How To Prepare Depreciation Schedule In Excel

How To Prepare Depreciation Schedule In Excel Youtube The syd function calculates the sum of years' digits depreciation and adds a fourth required argument, per. the syntax is =syd (cost, salvage, life, per) with per defined as the period to calculate the depreciation. the unit used for the period must be the same as the unit used for the life; e.g., years, months, etc. Select cells b5:b7 as the source cells. click ok in the data validation dialog box. click on the drop down arrow of cell b12. this will bring out the asset names. select car. insert the months to show in the monthly depreciation schedule in cells c12:c14. read more: how to create depreciation schedule in excel.

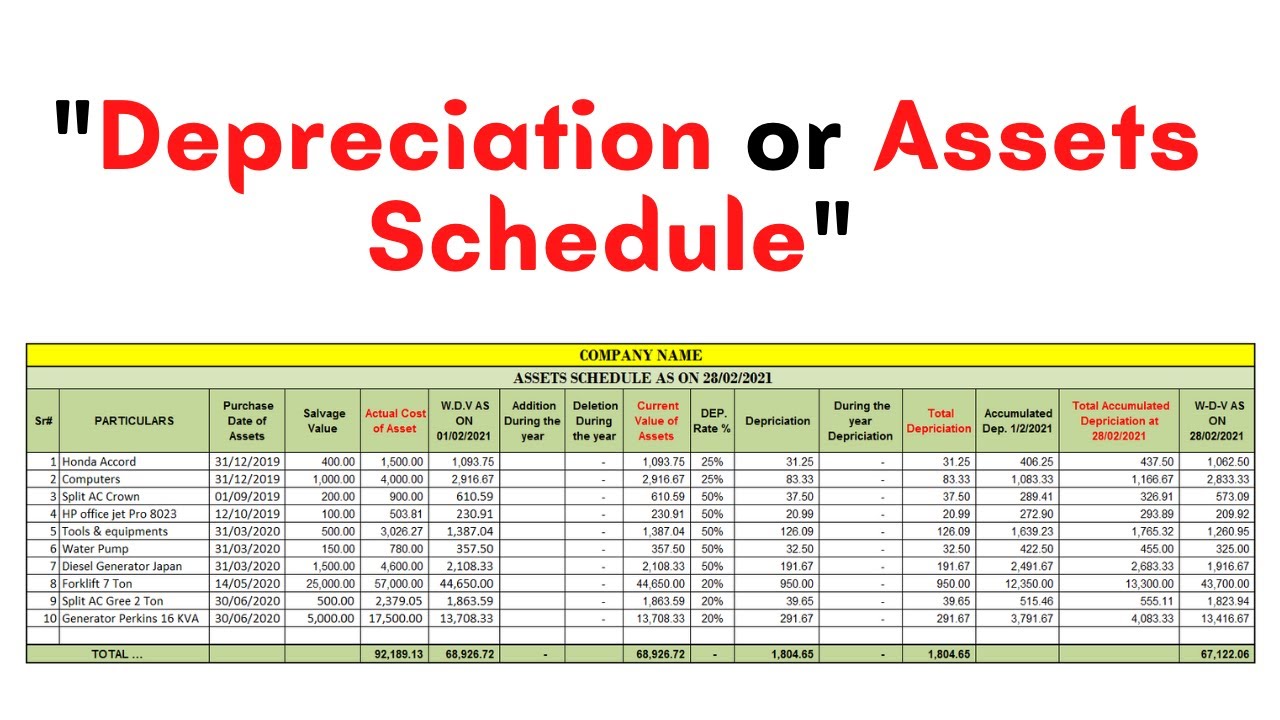

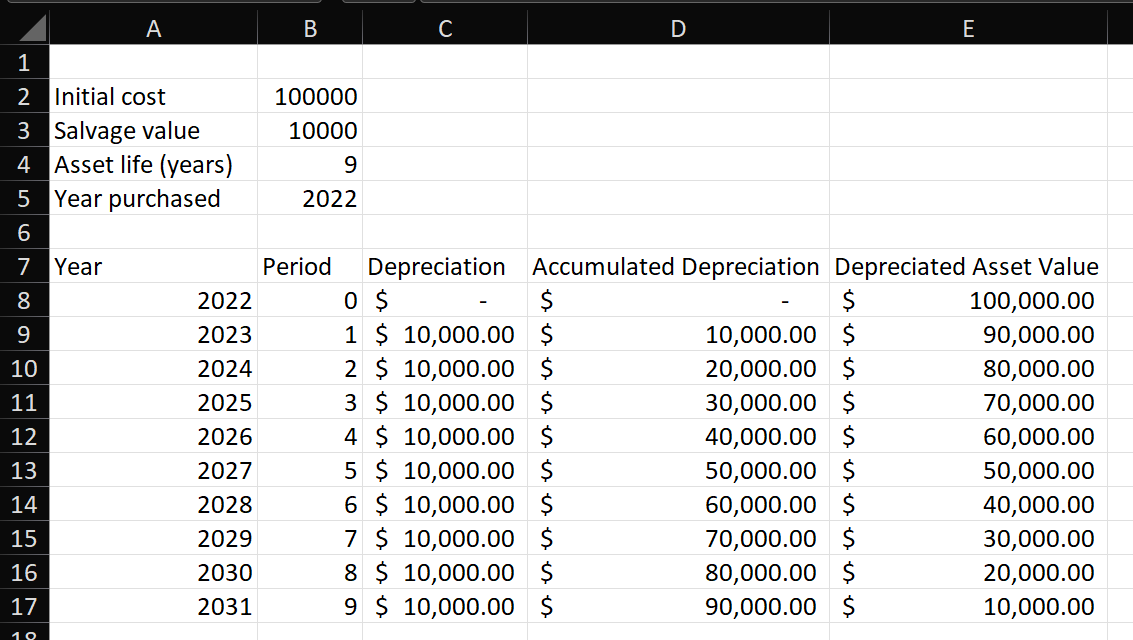

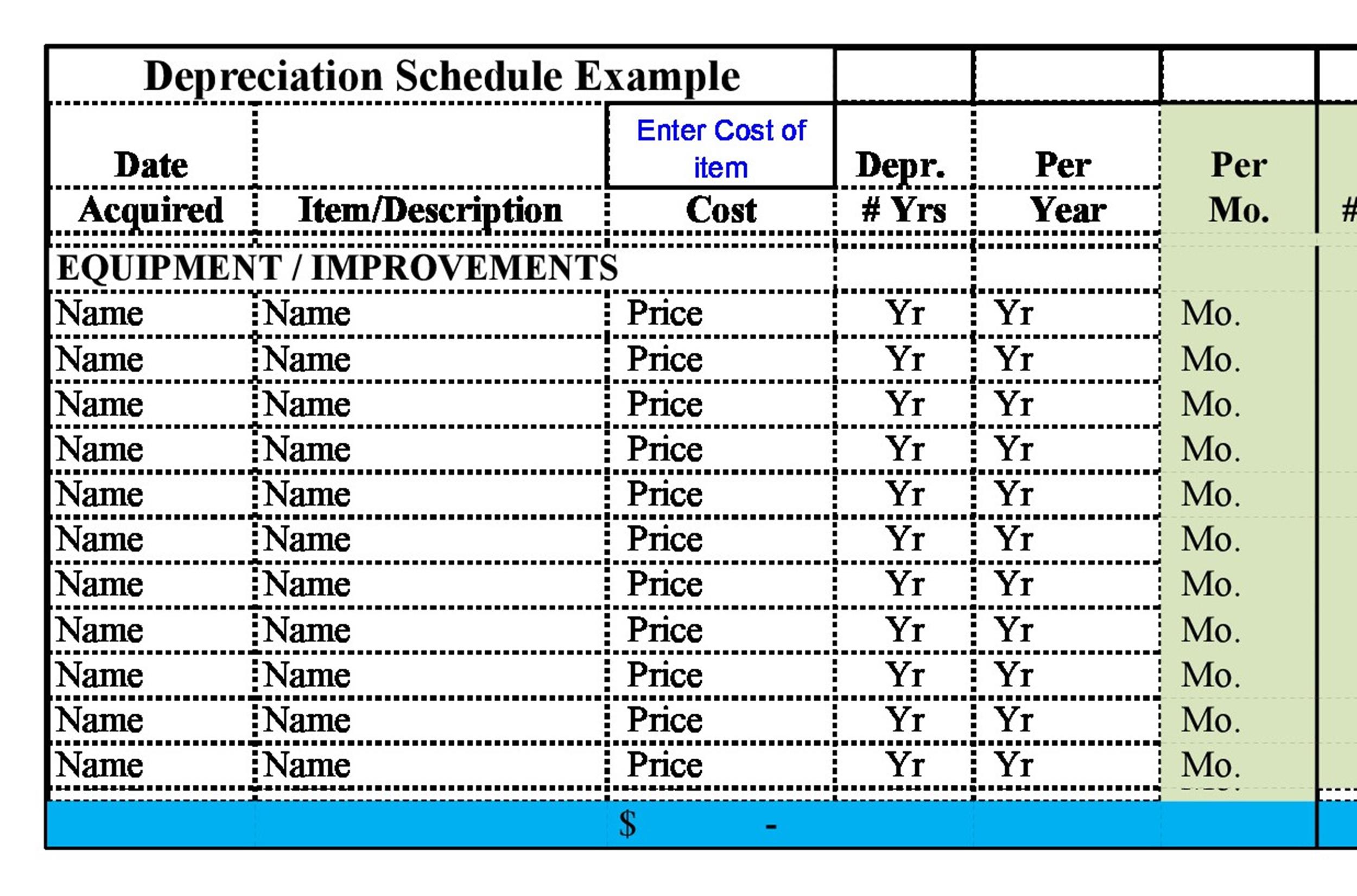

Excel Lambda Depn Schedule вђ Create A Depreciation Schedule In Excel Excel depreciation schedule instructions. our free excel depreciation template is simple to use and will help keep track of depreciation for the useful life of the asset. in the green box, enter the current year in format yyyy, 2024 is entered, but if it is a later or