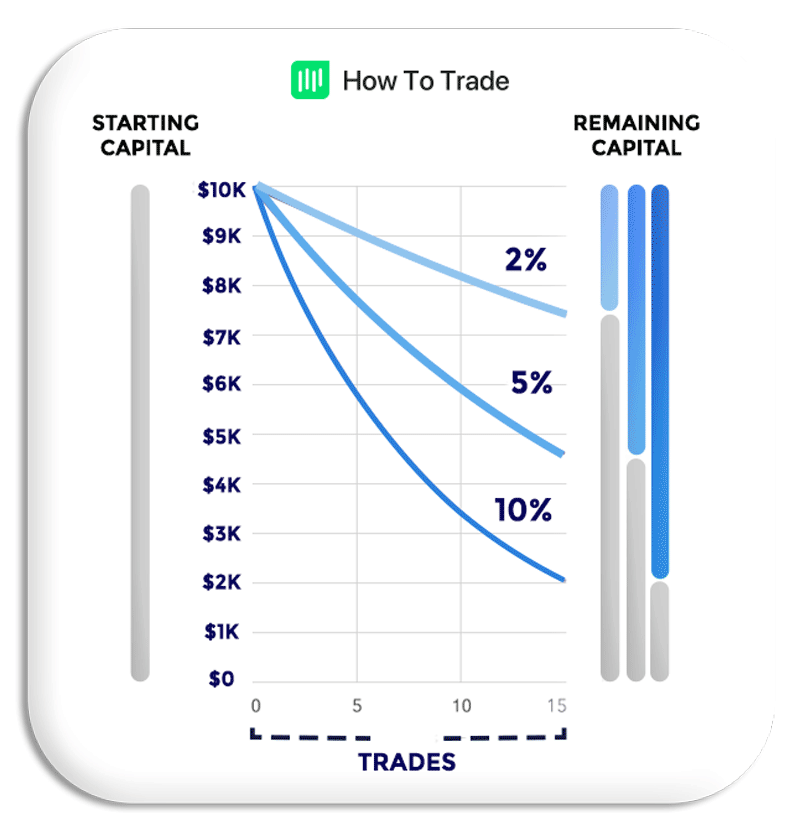

How To Manage Risk In Forex Trading Howtotrade Calculate how much you want to risk in the forex market. choosing how much to risk per trade is completely up to you. you will find many forex traders who advise not to risk more than 2% of your trading capital per trade, while others say it’s okay to go all the way up to 10%. however, most traders do agree that going anywhere above that. Within the realm of forex trading, the meaning of risk management depends upon context. as it pertains to the trading plan, the term refers to maximising the potential of your trading capital on a trade by trade basis. by doing so, we can vastly reduce the significant risk of trading highly leveraged currency pairs.

How To Manage Risk In Forex Trading Howtotrade Understanding forex risk management. in this forex course, you will develop a deeper understanding of risk management and learn how you can earn money from being consistent and sticking to your strategy. start course. learn more about risk management and why sticking to your trading strategy is key to your success. check our free course. 2. use stop loss orders: stop loss orders are an essential tool in managing risk in forex trading. a stop loss order is a predetermined level at which a trade will automatically be closed to limit potential losses. by setting a stop loss order, traders can avoid emotional decision making and prevent their losses from exceeding a predefined. As part of your forex trading plan, you should set your risk reward ratio to quantify the worth of a trade. to find the ratio, compare the amount of money you're risking on an fx trade to the potential gain. for example, if the maximum potential loss (risk) on a trade is £200 and the maximum potential gain is £600, the risk reward ratio is 1:3. Here is the impact of three different per trade risk levels – 1%, 2% and 10% – on an account balance of 100,000 over a 30 trade losing streak. the trader risking 10% per trade has lost 95.3% of their account balance, the trader risking 2% is down 44.3% and the 1% trader is down 25.2%.

How To Use Risk Management In Forex Trading 2020 Youtube As part of your forex trading plan, you should set your risk reward ratio to quantify the worth of a trade. to find the ratio, compare the amount of money you're risking on an fx trade to the potential gain. for example, if the maximum potential loss (risk) on a trade is £200 and the maximum potential gain is £600, the risk reward ratio is 1:3. Here is the impact of three different per trade risk levels – 1%, 2% and 10% – on an account balance of 100,000 over a 30 trade losing streak. the trader risking 10% per trade has lost 95.3% of their account balance, the trader risking 2% is down 44.3% and the 1% trader is down 25.2%. A forex trading plan is a comprehensive roadmap that guides investors on how to trade currency pairs with discipline and focus. traders must first set clear goals aligned with their financial objectives, risk tolerance, and available resources. then, choose a preferred trading style (e.g. scalping or swing trading) and timeframe. 1. market risk: one of the primary risks in forex trading is market risk. market risk refers to the possibility of losses due to unfavorable price movements in the currency pairs being traded. currency values are influenced by various economic, political, and social factors, making them highly volatile. traders must understand that prices can.

Tips To Manage Risks In Forex Trading Infographic By Fuad Ahmed A forex trading plan is a comprehensive roadmap that guides investors on how to trade currency pairs with discipline and focus. traders must first set clear goals aligned with their financial objectives, risk tolerance, and available resources. then, choose a preferred trading style (e.g. scalping or swing trading) and timeframe. 1. market risk: one of the primary risks in forex trading is market risk. market risk refers to the possibility of losses due to unfavorable price movements in the currency pairs being traded. currency values are influenced by various economic, political, and social factors, making them highly volatile. traders must understand that prices can.

What Is Risk Management In Forex Howtotrade

Comments are closed.