How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

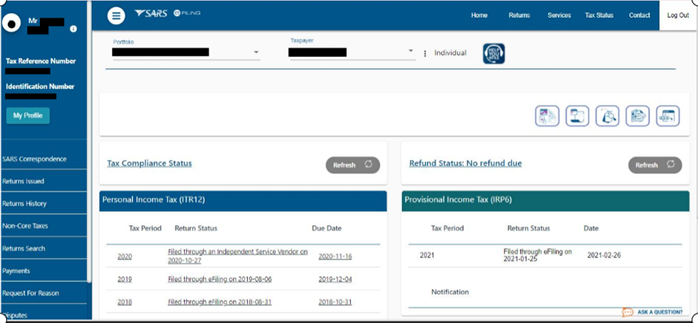

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa Step 2: generate your itr12 tax return. make sure that your name appears at the top under taxpayer list just in case you have logged onto someone else's sars efile page. if the title of the page is not income tax work page then click the returns issued button in the menu on the left hand side. in the menu on the left returns issued will open. Backed by sars registered tax practitioners. taxtim is created and operated by sars registered practitioners (pr 0009352) so you can rest assured your forms get checked for compliance before we submit them to sars. 100% compliant with sars. cheaper than practitioners. guided help & assistance with audits.

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa Connecting taxtim to your efiling profile takes less than a minute (on average) and once connected you can import your saved irp5s from efiling (saves you time), submit your completed tax returns to efiling in a click, get your ita34 assessments and letters (we'll explain what these mean when we send them to you) and upload supporting documents. 9.1 access payments function. to access the payment functionality on efiling, click the “returns” menu tab on the efiling top ribbon, and “payments” on the left side menu options. the below screen will be displayed. if you select the “payment guide” tab, you will be routed to the payments webpage on the sars website. If you need to submit an income tax return, you can complete and submit it to sars via the following channels: efiling on your computer – simply register for efiling at sarsefiling.co.za. the sars mobiapp from which you can complete and submit your income tax return (itr12). filing electronically at a sars branch where an agent will. Income tax return (itr12), and are ready to submit it to sars, simply click ‘file’. you will receive a confi rmation when your income tax return for individuals has been filed. when you click ‘file’, your income tax return (itr12) will be submitted to sars. efiling will check the correctness of specifi c information.

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa If you need to submit an income tax return, you can complete and submit it to sars via the following channels: efiling on your computer – simply register for efiling at sarsefiling.co.za. the sars mobiapp from which you can complete and submit your income tax return (itr12). filing electronically at a sars branch where an agent will. Income tax return (itr12), and are ready to submit it to sars, simply click ‘file’. you will receive a confi rmation when your income tax return for individuals has been filed. when you click ‘file’, your income tax return (itr12) will be submitted to sars. efiling will check the correctness of specifi c information. Step 1: initiate ussd by dialing *134*7277#. step 2: select the service you require. step 3: taxpayer verification – sars will request you to complete either your,id passport asylum number. step 4: tax resolution – upon successful verification by sars, a responce will be displayed. 4. how to submit online. the most prevalent way to submit an income tax return is online through the sars efiling portal. image: file. as before, sars efiling is the most used way to complete a 2024 sars tax return. if you haven’t already, simply register here and follow the prompts to complete your return. 5.

Comments are closed.