earlier year, change it. enter the description of the fixed asset; for a. This depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple assets. for each asset, choose between the straight line, sum of years' digits, double declining balance, or declining balance with switch to straight line. "no installation, no macros just a simple spreadsheet" by jon wittwer. Download the featured file here: bluepecantraining wp content uploads 2021 05 straight line depreciation.xlsxin this video i demonstrate how. Step 1: assemble the column headers in row 1 of the spreadsheet. create a new excel spreadsheet file and assemble the following information in row 1 of the spreadsheet. asset’s name. historical cost. salvage value. useful life. current period. depreciation expense. accumulated depreciation, beginning.

How To Create A Straight Line Depreciation Schedule In Excel The Usa Download the featured file here: bluepecantraining wp content uploads 2021 05 straight line depreciation.xlsxin this video i demonstrate how. Step 1: assemble the column headers in row 1 of the spreadsheet. create a new excel spreadsheet file and assemble the following information in row 1 of the spreadsheet. asset’s name. historical cost. salvage value. useful life. current period. depreciation expense. accumulated depreciation, beginning. At the bottom of the depreciation schedule, prepare a breakdown of the net change in pp&e. this begins with the beginning balance of pp&e, net of accumulated depreciation. from this beginning balance, add capital expenditures, subtract depreciation expense, and also subtract any sales or write offs. the final total should be the ending balance. 📹📈 in this video, i'll guide you through creating the depreciation schedule in excel using 3 different methods: 📅💻 straight line 🏗️ reducing balance.

Straight Line Depreciation Schedule Excel Template For Your Needs At the bottom of the depreciation schedule, prepare a breakdown of the net change in pp&e. this begins with the beginning balance of pp&e, net of accumulated depreciation. from this beginning balance, add capital expenditures, subtract depreciation expense, and also subtract any sales or write offs. the final total should be the ending balance. 📹📈 in this video, i'll guide you through creating the depreciation schedule in excel using 3 different methods: 📅💻 straight line 🏗️ reducing balance.

Comments are closed.